No.3800

Hair Salon and Barbershop Cosmetics Market in Japan: Key Research Findings 2025

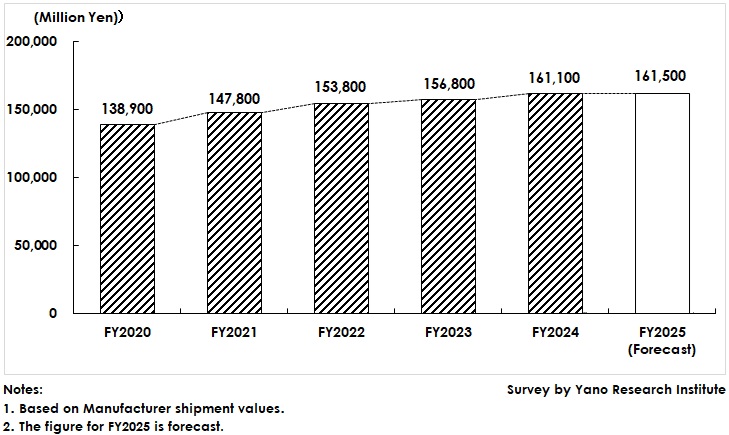

Hair Salon and Barbershop Cosmetics Market Rose by 2.7% YoY to Reach 161,100 Million Yen in FY2024

Yano Research Institute (the President, Takashi Mizukoshi) surveyed the domestic business-use haircare cosmetics market and found out the market size, trends by prefecture and product category, trends of market players, and future perspectives.

Market Overview

In FY2024, the market size for cosmetics used in hair salons and barbershops was 161,100 million yen, 102.7% of the previous fiscal year’s size based on manufacturer shipment values.

Supported by the market recovery from the pandemic, manufacturers of cosmetics for hair salons and barbershops have launched new brands and renewed their existing major ones. However, rising prices for materials, energy, logistics, and labor have caused these manufacturers to raise their product prices, thereby improving their sales performance. Additionally, sales of salon-specific cosmetics products remained favorable at salons and via ecommerce channels (offline/online), contributing to market expansion.

Meanwhile, rising food and commodity prices are negatively impacting consumers, affecting hair salons and barbershops in terms of visit frequency and selection of salon services.

Noteworthy Topics

The Number Hair Salons and Bankrupt Hair Salons Increased, With Staff Shortages Being Serious Problem in the Industry

According to the Ministry of Health, Labour and Welfare (MHLW), the number of hair salons in Japan are on the rise, as is the number of hairstylists who have passed the national exams. However, the number of hair salons filing for bankruptcy is also increasing.

In an industry with frequent openings and closings of salons, hair salons face difficulty in securing human resources and dealing with severe price competition. During the pandemic, the industry received financial support in the form of interest-free, unsecured loans, which suppressed the number of bankrupt salons. When the time came to repay the loans, however, salons with slow sales struggled to do so and eventually decided to close their businesses. Furthermore, the recent surge in utility and salon material costs, as well as the increase in employee salaries, has put pressure on revenues.

Because the hair salon business has low barriers to entry and requires little capital, new salons tend to open quickly in locations where bankrupt salons used to operate. Subtracting the number of newly opened salons from the number of closed salons shows a genuine increase in the number of domestic salons. The number of licensed hairstylists is also on the rise. However, due to high turnover caused by career changes, marriage, childbirth, and other factors, the actual number of hairstylists is probably decreasing. The shortage of salon staff is quite serious.

Future Outlook

Manufacturers of professional cosmetics for hair salons and barbershops are expanding their product portfolios and developing high-value salon services. These services provide salon customers with more luxurious experience, earning their loyalty. These manufacturers are growing their revenue-focused businesses by increasing customer lifetime value.

From 2023 to 2024, prices for cosmetics intended for hair salons and barbershops were revised among large and medium-sized manufacturers. The effects of these price revisions are expected to be fully realized by FY2025. Considering the current trend of salon operations affected by the structural factors, such as an excessive number of hair salons and barbershops opening and a shrinking population of salon users, the demand for professional cosmetics for hair salons and barbershops is projected to plateau or decline.

Research Outline

2.Research Object: Manufacturers and trading companies/dealers of hair salon and barbershop cosmetics, other businesses and associations related to the hair salon and barber shop cosmetics

3.Research Methogology: Face-to-face interviews by expert researchers (including online interviews), survey by telephone and email, and literature research

Hair salon and Barbershop Cosmetics Market

In this research, the hair salon and barbershop cosmetics market refers to the domestic market of cosmetics intended for use by hairstylists and barbers for hair styling and other hair treatments. This market also includes haircare products for home use that are sold exclusively at hair salons to salon customers.

In principle, the market does not include hotel amenities or professional cosmetics used by beauty salons.

<Products and Services in the Market>

Hair coloring products, perm solutions, hair care products, hair styling products, and other related cosmetic products

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.