No.3128

Leasing Market in Japan: Key Research Findings 2022

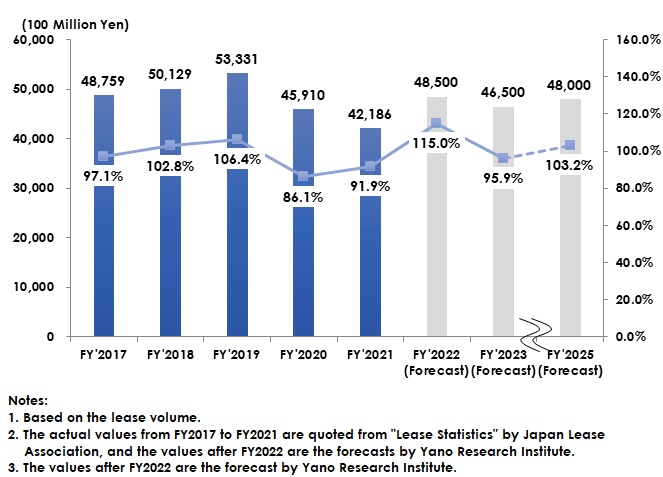

Lease Amount in FY2022 Rose to 4,850,000 Million Yen, 115.0% of That of Previous Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic leasing market, and found out the current status, trends of market players, and future perspective.

Summary of Research Findings

According to “Lease Statistics” by Japan Leasing Association, the lease volume in FY2021 was 4,218,600 million yen, 91.8% of the size of the previous fiscal year. Lease volume has been on the decline for two years in a row since FY2020.

The reason for decline was affected largely by hold back of capital investment in various industries in association with economic recession caused by spread of COVID-19 infections. While brisk investment was observed in some industry such as online retailing that enjoyed favorable spending by general consumers who stayed home, but many industries mainly automobiles and airlines saw frequent postponement in capital investment, which directly connected to decreased lease volume.

According to “Lease Statistics” by Japan Leasing Association, the “information and communication equipment” field occupies the largest at approximately 40% of the total lease volume in recent years, but the issue of semiconductor shortage having caused postponement in business negotiations and delivery within the industry, which also brought about some impacts.

Noteworthy Topics

Future Perspective of Leasing Market

Even amid the coronavirus crisis, a sign of recovery is observed in capital investment in FY2022, which can significantly recover the lease volume. In recent years, the demand for capital investment to respond to ESG (Environmental, Social, and Governance) management and decarbonization (proactive utilization of renewable energy, etc.) is increasing, which has raised the FY2022 capital investment plans to exceed the actual results of the preceding fiscal year mainly at major enterprises,

In such a situation, the lease volume for FY2022 is projected to recover to 4,850,000 million yen level, 115.0% of the size of the previous fiscal year. The market in FY2023 is likely to downturn from up-surged recovery of FY2022, but the market is projected to recover once again after three years by 2025 to 4,800,000 million yen, 103.2% of the size of FY2023.

Research Outline

2.Research Object: Domestic major leasing companies, etc.

3.Research Methogology: Face-to-face interviews (including online) by specialized researchers, and literature search.

About Leasing Market

Leasing market in this research is defined as the market for every leasing services except for all rental services, but includes finance leasing and operating leasing.

In general, a rental service refers to the service that lets users choose and use from what lenders possess. However, leasing is the service that lets the user borrow a thing he/she specifies which the lender buys on behalf of the user. Leasing can be categorized largely into finance lease and operating lease. The former occupies the most of leasing market and applies to the leasing contracts that meet both requirements i.e. full payout and non-cancellable. The latter applies to the rest of all leasing other than finance lease.

The leasing market is calculated based on the lease volume. The actual values from fY2017 to FY2021 are quoted from “Lease Statistics” by Japan Leasing Association, and the values after FY2022 are forecasted by Yano Research Institute.

<Products and Services in the Market>

Finance lease, operating lease

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.