No.3088

Electronic Contract Service Market in Japan: Key Research Findings 2022

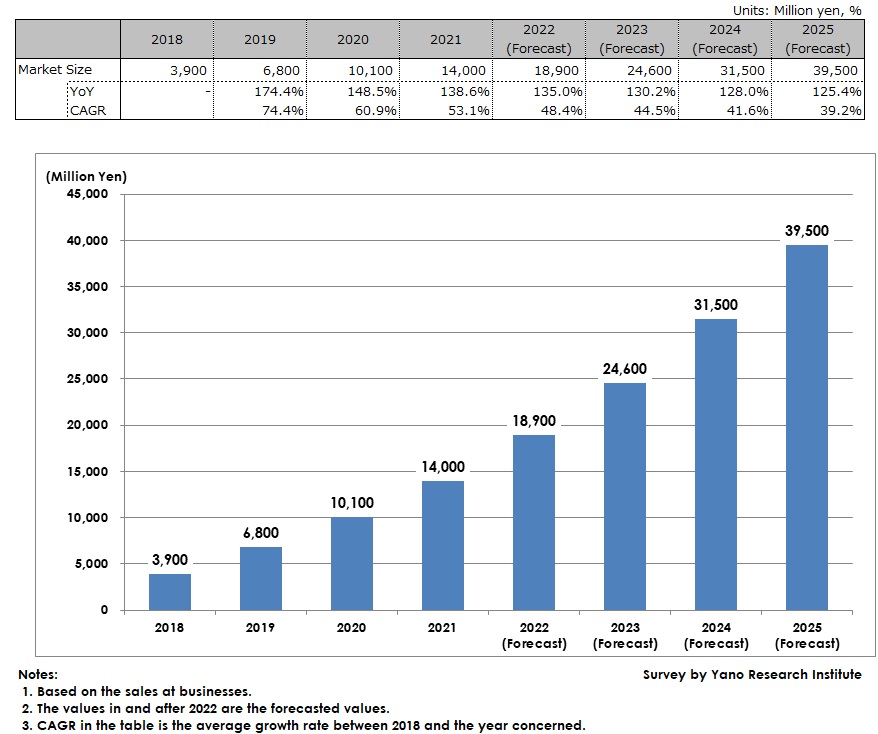

Electronic Contract Service Market in 2021 Rose by 38.6% to 14,000 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic electronic contract service market, and found out the market status, the trend of market players and of user acceptance, and the future perspectives.

Market Overview

The electronic contract service market size in 2021 was estimated to have risen by 38.6% from the previous year to 14,000 million yen, based on the sales at vendors. The market has been steadfastly growing, due to improved awareness, visualized contract procedures responding to telework, enhancement in compliance, etc.

Noteworthy Topics

Deployment Increased as a Part of Digital Transformation

The electronic contract service market, rapidly expanded due to increased telework in the COVID-19 crisis, is still on the rise in 2022. Conventionally, electronic contract services used to be implemented for cost reduction and work efficiency, but their deployment has rapidly increased for reducing “unnecessary commuting just for pressing a seal” in the pandemic.

After two years from occurrence of novel coronavirus pandemic, the consideration and purposes for deployment of electronic contract services are about to change again, with the recent reasons being promotion of digitalization and achievement of digital transformation.

In fact, there used to be some companies considering or implementing electronic contract services for digitalization and for achieving digital transformation even before the pandemic, seemingly making the vendors to feel the reasons for deployment or for considerations having returned to before COVID. Implementation of electronic contract services can be said as one of digital transformation projects easy to tackle, because of the easiness to visualize the effect.

Future Outlook

Expansion of telework, and reduction of opportunities for unnecessary commuting just for pressing a seal due to COVID-19 infections have affected substantially to the market, as the electronic contract service market in 2020 to expand by 48.5% from the previous year based on the sales at vendors. On the other hand, those companies that consequently chose not to implement electronic contract services are likely not to do so for the time being.

Companies are obliged to respond to various matters in recent two to three years, such as to the revised Electronic Book Preservation Act that went into effect on January 2022, the Invoice System to be commenced in October 2023, and to “2025 Digital Cliff” mentioned in the “Digital Transformation Report” announced by METI in 2018, which is reducing the priority of electronic contract service deployment and likely to somewhat slow down the market growth.

Although paper contracts are unlikely to disappear for the future, the ranges to be digitalized are expected to extend, and companies, like it or not, are expected to reach the point where they have to implement or use electronic contract services in the end.

The domestic electronic contract service market for 2025 based on the sales at vendors is projected to increase by 25.4% to 39,500 million yen, but as those companies currently without being implemented are many, the market is expected to have opportunities for major growth after 2026.

*2025 Digital Cliff: Although many company operators recognize the necessity of digital transformation for generating new business models and flexibly innovate by utilizing new digital technologies thereby for future growth and for obtaining competitive edge, the companies find difficulty in achieving it even though they want to, because of complexity in or dependence on specific personnel for using the corporate systems stemming from excess customization and from inability to utilize data across the whole company, because legacy systems have been built at each department and division. In a situation where reviewing of the current work processes i.e. business revolution itself, is also needed for solving the above-mentioned problems, how to implement this is a challenge, while the resistance onsite is not small. If the challenge cannot be solved, not only digital transformation cannot be achieved but also it is pointed out that there can be economic losses valued at 12 trillion yen (approximately three times larger than the current losses) after 2025.

Reference literature: “Report on Digital Transformation: Overcoming of '2025 Digital Cliff' Involving IT Systems and Full-fledged Development of Efforts for Digital Transformation” by METI, 7 September 2018.

Research Outline

2.Research Object: Domestic electronic contract service vendors and contract management service-related businesses

3.Research Methogology: Face-to-face interviews the expert researchers, surveys via telephone and email

About Electronic Contract Service Market

The electronic contract service market in this research refers to the market of products and services that can conclude the contract through pressing the seals or signing on electronic files on the web. Depending on the products and services, they can apply to the documents other than contract papers, and available for drawing up, conclusion, and management of a contract. The market size is calculated based on the sales at the vendors.

<Products and Services in the Market>

Electronic contract products and services regarding drawing up, conclusion, and management of a contract

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.