No.3687

Clinical Laboratory Reagents and Equipment Business in Japan: Key Research Findings 2024

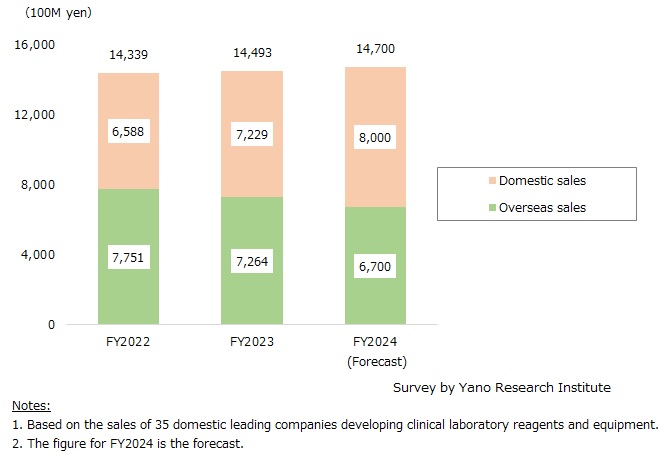

Business Size of Clinical Laboratory Reagents and Equipment at Domestic Leading Companies in FY2023 Yielded 1, 449,300 Million Yen, Up 1.1% from Previous Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the business of clinical laboratory reagents and equipment developed at leading 35 companies in Japan, and found out the related markets, the trends of market players, and future perspectives.

Market Overview

The business size of clinical laboratory reagents and equipment at leading companies in Japan in FY2023 (based on the sales at domestic 35 leading companies developing clinical laboratory reagents and equipment) was estimated at 1,449,300 million yen, up by 1.1% from the previous fiscal year. When separating the said business into that for domestic use and for overseas, the domestic business declined by 6.3% from the preceding fiscal year to 726,400 million yen, while that for overseas increased by 9.7% from the previous fiscal year to 722,900 million yen.

Following the reclassification of COVID-19 as a Category 5 disease under the Infectious Disease Act, sales of COVID-related antigen test kits and genetic testing reagents and equipment declined. However, with ongoing outbreaks of influenza and other diseases, demand for multi-disease test kits that can detect several infections simultaneously increased. Additionally, there was a broader recovery in the sales of clinical laboratory reagents and equipment. Together, these factors helped offset the drop in sales of COVID-specific products.

Noteworthy Topics

Increase of Flu-CoV Combo Test Kits for Checking Multiple Infections in One

Combination rapid test kit for checking COVID-19 and flu with one sample is garnering attention.

COVID-19 detection methods can be broadly categorized into genetic tests, primarily based on PCR, and antigen tests. While accuracy of rapid antigen tests may not be as high as genetic tests, their convenience and speed have driven strong demand, especially following the spread of the Omicron variant in 2022. Despite growing price competition as more suppliers entered the market for rapid antigen test kits, the government's decision to distribute these kits free of charge to local governments (which in turn provided them to medical facilities) led both domestic and foreign manufacturers to ramp up production. Additionally, with Japan's health ministry approving the over-the-counter sale of antigen self-testing kits, there has been a significant expansion in sales, as consumers increasingly use them for at-home testing.

In FY2023, the concurrent outbreak of novel coronaviruses and influenza resulted in a decrease in sales of rapid antigen test kits for COVID-19 alone. However, it also created a new market for CoV-Flu combo test kits, which can detect both infections simultaneously.

Future Outlook

The size of the domestic clinical laboratory reagents and equipment business for FY2024 is projected to grow by 1.4% year-on-year, reaching 1,470,000 million yen (based on the sales of 35 major domestic suppliers of clinical laboratory reagents and equipment). The domestic business is forecasted to decline by 7.8%, while overseas business is expected to grow by 10.7%.

Suppliers of clinical laboratory reagents and equipment saw significant demand for COVID testing in FY2021 and FY2022. In May 2023, when the government reclassified COVID-19 as a Category 5 disease under the Infectious Disease Act, the number of hospitals treating COVID outpatients increased, including local internal medicine clinics and pediatric centers not specifically designated for fever-related outpatient care. With the widespread adoption of antigen tests in these clinics, there was a shift in preference toward certain types of test kits. Compared to FY2022, total demand for test kits has decreased. While demand for rapid test kits, including Flu-CoV combo test kits, may remain strong, an overall decline is expected to continue. However, the weak yen could benefit the overseas sales of clinical laboratory reagents and equipment.

Additionally, the growth of point-of-care testing (POCT) during the pandemic boosted the demand for test systems that offer faster and more accurate results than traditional immunochromatographic assays*. With the expected rise in demand for respiratory disease testing, suppliers have a strong opportunity to capture market share.

*Immunochromatographic assay is a simple and rapid immunoanalytical method that relies on chromatography. It works by using specific antibody-antigen binding reactions to detect or quantify target substances.

Research Outline

2.Research Object: Leading 35 companies developing clinical laboratory reagents and equipment in Japan (Japanese companies and Japanese subsidiaries of overseas companies)

3.Research Methogology: Face-to-face interviews (including online interviews) by expert researchers, surveys via telephone and email

About Clinical Laboratory Reagents and Equipment Business Size

For this survey, the business size of clinical laboratory reagents and equipment was calculated by adding up the domestic and international sales at 35 leading domestic suppliers of clinical laboratory reagents and equipment.

<Products and Services in the Market>

Clinical laboratory reagents and equipment in general

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.