No.3630

Imported Luxury Brand Market in Japan: Key Research Findings 2024

Imported Luxury Brand Retail Market in 2023 Showed Substantial 30.1% of Growth from Previous Year, Boosted by Inbound Tourist Consumption Backed by Weak Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic imported luxury brand market and found out the market status, the trends of brands, and future perspectives.

Market Overview

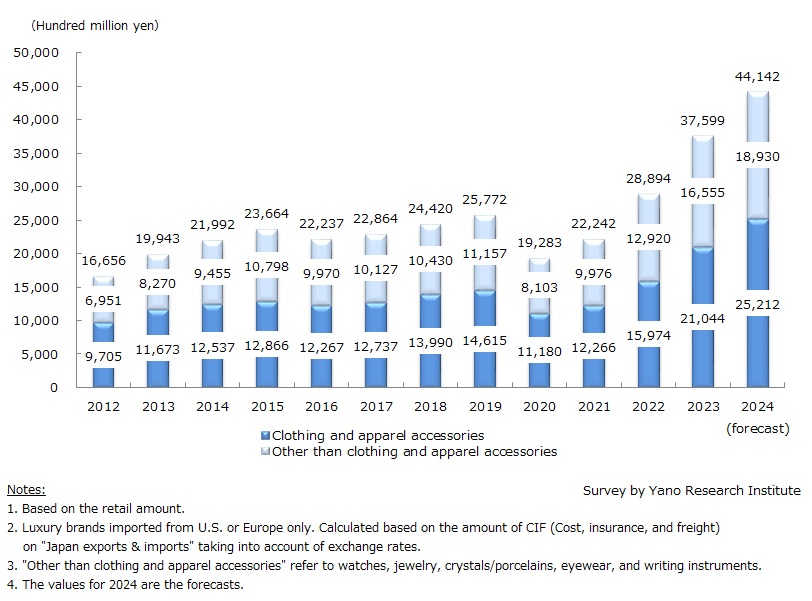

The domestic imported luxury brand (major 15 items) retail market in 2023 was estimated to have risen by 30.1% from the previous year to 3,759,900 million yen. The factors contributed to the expansion in 2023 include the growing consumption of the domestic affluent customers against the backdrop of high stock prices, the rise of new and replacement demand associated with the lift of pandemic activity restrictions, and the rapid increase of inbound demand (spending by foreigners visiting Japan) owing to the weak yen.

On the other hand, in addition to the soaring costs of raw materials, labor, and transportation, which were exacerbated by the covid situation, product price hikes continued in 2023 due to the rapid depreciation of the yen. In the past few years, product price hikes were nothing but a market driver. However, with ongoing price increases driving the younger and middle-class consumers away from luxury goods, it is becoming increasingly clear that affluent customers and inbound tourists are the primary target segments for the import brands market.

Noteworthy Topics

Significantly Growing Brands & Slumping Brands

As the economy and social activities bounced back from the COVID crisis, most brands experienced significant growth in 2023, driven by robust spending from affluent domestic consumers and inbound tourists. The demand from inbound tourists had a notable impact especially for top brands, surpassing even the levels seen in 2019 before the pandemic.

Looking at the sales breakdown, even brands that saw an increase in sales in 2023 attributed their growth primarily to price increases and sales to inbound tourists. Some brands noted that sales to domestic customers fell below 2022 levels, and this trend is continuing into 2024. In 2023, a distinct contrast was seen between those that experienced significant growth due to their domestic and international popularity, and those that struggled to recover from the pandemic downturn.

While strong inbound demand drives sales, import brands are concerned that too much reliance on inbound demand may have a negative impact on their engagements with domestic loyal customers, affluent customers in particular. Retention of domestic loyal customers is a challenge for all brands.

Future Outlook

Inbound demand is gaining momentum in 2024, outpacing the previous year's growth. While spending by general consumers is sluggish due to rising prices, consumption among affluent customers is as robust as ever. Despite the concerns that spending by affluent customers could slow in the second half of the year, depending on stock market trends, the strong performance of leading brands in the first half—driven by robust consumption from affluent consumers and inbound tourists—suggests that the domestic retail market for imported brands (15 main items) is forecasted to grow by 17.4% in 2024, reaching 4,414,200 million yen.

In view of the demand for import brands among inbound tourists, despite any potential fluctuations, we believe the current level will be maintained in the medium to long term. However, there is a risk that the domestic affluent class may increase their spending abroad or shift their focus towards products or experiences other than import brands. While the impact of the COVID crisis diminishes, we view 2024 is as a critical year for import brands to assess the future consumption behavior of affluent customers, determining whether they will continually spend domestically and maintain strong demand for luxury goods.

Research Outline

2.Research Object: Trading firms, manufacturers, retailers that import and sell products such as clothing, accessories, watches, jewelry, crystals/bone chinaware/porcelains, eyewear, and writing materials, produced by the European and U.S. brands, and Japanese subsidiaries of imported luxury brands

3.Research Methogology: Face-to-face interviews (including online interviews) by our expert researchers, survey via telephone, and literature research

Imported Luxury Brands Market

Imported brands in this research refer to luxury brands for the following 15 items (conventional 10 items and newly-added 5 items): 1) Women’s clothing, 2) Men’s clothing, 3) Babies’ clothing, 4) Bags & leather goods, 5) Shoes, 6) Ties, 7) Scarves/shawls/handkerchiefs, 8) Leatherwear, 9) Belts, 10) Gloves, 11) Watches, 12) Jewelry, 13) Crystals/chinaware/porcelains, 14) Eyewear, and 15) Writing instruments. Note that products include only those imported from U.S. or Europe.

<Products and Services in the Market>

Women’s clothing, Men’s clothing, Babies’ clothing, Bags & leather goods, Shoes, Ties, Scarves/shawls/handkerchiefs, Leatherwear, Belts, Gloves, Watches, Jewelry, Crystals/porcelains, Eyewear, and Writing instruments

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.