No.3860

Fifteen Logistics Industry Markets in Japan: Key Research Findings 2025

Size of Fifteen Logistics Industry Markets Expected to Upturn Again, Primarily Due to Rising Transportation Costs and Prices

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of the fifteen logistics industry markets and found out the trends by category, trends of market players, and future perspectives.

Market Overview

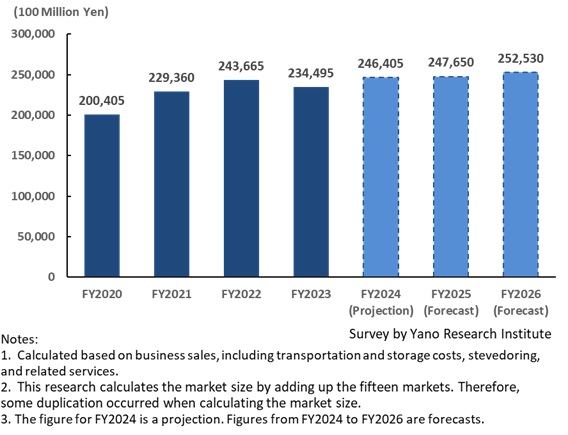

The size of the fifteen logistics industry markets, which is calculated by adding business sales of fifteen categories (including some duplications), was estimated at 23,449.5 billion yen in FY2023, 96.2% of the size in the previous fiscal year. As the imbalance between supply and demand has been resolved, the once soaring prices for maritime transportation, air freight transportation and freight forwarding businesses have declined. These factors, as well as slower growth in cargo transportation volume in and out of the country, reduced the market size.

The combined size of the fifteen logistics industry markets is projected to reach 24,640.5 billion yen in FY2024, which is a 5.1% increase from the previous fiscal year. In international logistics, demand for maritime and air freight transportation recovered from the year before, particularly for shipments from China to Europe and the United States. The increased demand is expected to raise transportation costs from Asian countries, including Japan, to Europe and the United States. The weaker yen has also impacted on the market size, particularly for maritime transportation, and this expansion is expected to continue.

In domestic logistics, labor costs are projected to rise further to secure drivers. As freight owner companies begin to understand driver shortage situations, transportation businesses are finding it easier to pass on prices. This expansion is especially evident in land transportation, such as trucking. However, consumer activity may continue to stall due to rising food prices, and the volume of imported freight volume is continuing to decrease due to the weaker yen.

Overall, the lack of factors to increase the freight volume in both international and domestic logistics raises prices and transportation costs, driving the expansion of the combined size of the fifteen logistics industry markets.

Noteworthy Topics

Appointment of Chief Logistics Officers (CLO)

In May 2024, the Law Concerning the Efficiency of Material Distribution (Logistics Efficiency Law) was revised to promote sustainable growth in the logistics industry. The revision mandates freight owners and logistics companies to strive for efficiency improvement measures. Additionally, beginning in FY2026, businesses of a certain size must create medium- to long-term plans and regularly report on their contributions to logistics efficiency improvements. As part of these obligations, specific freight owners and chain operators (franchise chain headquarters) must appoint a Chief Logistics Officer (CLO).

Rather than accommodating logistics companies, freight owner companies should appoint a CLO to meet their own strategies. In other words, they should reap the benefits of increased logistics efficiency rather than benefit logistics companies. It is important for them to take the lead in improving logistics efficiency and reevaluating supply chains, thereby aligning with their business strategies. If they entrust all efficiency initiatives to logistics companies, the results may not align with their business strategy.

Conversely, focusing solely on one's own convenience may generate risks of not being selected by logistics companies. To improve logistics efficiency that meets both the company’s business strategy and the needs of logistics companies, it is necessary for a CLO of freight owners to communicate with logistics companies as partners.

Future Outlook

The combined size of the fifteen logistics industry markets is forecast to reach 24,765.0 billion yen in FY2025, a 0.5% increase from the previous fiscal year.

Four sectors, namely, maritime transportation, general harbor transportation, consolidated freight trunking transportation, and the moving business, are projected to decline from the previous fiscal year. On the contrary, growth is expected in seven sectors: third-party logistics (3PL) services, general warehousing, refrigerated warehousing, air freight transportation, rail freight transportation, rail freight forwarding, and lightweight freight delivery.

Please note that the increase in the U.S. tariffs is taken into account for the sluggish export volume in maritime and general harbor transportation. However, the increase in the U.S. tariffs has not been factored into 3PL or general warehousing due to too many uncertain factors. The 3PL sector is expected to steadily expand, because it provides freight owners with multiple logistics services that support their entire supply chain, both domestically and internationally.

Research Outline

2.Research Object: Domestic leading logistics companies and organizations

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, questionnaire via telephone, and literature research

What are Fifteen Logistics Businesses?

This research focuses on fifteen logistics businesses. These businesses include those that provide the following services: consolidated freight trunking transportation, domestic home delivery, international home delivery, third-party logistics (3PL) services, maritime transportation (domestic and international voyages), general harbor transportation, air freight transportation, freight forwarding, rail freight transportation, rail freight forwarding, lightweight freight delivery, general warehousing, refrigerated warehousing, moving businesses, and other businesses.

What are Fifteen Logistics Industry Markets?

This research calculates the market size by adding up the fifteen markets. Therefore, some duplication occurred when calculating the market size. Market size is calculated based on business sales, including transportation and storage costs, stevedoring, and related services.

<Products and Services in the Market>

Consolidated freight trunking transportation, domestic home delivery, international home delivery, third-party logistics (3PL) services, maritime transportation (domestic and international voyages), general harbor transportation, air freight transportation, freight forwarding, rail freight transportation, rail freight forwarding, lightweight freight delivery, general warehousing, refrigerated warehousing, moving businesses, and other businesses.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.