No.3787

Automotive Parts and Components Market in Japan: Key Research Findings 2024

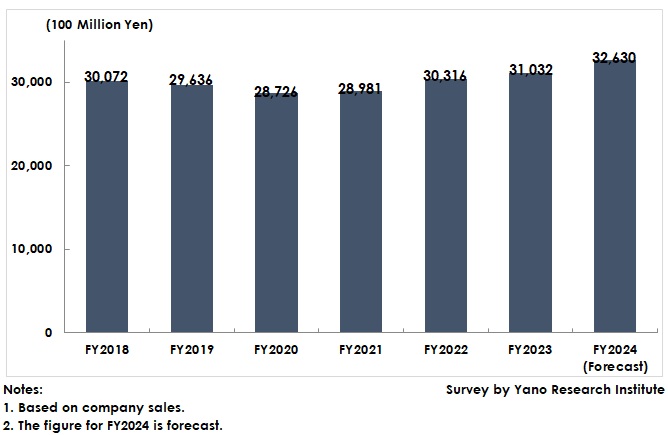

Automotive Parts and Components Market Size Remained Strong at 3,103.2 Billion Yen in FY2023, a 2.4 % Increase from Previous Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) surveyed the domestic automotive parts and components market and discovered the market status, trend of market players and future outlook.

Market Overview

Total maintenance sales in the automotive maintenance market reached 6,256.1 billion yen (*1) in FY2023, making three consecutive years of increases. The number of vehicles requiring inspection was 33,942 thousand units (*2), a decline from the previous fiscal year. This decline is due to the inclusion of vehicles undergoing their first inspection after being sold in FY2020, when automobile production and supplies stalled due to semiconductor shortages during the pandemic. Nevertheless, increased maintenance sales were fueled by demand for battery and oil replacements due to improved vehicle utilization and higher sales from repairs of a greater number of vehicles subject to recall notification than in the previous fiscal year.

The automotive parts and components market, which is highly aligned with the maintenance market, is estimated at 3,103.2 billion yen (based on company sales), up 2.4% year on year. Auto parts are components that are replaced or repaired during automotive inspections or maintenance. Therefore, the automotive parts market tends to be affected by the number of vehicles requiring inspection (*2). However, despite the decline in the number of vehicles inspected in FY2023, the automotive parts and components market was estimated to have grown due to rising component unit prices stemming from rising energy and labor costs.

While the automotive parts and components market relies on the number of vehicles requiring inspection (*2) and new car sales (*3) in the short-term perspective, it largely conforms to the number of vehicles owned (*4) in the medium-to-long term perspective. At the end of 2024, the number of owned vehicles (*4) was 78,970 thousand units, slightly down from the previous year. In the medium to long term, the number of owned vehicles cannot avert shrinkage, nor can the automotive parts and components market, due to the shrinking population. One way to somewhat alleviate the decline is to increase the average ownership period.

As of the end of March 2024, the average ownership period for passenger cars (excluding miniature cars) was 13.32 years (*5). While this figure declined from the previous year but increased compared to a decade ago. As the ownership period increases, the frequency of maintenance work and the number of replacement parts are expected to rise. Therefore, the longer the ownership period, the more moderate the expected decline in demand.

*1) Source: Automotive Maintenance White Paper FY2023 by the Japan Automobile Service Promotion Association (JASPA).

*2) Source: Automobile Inspection Workload (Annual Report) by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT).

*3) Source: the Japan Automobile Dealers Association

*4) Source: Yearly Statistical Report on Motor Vehicle Transport by the MLIT

*5) Source: The Automobile Inspection & Registration Information Association.

Noteworthy Topics

The Market Size of Genuine Parts Reached 1,492.1 Billion Yen in FY2023, Which is Advantageous as Vehicles Becoming Sophisticated

The genuine parts market in Japan is estimated to reach 1,492.1 billion yen in FY2023.

An increase in the number of vehicles brought in for maintenance at dealerships, coupled with strong new car sales causing favorable sales of car accessories associated with dealer options, seemed to have worked well for the genuine parts market.

As vehicles have become more sophisticated, genuine parts have become the only solution for many repairs, which also boosted the genuine parts demand.

More vehicles are expected to be brought in for maintenance at dealers due to the sophistication of vehicles and the prevalence of electric vehicles. This will likely slow the pace at which the genuine parts market is shrinking. Nevertheless, the genuine parts market is expected to continue shrinking in the medium to long term, due to the declining number of cars owned.

Future Outlook

In the first half of FY2024, automakers generally increased shipment values of genuine parts compared to the previous fiscal year. Auto parts recommended by JAPA are likely to show favorable sales at major dealer chains in FY2024, and tire sales, which are classified as "other car parts”, are also exceeding the previous fiscal year's numbers. Therefore, sales at car parts stores are projected to surpass the previous fiscal year’s sales. Additionally, sales of recycled parts are on the rise, and the shipments of rebuilt parts to local dealers are favorable.

The number of vehicles requiring inspection (*2) in FY2024 is 33 million units, which is about a million units (or approximately 3.0%) fewer than the previous fiscal year. However, owning vehicles for longer periods is making the demand for auto parts steadfast.

Due to strong sales at companies in the car parts market, which include automakers, parts dealers, and car parts stores, and increased unit prices for auto parts stemming from vehicle sophistication and soaring material costs, the auto parts market is expected to grow. The automotive parts and components market is forecast to increase by 5.1% year over year to reach 3,263.0 billion yen in FY2024.

Research Outline

2.Research Object: Automakers, automotive maintenance companies, automotive parts and components distributors (via separate automaker network or across different automaker networks), automotive parts and component wholesalers, automotive dealers, and related organizations

3.Research Methogology: Face-to-face interviews by specialized researchers (including online), surveys via telephone and email, and literature research

About the Automotive Parts and Components Market

In this research, the automotive parts and components market refers to the market for automotive parts used for maintenance, as well as other automotive components. This market includes genuine products from manufacturers, auto parts recommended by the Japan Automotive Products Association (JAPA), and recycled parts, such as reused and rebuilt parts, as well as other automotive components.

Genuine products from manufacturers: Auto parts manufactured and sold by automakers for the automotive aftermarket, which are primarily used by dealers.

Auto parts recommended by JAPA (Japan Automotive Products Association): Low-cost auto parts that can be used regardless of brand and are of equal quality equal to genuine products. They are primarily used at maintenance factories.

Recycled parts (reused or rebuilt): Commercialized parts that are reused or rebuilt from used vehicles.

Other automotive parts and components: This category includes consumables, repair parts, and automotive accessories, which are primarily available at mass merchandisers.

<Products and Services in the Market>

Genuine products from manufacturers, auto parts recommended by JAPA (Japan Automotive Products Association), recycled parts (reused or rebuilt), automotive components

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.