No.3647

Automotive Software (Automakers & Auto Parts Suppliers) Market in Japan: Key Research Findings 2024

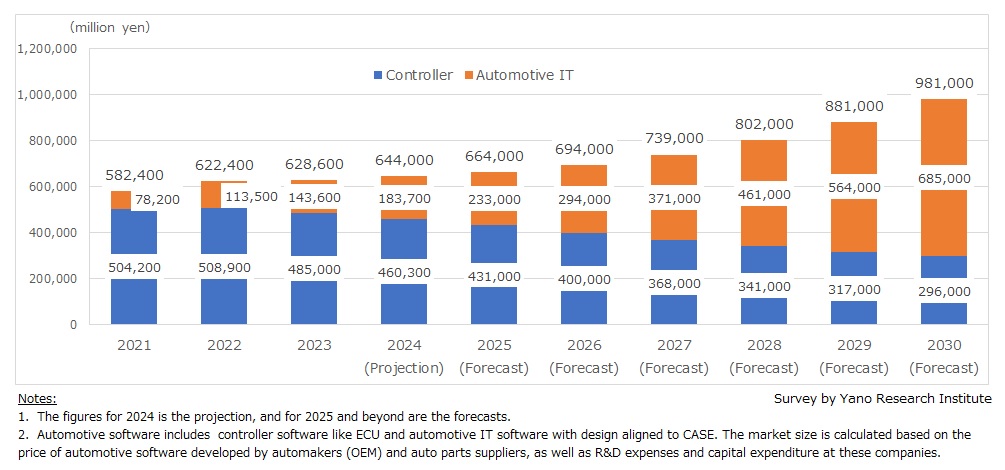

Domestic Automotive Software (Developed by OEMs & Auto Parts Suppliers) Market Size Estimated at 644 Billion Yen in 2024, Forecasted to Approach 1 Trillion Yen by 2030

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the automotive software market in Japan, and found out the trends of automotive software (controller software and automotive IT software) by OEMs and autoparts suppliers, the changes in architecture, challenges, and future directions. This press release announces our forecasts on the market size and market composition of automotive software by 2030.

Market Overview

Automotive software can be categorized briefly into 1) controller software and 2) automotive IT software. Controller software consists of ECU units that control automobile electronically, and the number of controllers per vehicle is increasing in tandem with ADAS sophistication. Automotive IT software is cloud-based software with design aligned to CASE (Connected, Autonomous, Shared & Service, Electric), which is the platform for various vehicle-related applications including entertainment.

The market size of automotive software developed by automakers and auto parts suppliers (Tier 1 etc.), based on the price of such software as well as R&D expenses and capital expenditure at these companies, was 582,400 million yen in 2021, 86.6% of which was occupied by controller software and the rest (13.4%) by automotive IT software. The same market size has grown to 628,600 million yen in 2023 (101.1% of the previous year), with the composition ratio of automotive IT software rising year by year (controller software 77.2%, automotive IT software 22.8%).

The market is projected to reach 644,000 million yen in 2024 (102.4% YoY), with composition ratio of controller software at 71.5% and automotive IT software at 28.5%. Against the background of a rapid increase of OEM R&D expenses, especially for vehicle OS and HAL*2, some of the expenses are outsourcing fee paid to contractor vendors (software developers). Controllers are on a declining trend from 2022 due in part to the integration of conventional ECUs, which on the other hand increases the ratio of automotive IT systems to controller software.

*1 ECU: ECUs (Electronic Control Units) electronically control lane keeping systems, distance control systems, etc. The number of ECUs installed per vehicle has been on the rise in the last few years. The increase of volume and cost of ECUs has become an issue for automakers.

*2 HAL: The hardware abstraction layer (HAL) provides a software interface between hardware and software, effectively bridging the gap between the two. It is responsible for managing the differences among various hardware components.

Noteworthy Topics

Shift of Automotive Electronics Architecture from Domain-type to Zone-Type

In the early 2020s, automotive manufacturers (OEMs) actively engaged in the development of automotive IT software, especially vehicle operating systems (OS). However, trying to implement a vehicle OS while still using traditional control software for powertrains and chassis turned out to be quite complicated. Many projects faced major difficulties during the integration phase, resulting in a number of failures.

In light of these challenges, OEMs are now exploring the development of zone-type control systems. This approach involves rethinking traditional control systems, which are usually organized by specific areas, to redesigning the control software. This means breaking down existing electronic control units (ECUs) grouped by domain, like powertrain and chassis, and then reorganizing them into new categories based on their operational needs, such as "those that need critical movements" versus "those that can tolerate some delays (even though the amount of info may be vast)".

While OEMs have yet to define their product categorization clearly, they frequently adopt the ASIL (Automotive Safety Integrity Level) framework based on ISO 26262. This framework typically allows for classification into three to four groups. For instance, products that require critical operations are classified as ASIL-D, while those that can accommodate delays fall under ASIL-B. The electronic control units (ECUs) are connected to and managed by a high-performance computer (HPC) through a gateway. The HPC's upper layer functions as the application layer, where necessary functionalities are implemented according to application requirements.

For example, if the HPC system consists of three HPCs, it will necessitate three separate operating systems. The traditional method of relying on a single operating system has not yielded success. By breaking down the control software into multiple components, it becomes feasible to implement them incrementally, starting with the functionalities that are simpler to develop.

Future Outlook

In the development of automotive software, there is much to be done through trial and error. In fact, major Japanese OEMs and others are currently developing vehicle OS and peripheral systems at a rapid pace, and we expect to see the fruits of their efforts around 2027. In addition, coupled with the convergence toward integrated ECUs, we expect the market composition of control systems and automotive IT systems in the automotive software market (developed by OEMs and auto parts suppliers) to account for roughly 50 percent by 2027. However, controller software will also shift from domain-type to zone-type. The investment is expected to continue, although not on the scale of automotive IT systems.

Given that the actual installation of the next-generation automotive software will be seen around 2030, the total market size of automotive software market (controller software and automotive IT systems) developed by automakers and auto parts suppliers is expected to approach 1 trillion yen by 2030 (981 billion yen).

Research Outline

2.Research Object: Automakers, auto parts suppliers (Tier 1, etc.), and automotive software developers

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews) and literature research

<What is Automotive Software? >

Automotive software has been categorized briefly into controller software and automotive IT software. Controller software are small computers inside ECUs (CPU), each of which electronically controls specific system, such as system for “run,” “turn,” and “stop”, respectively. On the other hand, we define software with design aligned to CASE (Connected, Autonomous, Shared & Service, Electric) and SDV concepts as automotive IT software (infotainment software and driver assistance systems, etc.).

<What is the Automotive Software Market?>

The automotive software market in this research includes both controller software and automotive IT software, and the market size is calculated based on the price of automotive software developed by automakers (OEM) and auto parts suppliers, as well as R&D expenses and capital expenditure at these companies.

*For the market size of automotive software based on the price of subcontractors of OEMs and auto parts suppliers, please refer to “Automotive Software (Developed by Software Development Vendors, IT Semiconductor Companies, and Microcontroller Vendors) in Japan: Key Research Findings 2025”, released on August 27, 2025.

https://www.yanoresearch.com/en/press-release/show/press_id/3878

<Products and Services in the Market>

Domestic automotive software developed by automakers and auto parts suppliers

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.