No.3150

IT Investment by Domestic Enterprises in Japan: Key Research Findings 2022

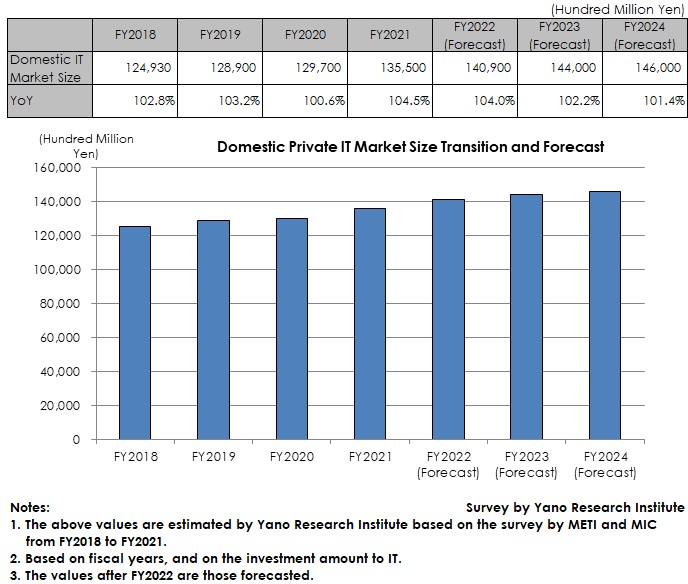

FY2021 IT Investment Size by Domestic Private Enterprises Expected to Rise to 13,550 Billion Yen, by 4.5% on YoY

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on IT (Information Technology) investment by domestic private enterprises in FY2022 and the future trends.

Market Overview

The IT (Information Technology) market size at domestic private enterprises by investment amount in IT (including hardware, software and services) in FY2021 was estimated as 13,550 billion yen, a rise by 4.5% on a year-on-year basis. Spread of telework in the coronavirus pandemic encouraged investment in infrastructure for telework, as the measure was an urgent matter for any companies, regardless of the size, to tackle, which hugely impacted the market. Even in those industries and business forms not suited for telework became more frequently requested to take measures for remote accessibility, which drove the companies to enhance ecommerce and invest in AI-utilized call centers and in digital marketing. Investments as a COVID-19 measure are likely to continue even in FY2022. FY2021 observed resume of some projects that had been suspended during the pandemic, showing a tendency of a short-term recovery from negative growth.

Noteworthy Topics

Willingness Expanded for Digital Transformation

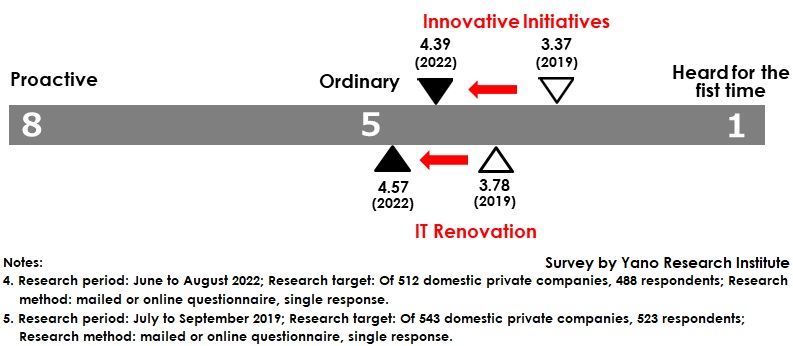

The questionnaire survey was performed to 512 domestic private enterprises by mail or online, in which it categorized the willingness to address digital transformation into that for “Innovative Initiatives (challenging new business by using IT) and for “IT Renovation (renovate mission-critical systems into SaaS or work processes into mostly cloud, etc.)”

In the questionnaire, companies were asked to respond to the level of their eagerness for innovative initiatives and for IT renovation into eight levels, with “8” being eager, “2” being passive, and “1” heard for the first time. Therefore, the larger the numeric value was the more eager their willingness was.

Of 512 domestic private companies, the average rates of 488 companies that responded were 4.39 for innovative initiatives and 4.57 for IT renovation. Both showed the near-average values. Though only by 0.18 points, the eagerness for IT renovation exceeded the willingness for innovative initiatives. The results were agreeable, as hurdles to taking on new business challenges are high.

The questionnaire likewise was performed in 2019, and of total 543 domestic private enterprises the responses were earned from 523 companies, with the average values for innovative initiative being 3.37 and for IT renovation 3.78. When compared the average values between those in 2022 and in 2019, the eagerness for IT renovation improved by 0.79 points, and for innovative initiatives by 1.02 points, indicating how willingness for digital transformation at enterprises were somewhat expanding, especially for innovative initiatives. In the situation where business environment has been changing dramatically, companies considering IT renovation being not enough seemed to be on the rise. As digital transformation cannot be achieved without any innovative intentions, it can be said as a healthy tendency.

Future Outlook

The IT market size at domestic private enterprises by the investment amount in IT (including hardware, software and services) for FY2022 was projected to expand by 4.0% on a YoY basis to 14,090 billion yen, for FY2023 to increase by 2.2% to 14,400 billion yen, and for FY2024 by 1.4% to rise by 1.4% on YoY 14,600 billion yen.

During FY2022, those efforts to enhance competitive edge and strengthen customer engagement are prominent. Investments to respond to “the Electronic Book Preservation Act (*1)” and “the Invoice System (*2)” are also promising. In the service industry that have severely affected by the pandemic are showing a sign of recovery in business, and increasing the investment relating to labor shortage and digital marketing. In those factors that support favorable IT investment, there are security measures and response to BCP (business continuity planning). Because of increase in those being victimized by cyber-attacks, investments are expected to expand in each industry and scale. From FY2023 onward, in addition to replacement of mission-critical systems and servers and security enhancement, the need for data-based initiatives are likely to increase. To press ahead with data-based initiatives, human resource shortages are often cited as an issue, which is expected for user companies to invest in IT personnel development for the future. The attention paid to reskilling and recurrent education in recent years can be the manifestation of this

*1) “Act on Special Provisions concerning Preservation Methods for Books and Documents Related to National Tax Prepared by Means of Computers” by National Tax Agency (effective in January 2022)

*2) Scheduled to come into force in October 2023 by National Tax Agency

Research Outline

2.Research Object: Domestic private companies

3.Research Methogology: Mailed questionnaire to private companies, and literature research

What is the IT Investment Market Size by Domestic Private Enterprises?

The IT investment market size by domestic private enterprises in this research is calculated based on the investment amount to IT by domestic private companies from the surveys by the Ministry of Economy, Trade and Industry, and Ministry of Public Management, Home Affairs, Posts and Telecommunications, added with the results of the questionnaire to domestic private companies on IT investment, conducted by Yano Research Institute.

*Period of Questionnaire Carried Out: June to August 2022; Target Audience: 565 domestic private companies and organizations; Methodologies: Mailed and online questionnaire.

<Products and Services in the Market>

IT investment by domestic private enterprises (hardware, software development from scratch, software package introduction and customization, outsourcing services for maintenance and operations, online services for ASP/cloud, access charges, consulting, etc.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.