No.3698

Global Market for 5G/6G Devices & Materials: Key Research Findings 2024

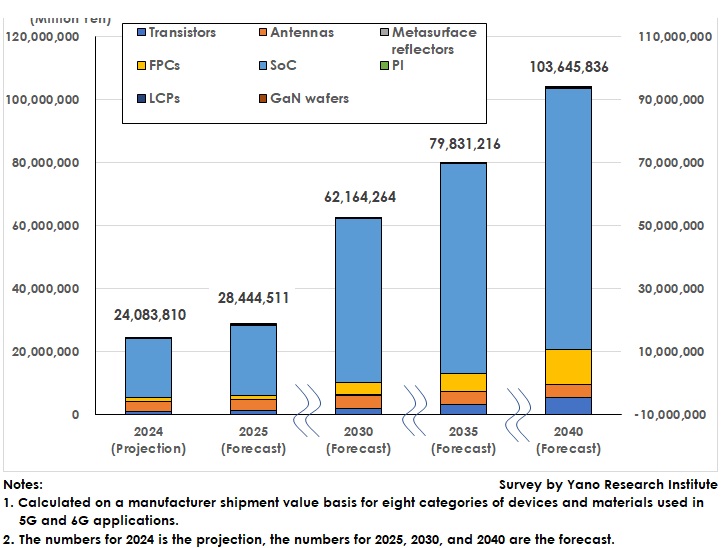

Global 5G/6G Devices and Materials Market Size Projected to Reach 24,083.8 billion yen in 2024

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the global market for 5G and 6G devices and materials and found out the trends by major device and by material, the trend of market players (manufacturers, trading firms), the trend of R&D institutions, and the market outlook.

Market Overview

The global market size of devices and materials (total of 8 categories, based on the manufacturer shipment value) for the fifth generation (5G) and the sixth generation (6G) mobile communication systems is forecast to reach 24,083.8 billion yen in 2024. In detail of eight categories of the market, transistors are forecast at 1,139.8 billion yen, antennas at 2,938.8 billion yen, flexible printed circuits (FPCs) at 1,250.0 billion yen, system on a chip (SoC) at 18,735.6 billion yen, polyimide (PI) at 15.3 billion yen, and liquid crystal polymers (LCPs) at 4.3 billion yen. Note that metasurface reflectors and gallium nitride (GaN) wafers, which are included in the 8 categories of the market, have not yet formed the market for commercialization as of 2024.

Compared with the initial estimate at the beginning of the provision of 5G commercial services, the acceptance of the services can be said to be far from favorable. The main reasons are that the communication services that can only be achieved by 5G are hardly needed by consumers, and telecom operators have faced difficulties in expanding the communication areas and in monetization, which has prevented the services from diversifying and being widely accepted.

Noteworthy Topics

Fusion of AI and 5G/6G will be Key for Telecom Operators to Improve Monetization

In 2024, an action was launched to explore the possibility of synergies between AI and telecommunications. Namely, the establishment of the AI-RAN Alliance. Its vision is to integrate AI with Radio Access Networks (RAN) to drive innovation, increase efficiency, and generate new economic opportunities for the telecom ecosystem. Founding and General Members, both composed of industry leaders, research institutions, and academia, are working to develop the following three themes by leveraging their respective technology capabilities. According to the “AI-RAN Alliance Vision and Mission White Paper”, the three themes are explained as follows:

AI-for-RAN: focuses on the integration of AI into RAN to significantly enhance RAN performance, such as improving spectral and operational efficiency, optimizing radio resource management, and enabling predictive maintenance.

AI-and-RAN: seeks to create a shared infrastructure between RAN and AI workloads, enabling concurrent resource utilization on this converged computer-and-communications infrastructure. The goal is to increase the overall utilization of such platform infrastructure supporting the RAN workloads and open new monetization opportunities for running non-RAN AI applications on the same infrastructure.

AI-on-RAN: aims to enable new RAN services to enhance AI applications running at the network edge, to be able to offer new consumer and enterprise services and applications from the edge of the network.

As a part of the AI-and-RAN initiative of the AI-RAN Alliance, an integrated solution has been developed and demonstrated that enables both AI and RAN to operate on the same platform. Traditional RAN-specific hardware installed in base stations is designed and built with computing resource capacity to handle the peak traffic hours of a day. However, the peak hours of a day are instantaneous, resulting in a surplus of computing resources during off-peak hours.

The integrated solution, which enables AI and RAN to run on the same platform, allows the excess computing resources during off-peak hours to be transferred to AI service providers to be used for AI workloads.

Telecom operators can generate revenue by monetizing the transfer of computing resources, which can improve their revenue planning. This is expected to accelerate the capital investment in 5G/6G communications infrastructure.

Future Outlook

The diffusion of 5G technology to date cannot be described as successful. However, as of November 2024, some factors have emerged that could potentially boost the diffusion of 5G/6G networks in the future. For example, the growing power of short-form video platformers such as TikTok is increasing the traffic as the number of views increases, which may have a negative impact on communication quality. As the short-form video market continues to grow, consumers may require greater capacity and multiple simultaneous connections on the network, which is exactly what 5G has.

Generative AI has been widely accepted, leading to a development race for System on a Chip (SoC) for smartphones with superior AI processing performance, resulting in a shortage of SoC production capacity. A market for SoC for notebook PCs with high AI processing performance that also supports 5G is emerging.

Images, pictures, and videos that are created but used by consumers on a limited basis are expected to be used more extensively. If so, the ability to download or upload created images and videos to the cloud will increase consumer demand for better communication quality.

For the 6G network, the International Telecommunication Union (ITU) and the 3rd Generation Partnership Project (3GPP) are setting the timelines for standardization and commercialization. The future may be very different from what is planned, depending on the realization of the steady growth of those factors that have the potential to drive the demand for 5G/6G services, such as generative AI and self-driving cars, and the launch and subsequent steady growth of 6G commercial services going as planned. If 6G commercial services are launched as planned, and if generative AI and self-driving cars continue to proliferate, investments in communication infrastructure for 5G/6G networks will increase. Therefore, the global market size for 5G/6G devices and materials is projected to grow to 103,645.8 billion yen by 2040.

Research Outline

2.Research Object: Companies dealing in devices and materials for 5G/6G applications (manufacturers, trading companies), universities/R&D institutions, telecom operators

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, and literature research

The Market for 5G/6G Devices and Materials

The 5G/6G devices and materials market refers to the market for devices and materials for 5G/6G applications, such as transistors, antennas, metasurface reflectors, flexible printed circuits (FPCs), system on a chip (SoC), polyimide (PI), liquid crystal polymers (LCPs, PCB application only), and gallium nitride wafers (GaN wafers). The market size has been calculated based on the shipment value of the manufacturers.

These 5G/6G devices and materials are not only used in base stations supporting 5G and 6G using sub-6 GHz or higher bands, or embedded in mobile devices such as smartphones and notebook PCs and automotive equipment such as an advanced driver-assistance system (ADAS), but used also as IoT modules for production facilities and equipment in the manufacturing industry, embedded in various robotic systems, heavy machinery/construction equipment in the construction industry, and distribution equipment.

<Products and Services in the Market>

5G/6G devices and materials: transistors, antennas, metasurface reflectors, flexible printed circuits (FPCs), system on a chip (SoC), polyimide (PI), liquid crystal polymer (LCP, PCB application only), and gallium nitride wafers (GaN wafers)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.