No.3075

Food Service Market in Japan: Key Research Findings 2022

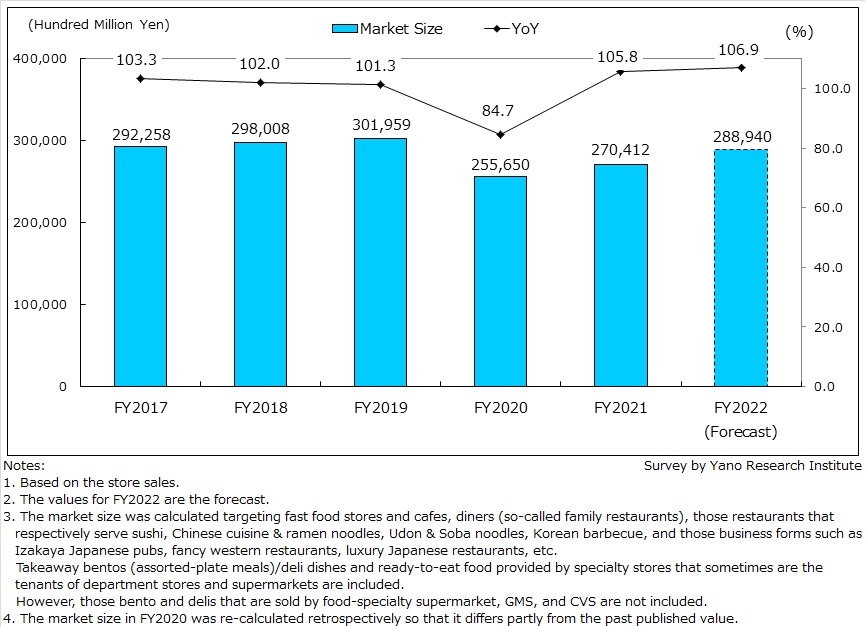

Food Service Market for FY2022 Projected to Grow Positively to 28,894 Billion Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic food service industry, and found out the market size, trends of market players, and future outlook.

Market Overview

The domestic food service market size (including those business categories of takeaway bentos, delis, ready-to-eat food) in FY2021 grew by 5.8% from the previous fiscal year to have reached 27,041.2 billion yen, based on store sales. The market has recovered remarkably, because of relaxation from mandatory temporary closure, shortened business hours, and voluntary prevention from going out, stemming from COVID-19 pandemic continued from the previous fiscal year.

When observing the market by business form, Izakaya pubs, gastropubs, and beer restaurants have shown belated recovery, but conveyor-belt sushi restaurants, Udon & Soba restaurants, cafes, Korean barbecue restaurants have shown steadfast growth, because now that dining is allowed, and because of favorable sales in takeaway food. The business at fast food stores serving Japanese food or western-style food has been good and bad depending on company, but in some cases, the business was firm even during the COVID calamity, which has led the recovery from devastation swift and gradual. Though the launch of takeaway and/or home delivery services was late, diners (so-called family restaurants) have recovered gradually, because of some strategical transitions occurred from mass store closures and shifts of business forms.

Noteworthy Topics

Health-Conscious Product Development Invigorated. Food Barrier Free in Progress

Increasing numbers of food service companies have intensified in appealing their “health consciousness” by continuously launching healthy menus such as those low carbo, low calories, low allergen, no chemical additives, etc. to attract health-conscious seniors and women interested in diet.

For example, provision of dishes using low-allergen food (dispensing with eggs, milk, wheat, prawns, crabs, buckwheat, peanuts, etc.,) and adoptions of salacinol-combined products that suppress blood sugar level, and GABA-combined products that support pressure drop have been in progress.

Such a rise in health consciousness has been reflected in the process of production, processing and shipment of raw materials such as vegetables, fish, and neat. Especially, food service providers have become particular about vegetables by using domestically produced ones, and simultaneously, they have deployed traceability systems for understanding the production processes of each material at contracted farmers, and production & shipment systems to enable season-fresh organic vegetables to be shipped by affiliate farm-operating companies, by which to thoroughly ensure food safety.

They have also started developing menus for vegans, vegetarians, and Muslims, as they address to respond to food diversification for enabling those with dietary choices to enjoy their meals. These attempts show how diversification in product development is underway.

Future Outlook

The domestic food service market for FY2022 is projected to increase by 6.9% from the previous fiscal year to reach 28,894.0 billion yen. Each market player has taken measures against COVID-19 crisis, such as obtaining takeaway and delivery demands at western-style fast-food companies and enhancing them at Japanese fast-food companies. In addition, gradual recovery in dining demand is expected, including those casually-used conveyor-belt sushi restaurants serving sushi and other foods at low price mainly targeting family customers. Other forms of restaurant business are also likely to experience reactionary increase from drastic reduction. Radical revisions at each food service company have been underway to build business models that can secure profits even when the sales are falling.

Hereafter, in addition to increase in the number of takeaway specialty stores and ghost restaurants, and invigorated moves in bringing up takeaway and delivery services as new business pillars, the food service industry is likely to face corporate alliances including business conversions using M&A. Due to decreasing population and declining trends to consume alcohol drinks, those business models appropriate in the growing period, that is increasing the sales by increasing the number of stores, have been close to an end. Instead of expanding the business scale, quality-oriented strategy is likely to be adopted more, such as addressing the sales increase at existing stores by means of store refurbishment to improve the comfort, developing new products and season-limited products to stimulate attention, deployment of new services to increase convenience, etc.

Research Outline

2.Research Object: Food Service Providers (major food chains, leading companies)

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, surveys via telephone & email, consumer survey, and literature research

About Food Service Market

The food service market in this research refers to the market targeting fast food stores, cafes, diners (so-called family restaurants), those restaurants that respectively serve sushi, Chinese cuisine & ramen noodles, Udon & Soba noodles, Korean barbecue, and those business forms such as Izakaya Japanese pubs, fancy western restaurants, luxury Japanese restaurants, etc. This research only targets those business forms specializing in restaurants and takeaway food, and no canteens at schools, hospitals, offices, and those food services associating with accommodation such as hotels and inns are included.

Among those restaurants in business during nighttime, those business forms that serve enough food such as Izakaya pubs, gastropubs, beer restaurants, luxury restaurants, etc. are included in this research, but those business forms that serve mainly alcohol drinks such as snack bars, nightclubs, cabarets, etc., and those business related to sex are not included. Takeaway bentos (assorted-plate meals)/deli dishes and ready-to-eat food provided by specialty stores that sometimes are the tenants of department stores and supermarkets are included. However, those bento and delis that are sold by food-specialty supermarket, GMS, and CVS are not included.

<Products and Services in the Market>

Fast food stores serving Japanese food or western-style food, diners (so-called family restaurants), restaurants that respectively serve sushi, conveyor-belt sushi, home-delivery sushi, Izakaya pubs, gastropubs, beer restaurants, luxury restaurants, Chinese cuisine & Ramen noodle restaurants, Udon & Soba noodle restaurants, Korean barbecue restaurants, other business forms such as those takeaway bentos (assorted-plate meals)/deli dishes and ready-to-eat food specialty stores that sometimes are the tenants of department stores and supermarkets

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.