No.3071

Public Service Outsourcing Market in Japan: Key Research Findings 2022

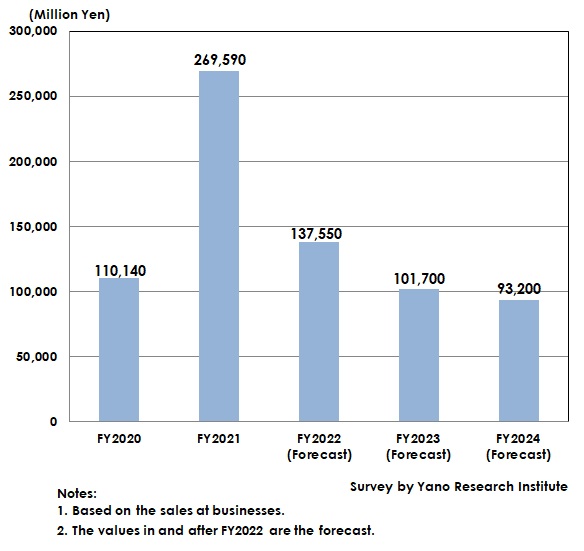

Driven by Sharp Increase in Operations Related to Coronavirus Vaccination, Public Service Outsourcing Market for FY2021 Expects a Rise by 44.8% from Previous Fiscal Year to 269,500 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic public service outsourcing market and found out current market size and trends.

Market Overview

The public service outsourcing market size (based on the sales at businesses) in FY2020 showed exponential rise by 63.5% from the previous fiscal year to have reached 110,140 million yen, as the use of outsourcing services sharply increased at many municipalities because of rollout of various financial relief programs including nationwide special cash payments, and financial aids for food service companies having accepted the requests to reduce business hours, which rapidly increased operations to handle inquiries and to receive applications.

In FY2021, the market size grew by 44.8% from the preceding fiscal year to 269,590 million yen, as outsourcing for COVID-19 measures-related operations increased steeply to occupy nearly 70% of the entire market. The outsourced COVID-19 measures-related operations specifically include COVID-19 consulting services, vaccination reservation call center services, vaccination voucher printing and mailing services, guidance services at vaccination venues, back-office operation services such as data input after vaccination, etc.

Noteworthy Topics

Increase in Demand for Outsourcing Associated with Digital Transformation

The government has launched the Digital Agency in FY2021 aiming to fully standardize municipal systems (to adjust and integrate mission-critical information systems that differ by each municipality) by FY2025. In such a status, it seems to be difficult to completely digitalize all operations, and is likely to increase the demand for outsourcing services to carry out those conventional operations that have not been digitalized.

Although digital transformation has digitalized reporting, complete paperless cannot be achieved, and while shift from telephone support operations to chat support operations may be in progress, there is no elimination of telephone support operations. As a method to streamline these yet-to-be digitalized operations, use of outsourcing services is expected to increase furthermore for the future.

Future Outlook

While outsourcing for COVID-19 measures-related operations is still in need in FY2022, the demand is likely to be one third of FY2021, as the vaccination target has been more limited than before. The size of financial aid operations is also likely to shrink. Therefore, the public service outsourcing market size (based on the sales at businesses) for FY2022 is projected to shrink by 49.0% from the previous fiscal year to 137,550 million yen.

Although special demand for COVID-19 measures-related operations is expected to shrink after FY2023, outsourcing for emergency operations against infections is expected to continue being in demand, because complete end of the pandemic seems to take time and because there still is a potential risk of new virus generation,

Demand for outsourcing services for regularly-occurred municipal operations, such as family registry, taxation, those related to national health insurance and long-term care, and child-related, is projected to slightly increase. It is because of decreasing numbers of officials, and reduced overtime hours due to work-style reform, regardless of more diversifying and complicating public services than before, as can see in “expansion of welfare service to adapt to aging population” and “expansion of childcare services for zero-waiting list”, which has led the handling of workload to go beyond the capacity of in-house resources and has only to rely on external resources.

CAGR of the public service outsourcing market from FY2020 to FY2024 is expected to be -4.1%, as the extremely expanded market in FY2020 is projected to show negative growth by FY2024 to 93,200 million yen (based on the sales at businesses), as special demand for outsourcing the COVID-19 measures-related operations decreases.

Research Outline

2.Research Object: Public service outsourcing service providers

3.Research Methogology: Face-to-face interviews by expert researchers, and literature research

What is the Public Service Outsourcing Market?

Public service outsourcing refers to the outsourcing service for back-office work of municipalities. Specifically, it refers to the outsourcing services for the following operations: Family registry operations, taxation, operations related to national health insurance and long-term care, child-related operations, outsourcing for COVID-19 measures-related operations, cash payment and financial aid operations, My-Number-related operations, economic vitalization operations, and general affairs & accounting operations.

<Products and Services in the Market>

Outsourcing for family registry operations, outsourcing for taxation, outsourcing for operations related to national health insurance and long-term care, outsourcing for child-related operations, outsourcing for COVID-19 measures-related operations, outsourcing for cash payment and financial aid operations, outsourcing for My-Number-related operations, outsourcing for economic vitalization operations, and outsourcing for general affairs and accounting operations

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.