No.3110

Retail Logistics Market in Japan: Key Research Findings 2022

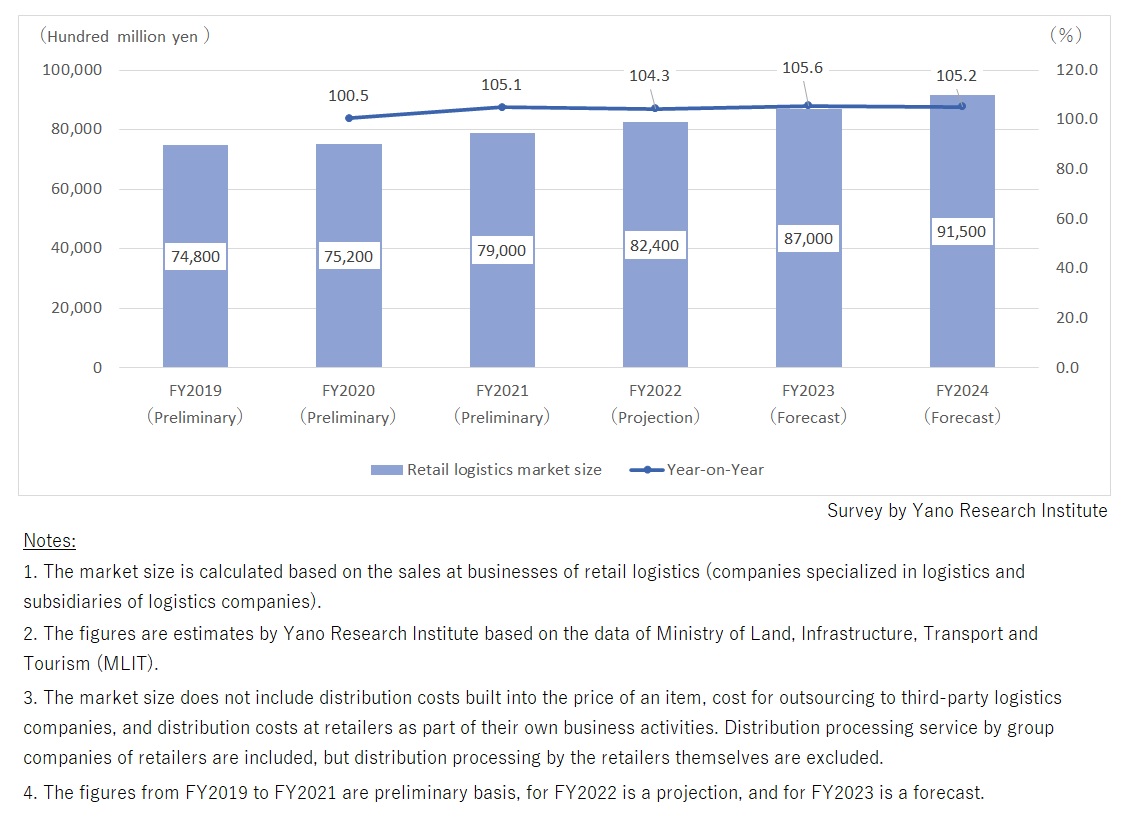

Retail Logistics Market Grew to 105.1% Year-on-Year to 7.9 Trillion Yen in FY2021 (on preliminary basis)

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the domestic market of retail logistics, and found out the market overview, the trends of market players, and future perspectives.

Market Overview

According to the preliminary results, size of the retail logistics market grew to 105.1% of the preceding fiscal year to 7.9 trillion yen for FY2021, based on the sales at businesses of retail logistics (companies specialized in logistics and subsidiaries of logistics companies).

Major market drivers are the increase in the total volume of distribution due to the expansion of the entire retail market*1, and the rise of last mile delivery such as home delivery services*2 led by the changes in consumer purchasing behavior, which shifted from shopping at physical stores to shopping online (e-commerce) *1. In addition, the market is affected by the soaring transportation cost, which is due to swelling labor cost led by the driver shortage as well as increase in fuel cost. Characteristics of consumer e-commerce - ‘multiproduct’, ‘small quantities (small-lot)’, and ‘frequent deliveries’- have caused the rise in shipping cost (loading and transportation). In particular, the increase of last-mile delivery has augmented the size of the retail logistics market.

*1. Data source: “Current Survey of Commerce” and “e-Commerce Market Survey” by Ministry of Economy, Trade, and Industry (METI)

*2. Last mile delivery indicates the delivery process when an item (merchandise, parcel) is moved from a distribution hub to a final destination, which is usually a home or office of an individual general consumer (B2C), or a delivery of item from a general consumer to another consumer (C2C).

Noteworthy Topics

Last-Mile Delivery Indispensable for B2C E-Commerce

As consumers increasingly turn to e-commerce for all their shopping needs, many retailers have expanded to online retail. The last mile delivery logistics is required as a must in e-commerce, in other words, the home delivery service providers play the largest role in the direct delivery of e-commerce merchandize to consumers.

Since home delivery companies that provide last-mile delivery have been seriously impacted by the labor shortages, they are required to reestablish their workflows and organizational mechanism to adapt to the increase in the number of parcels. Meanwhile, retailers also need to work on reducing the need for redelivery, leveling out the volume of parcels, improving loading efficiency of vehicles used for the transportation, and calling out for consumer cooperation.

Future Outlook

The retail logistics market is forecasted to grow to 8.24 trillion yen for FY2022 (104.3% of the previous year), based on the sales at businesses of retail logistics (companies specialized in logistics and subsidiaries of logistics companies). Despite the slight decline in the momentum compared to the previous fiscal year, the market is expected to grow, and the growth attributes to the same factors as in the previous fiscal year, i.e., the growth of the EC ratio (the ratio of the e-commerce sales size to the total amount of all transactions) and the increase in transportation costs due to soaring fuel cost and labor cost. As the trend is expected to remain for the forthcoming years, further growth is foreseen for the retail logistics market.

Research Outline

2.Research Object: Retail businesses, logistics businesses

3.Research Methogology: Face-to-face interviews by our specialized researchers (including online interviews), questionnaire survey, and literature research.

What is the Retail Logistics?

The retail logistics in this research involve the “logistics related to retail industry”, the domain which may also be called sales distribution. In detail, the functionalities of retail logistics include (1) services at distribution centers such as inventory management, freight, distribution processing and fulfillment (packaging/packing), (2) shipping of items from distribution center to retail stores, (3) facility logistics management services for large retailers, (4) home delivery services for consumers, and (5) logistics data management.

The market size is calculated based on the sales at businesses of retail logistics (companies specialized in logistics and subsidiaries of logistics companies). It does not include distribution costs built into the price of an item, cost for outsourcing to third-party logistics companies, and distribution costs at retailers as part of their own business activities. Distribution processing service by group companies of retailers are included, but distribution processing by the retailers themselves are excluded. The retailers include the online-only retailers, and the market includes e-commerce distribution by brick-and-mortar retailers.

<Products and Services in the Market>

Services at distribution centers (inventory management, freight, distribution processing and fulfillment [packaging/packing), shipping of items from distribution center to retail stores, facility logistics management services for large retailers, home delivery services for consumers, and logistics data management

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.