No.3046

Housing Equipment Market in Japan: Key Research Findings 2022

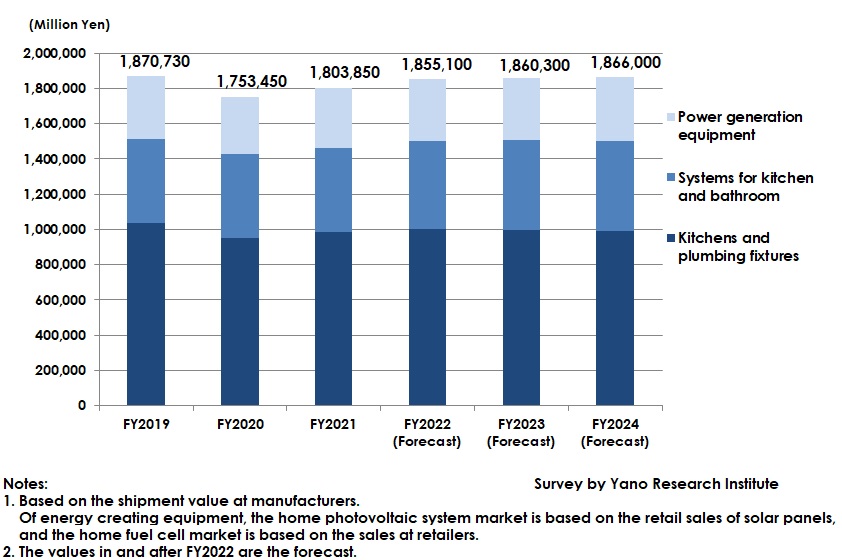

Housing Equipment Market Size for FY2021 Rose by 2.9% to 1,803,850 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic housing equipment market and found out current market status, trends of market players, and future perspectives.

Market Overview

The major housing equipment market size (total shipment values of kitchens and plumbing fixtures, kitchen and bathroom systems, and power generation equipment at manufacturers) for FY2021 estimated as 1,803,850 million yen, an increase by 2.9% from the previous fiscal year. The market as a whole, including house plumbing fixtures and energy creating equipment, grew on a YoY basis, mainly because of upturn from sudden reduction in demand, and of market recovery in newly built houses.

Noteworthy Topics

Multiple Inhibitors for Market Expansion

While future expansion is expected for the market of major housing equipment, there are concerns over increasing obstacles for market expansion.

One of such concerns is the home renovation market, in spite of its recent robustness stemming from consumers' eagerness in improving residential environment due to longer hours at home in the COVID-19 pandemic, full-scale resume of economic activities has gradually recovered the demand for travel as well as leisure, which may deprive of the demand for home renovation.

Secondly, there are skyrocketing equipment prices. Each manufacturer has announced to raise MSRP (manufacturers’ suggested retail price), as it became impossible to absorb the worldwide rise in raw material prices only by corporate efforts. The price rise, however, may cause demand reduction.

Thirdly, there is no foreseeing of normalization in global supply chain disruptions, caused by restricted economic activities in the COVID-19 crisis and by international unrest. Any early solutions for this issue are expected, as there are many kinds of equipment that cannot be supplied due to shortage of materials and components.

Future Outlook

The major housing equipment market size (total shipment values of kitchens and plumbing fixtures, kitchen and bathroom systems, and power generation equipment at manufacturers) for FY2022 is projected to increase by 2.8% on a YoY basis to 1,855,100 million yen. While the market is expected to recover to the level of FY2019, before COVID, the recovery speed is regarded to be slow due to decrease in new demand.

From the short-term perspective, the major housing equipment market size for FY2024 is estimated to rise by 3.4% from FY2021 to 1,866,000 million yen.

Of major housing equipment, the market of kitchens and plumbing fixtures for FY2024 is likely to expand by 8.1% from FY2021, and the energy-creating equipment market to grow robustly by 6.2% from FY2021.

Although the market for kitchen and bathroom systems has shown significant fall in FY2021, the basing point for comparison, due to component shortage of water heaters, the market is projected to grow stably, because compliance with energy conservation standards becomes mandatory in 2025 aiming to achieve decarbonized society, which is likely to increase adoption of highly-efficient water heaters and to increase the replacement demand for EcoCute, a heat pump water heater using aerothermal energy.

In addition, according to the Agency for Natural Resources and Energy there are approximately 300,000 households per year with their respective FIT contracts to expire for next several years*. By acquiring self-consumption of excess electricity being shifted from selling it at such households, the residential power generation equipment market, especially home fuel cells, is projected to expand. Higher environmental consciousness than before is expected to boost the entire residential power generation equipment market.

*Source: “Actions for Home Photovoltaic Systems toward the end of the FIT purchase period (September 2018)” by the Agency for Natural Resources and Energy

Research Outline

2.Research Object: Housing equipment manufacturers and industrial organizations

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, surveys via telephone and email, and literature research

About Housing Equipment Market

The housing equipment market in this research refers to equipment installed at residence, categorized into three types: 1) Kitchens and plumbing fixtures, 2) Systems for kitchen and bathroom, and 3) Power generation equipment. Details of each category are as follows:

(1) Kitchens and plumbing fixtures: kitchen (systematic kitchen, sectional kitchen), systematic baths, electronic toilet seats, household sanitary equipment, and washstands (not including taps)

(2) Systems for kitchen and bathroom: dish washers, hot water supply systems, stoves, bathroom heating and drying machines

(3) Power generation equipment: Residential energy storage systems, home solar systems, and home fuel cells

Basically, market sizes for equipment are calculated based on the shipment value at manufacturers. Nevertheless, of (3) power generation equipment, the market of home-use photovoltaic systems is based on retail sales of solar panels, and the market of hosehold fuel cells is based on the sales at retailers.

<Products and Services in the Market>

Housing equipment (kitchens and plumbing fixtures, systems for kitchen and bathroom, and power generation equipment)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.