No.3622

Confectionery Co-manufacturing Market in Japan: Key Research Findings 2024

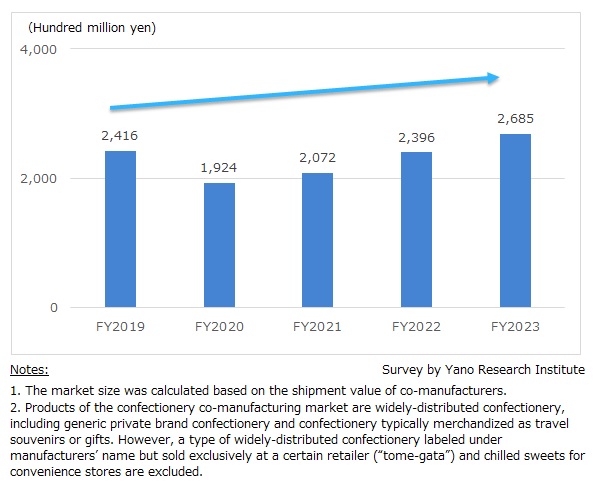

Confectionery Co-manufacturing Market for FY2023 Expanded to 268,500 Million Yen, Up 12.0% From Preceding Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic confectionery co-manufacturing market. This press release shares the market size transition from FY2019 to FY2023, the current status of the market, and the background of market expansion.

Confectionery Co-manufacturing Market in Japan

<Survey Result Summary>

The domestic confectionery co-manufacturing market for FY2023 rose by 12.0% from the previous fiscal year to 268,500 million yen. While it is true that the increase partly owes to the recovery of demand for travel souvenirs from FY2021 as the Covid situation ended, even without consideration to this, the confectionery co-manufacturing market has been on a growing stably in the last few years. The growth was driven by diversifying needs and tastes of consumers, the trends of retailers and wholesalers increasing private label products, the rise of small-scale co-manufacturers entering the market, and the market entry of non-food businesses.

One trend to note is a recent move of a Japanese household consumer item retailer enhancing a selection of its food products. The company uses standardized minimalistic packaging for all of its products to showcase its brand philosophy. This has contributed to the expansion of confectionery co-manufacturing market. In addition, food services, especially chain coffee house, are enhancing “impulse buys" (or "checkout counter candy”), the types of sweets sold at the counter of a cashier. The confectionary co-manufacturing market is expanding along with the increase in the number of non-food businesses utilizing co-manufacturing.

In the confectionery co-manufacturing market, typical co-manufacturers are food OEMs that specialize in co-manufacturing. Nonetheless, as the demand increases, small- and medium-sized manufacturers that have brands of their own are increasingly embarking on co-manufacturing. For some of these companies, co-manufacturing business has become one of their business pillars. Increase of co-manufacturing deals is encouraging for the market growth. However, the challenge is that brand owners tend to control the prices of jointly manufactured products, and product prices are relatively low with the exception of gift confectionery. Under the circumstances, negotiation to add soaring costs on price and demonstrating originality in product development are important for the co-manufacturers.

<Definition of the Market>

In this research, the confectionery co-manufacturing market includes confectionery OEM (short for Original Equipment Manufacturer, a company that makes products on behalf of a brand owner) and confectionery ODM (short for Original Design Manufacturer, a manufacturer with expertise not only in production but has the capability to design products for its client, which may include selection of ingredients and development of recipes).

Viewing by products, the confectionery co-manufacturing market refers to widely-distributed confectionery, such as generic private brand confectionery (i.e., private label products providing customers with a low price option), and confectionery typically merchandized as travel souvenirs or gifts. However, a type of widely-distributed confectionery labeled under manufacturers’ name but sold exclusively at a certain retailer with features, such as flavor, customized for target customer segment of that retailer (called “tome-gata” in Japan), and chilled sweets for convenience stores are excluded. The market size was calculated based on the shipment value of the co-manufacturers.

<Published Report>

Confectionery Industry: Widely Distributed Confectionery Products 2024

https://www.yanoresearch.com/market_reports/C66107200

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.