No.3532

Used Car Market in Japan: Key Research Findings 2024

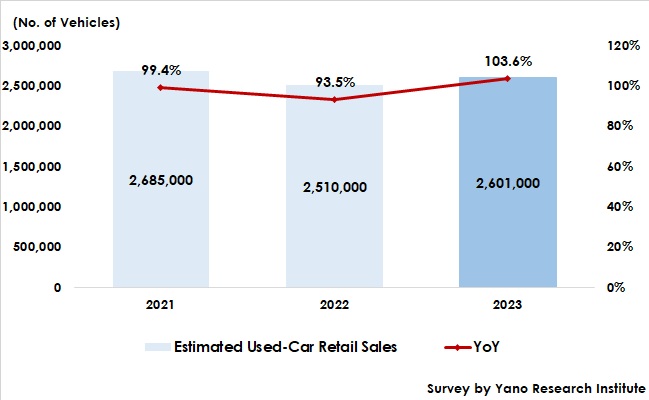

Number of Used Cars Retailed in 2023 Estimated as 2,601 Thousand Units

Yano Research Institute (President, Takashi Mizukoshi) has surveyed the domestic used car distribution and found out the trends by major segment (used car retailing, used car purchasing, auto auction (including bidding), and used car exporting), trends of market players, and market outlook.

Market Overview

The number of used cars retailed in Japan in 2023 was estimated as 2,601 thousand units.

In 2023 elimination of disruptions in supply chains for semiconductors and other components improved the environment of new car production and sales and increased the number of used cars as trade-in for new cars. This reduced the average contract price at auto auctions and restored the environment for domestic consumers to be more willing to purchase secondhand vehicles. According to the questionnaire to the domestic automobile users, conducted in association with the research, total used car purchase value for 2023 on average was 1,628,000 yen, making the domestic used car retail market in value (number of retailed vehicles multiplied by total purchase value on average) as 4,234,260 million yen.

Used car market, being on the way to the recovery alongside new car market, saw a scandal by a major used car dealer in 2023, which caused no small untrusted feelings to the entire secondhand car market. Competitors and consumers seemed to accept the matter cooly as the problem belonged strictly to the concerned company, but they were expected to make collaborative efforts to improve the image of the industry in unison.

Noteworthy Topics

Changes Caused by Invoice System Introduction and Mandatory Indication of Total Payment Sum

In 2023, as the invoice system introduced and total sum indication for payment mandated, changes occurred to sales environment and purchasing for used car businesses.

While both cases did not affect enormously, various reactions were made to obligatory indication of total sum for payment in the questionnaire conducted in association with this research, such as some negative responses of “Too much labor to renew all the price boards” and some positive opinions of “Easier to understand the amount to pay for consumers”.

As there were some changes that could lead to improvement in the conventional habits that had long been seen as problematic, the market environment going forward draws attention.

Future Outlook

The mainstream of domestic new car sales is the replacement of existing cars, but the replacement frequency has become lower in recent years. As vehicles for sales are more advanced in features and in electrification, so as to solve the recent global-based environmental issues such as decarbonization and to be ready for ever diversifying mobility methods for individuals, new car prices are likely to rise in the short term.

In contrast, demand for used cars, lower in price than new cars, is very likely to expand and to continue enjoying the tailwind for the time being.

Some manufacturer-based dealers have consolidated their companies and enhanced the base that sell both new and used vehicles, aiming to strengthen the measures against potential new car market shrinkage for the future. In addition, by offering residual value (balloon payment) for new car sales, which is to allow a customer to pay the residual car value in installment, that is the subtraction of the car value at due period from the new car price, the dealers try to secure customers, increase the profits from used car sales that have been returned at contract expiration, and to obtain new customers. Automakers, too, tend to support the dealers in used car business. Used car business with automakers and dealers aligned may accelerate the business expansion as they renew the recognition of importance of the alignment.

Meanwhile, used car traders (both sell and purchase used cars) show continuous investment and customer acquisition by strengthening purchases directly from end users, thereby to stabilize the revenue base while striving to reduce the purchase cost and expand the profit from retail sales. Used car purchasers, on the contrary, are focusing on retail sales to end users, as they expect profit expansion from vehicle sales.

The environment for used car sales is about to return to what used to be, that is easier for end users to purchase. Partly because of the above-mentioned factors, the used cars are in demand steadfastly. Added to that, obligatory indication of total payment sum is now the unified rule for used car retail business. While the impact is smaller, the scandal by a major used car dealer has tended customers to avert major companies temporarily and has seemingly caused an inflow to other competitors.

This, in turn, can be said as an increase of options for end users. As price transparency is assured by total payment sum indication, it will be more important for end users to have a variety of options to choose from hereafter, other than the vehicle price, such as a wide selection of vehicles or convenience in terms of services during and after the purchase.

Research Outline

2.Research Object: Automakers, car dealers, auto auctioneers, bidding operators, used car traders/buyers, used car distributors, and automobile users

3.Research Methogology: Face-to-face interviews by expert researchers (online included), questionnaire, and literature research

What is the Used car Distribution Market?

The used car distribution market in this research consists of the following four markets: Used car retailing, used car purchasing, auto auction (including bidding), and used car exporting.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.