No.3586

High-Performance Packaging Materials Market in Japan: Key Research Findings 2024

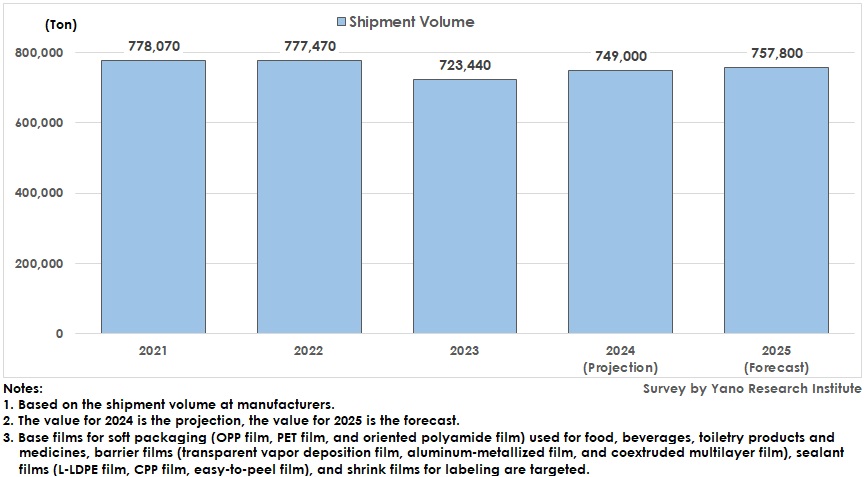

Shipment Volume of High-Performance Packaging Materials in 2023 Dropped to 723,440 tons, 93.1% of Previous Year

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic high-performance packaging materials market and found out the trends by product segment, trends of market players, and future perspectives.

Market Overview

The high-performance packaging materials market size in 2023 (domestic shipment volume as well as exported volume) fell to 723,440 tons, 93.1% of the previous year. When observing the details, shipment volume of base films was 320,380 tons (91.0% on YoY), barrier films 70,960 tons (93.1%), sealant films 299,570 tons (94.7%), and shrink films for labeling 32,530 tons (99.8%).

Demand for packaging materials for retail food declined due to reluctant purchases stemming from merchandise price hikes, in addition to a downturn from special demand during the pandemic. Huge decline in shipment volume of high-performance packaging materials also stemmed from efforts by convenience stores and supermarkets to reduce excess merchandise stocks as well as to diminish food losses by discounting. Still, many packaging material manufacturers optimistically anticipated recovery in demand, while inventory optimization and reviving desires for dining at home increased the needs of packaging materials, which led the estimation of the high-performance packaging materials market size in 2024 to be 749,000 tons, 103.5% of the preceding fiscal year, on the way of recovery.

Noteworthy Topics

Pouches

While retort pouched curry products have long been contained within a flat pouch in a paper box to stand upright, which still are the mainstream in supermarkets and department stores, convenience-store private brands currently adopt flat-bottom pouches that can self-stand without needing a paper box to cover. When observing the recent trend of food packaging, standup pouches have widespread by being used as the container for convenience-store private brand delis. However, as replacement overall finished from rigid containers such as plastic trays or cups to standup pouches, the growth rate is slowing down. Although demand for microwavable flat pouches for curry has already run its course, many pasta sauces still use aluminum boil pouches, which have room to shift to microwavable flat pouches.

Future Outlook

In addition to continuous shrinkage in demand for domestic packaging materials in accordance with waning population, improved techniques by overseas packaging material manufacturers, excess supply in global scale, and price competition are increasing the predicament for domestic packaging material manufacturers. On the other hand, environmental considerate products and high-barrier food containers i.e., retort food pouches are obviously in demand in the ASEAN markets, showing no small ranges for growth.

At the time when environmental issues started gathering attention, plastic itself was regarded as “evil” and deplasticization that could be said as over-reacting was underway.

Lately, however, plastic has been re-evaluated for its usefulness, cost, and recyclability. As can see from packaging material manufacturers being required to consider a circular economy of plastic as a prerequisite when building the scheme and designing container packaging, winds of change are blowing.

After the lift of behavior restrictions during the pandemic, whole-scale business activities became available at packaging material manufacturers. In the meantime, price hikes for raw materials are seen as overall done with, which has fueled brand owners (food manufacturers, convenience stores, supermarkets, etc.) to review the priorities on environmental designing of packaging materials. Especially, as the sustainability target of 2025 closing in, the efforts to adopt environmentally friendly products by brand owners are escalating.

In a bid to cater to such changes in the market, packaging material manufacturers are required to reform the business portfolios.

Research Outline

2.Research Object: Companies providing soft packaging materials (film manufacturers, converters)

3.Research Methogology: Face-to-face interviews by expert researchers, and literature research

The High-Performance Packaging Material Market

High-performance packaging materials in this research refer to following films: Base films for soft packaging (oriented polypropylene [OPP] film, polyethylene terephthalate [PET] film, and oriented polyamide or oriented nylon [Ony] film) that are used for food, beverages, toiletry products and medicines; barrier films (transparent vapor deposition film, aluminum-metallized film, and coextruded multilayer film); sealant films (linear low density polyethylene [L-LDPE] film, cast polypropylene [CPP] film, easy-to-peel film); and shrink films for labeling. The market size is calculated based on the shipment volume at domestic manufacturers. The market size includes domestic shipment as well as those exported.

<Products and Services in the Market>

Base films for soft packaging (OPP film, PET film, and oriented polyamide film), barrier films (transparent vapor deposition film, aluminum-metallized film, and coextruded multilayer film), sealant films (L-LDPE film, CPP film, easy-to-peel film), and shrink film for labeling

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.