No.3013

CBD (Cannabidiol) Product Market in Japan: Key Research Findings 2022

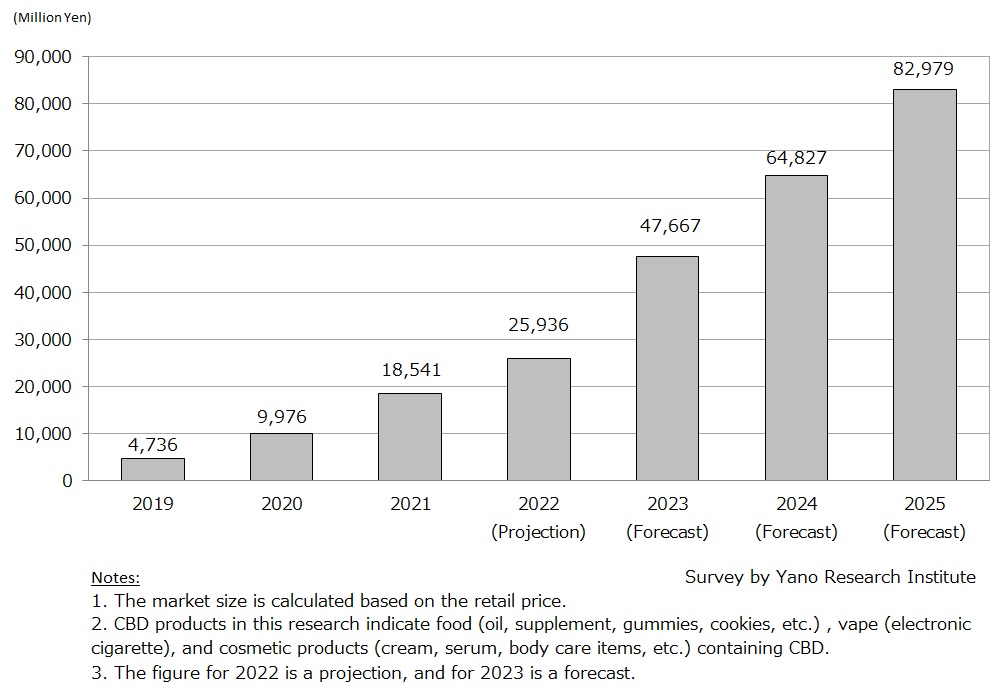

CBD Product Market in Japan Grew to 18,541 Million Yen in 2021, 185.9% of Previous Year

Yano Research Institute (the President, Takashi Mizukoshi) has researched on the market of CBD products in Japan, and has found out the trends by product category, the trends by channel, the trends by market players, and future perspective.

Market Overview

The market size of CBD products in Japan amounted to 18,541 million yen in 2021, 185.9% of that of the preceding year. It is projected to grow to 25,936 million yen for 2022, 139.9% on a year-on-year basis.

CBD is short for cannabidiol, a chemical constituent found in cannabis plant (marijuana). CBD is thought to have a homeostatic effect on immune system, neural transmission system, and autonomic nervous system, and therefore helpful to treat conditions of anxiety, seizure disorder (epilepsy), cancer, and inflammation. As health-related benefits of CBD became widely known around 2013 in Europe and the United States, manufacturers released a variety of CBD-infused products.

Sales of CBD products started in Japan around 2019 at pop-up shops (a temporary retail space) of department stores and commercial facilities, as well as in beauty retailers and variety stores. As its exposure increased in various media, general consumers gained more chance to know CBD products, and the number of companies handling CBD products multiplied accordingly. Since the outbreak of COVID-19 in 2020, people become more concerned about their health and for that reason their interest has been rising for CBD products that are said to provide favorable effects on the mind and body. Rapid growth of CBD product market attributes to the expanding demand for products that help them relax, as well as maintain and improve their health.

According to the Framework Policy announced in June 2022 (Basic Policy on Economic and Fiscal Management and Reform 2022), the government has an intention to revise legislative systems regarding cannabis to legalize the use of cannabis-derived constituents in medical drugs and other items. Under the circumstances, major companies are expected to enter the CBD product market from 2023.

Noteworthy Topics

The Rise of “Made in Japan” CBD Products

As the current law prohibits the cultivation of cannabis, it is impossible to produce CBD products in Japan using domestically cultivated cannabis. For this reason, CBD businesses had been occupied mostly by distributors of imported products.

Nevertheless, as the number of market players rises and competition intensifies, companies started to seek for ways to produce “made in Japan” products. Against the background of growing acceptance of CBD in Japan as a substance that may have health-promoting benefits, which has also driven contract manufacturers to accept production of CBD-infused products, the number of businesses producing/processing CBD products with imported raw materials of CBD are on the rise. To make sure these “made in Japan” products are safe, importers are required to prove and report to the authority that the raw materials they intend to import does not contain THC (tetrahydrocannabinol), a psychoactive constituent that produces high sensation, by carrying out multiple inspections on their end as well as at the site of their suppliers.

Some of the Japanese companies are planning to export domestically processed CBD products. High quality CBD products produced in Japan are expected to increase the presence in the market hereafter.

Future Outlook

As mentioned earlier, the government has shown its intention in the Framework Policy 2022 to modify legislative framework to legitimize the use of cannabis-derived chemicals in medical drugs and other products. If the revision is completed by the end of FY2022, leading enterprises in various industries, such as food, beverage, and cosmetics, which had been waiting for the right time, are likely to accelerate their product development. Meanwhile, convenience stores, supermarkets, and drugstores have a great chance of winning opportunities to sell CBD products.

Once the leading enterprises start producing CBD products and build distribution channels, general consumers will have more chance to come across CBD products. Despite their concerns for using products made with materials derived from cannabis, consumers willing to try CBD products are expected to increase as they become “major brand-endorsed products”.

Moreover, due to the ongoing development of medical drugs using CBD as a major ingredient to treat refractory epilepsy, the image of CBD in Japan may be altered drastically hereafter. Considering the probable changes in the surrounding environment from mid-2022 to early 2023, further growth of the CBD market is anticipated.

Research Outline

2.Research Object: Manufacturers, importers, distributors, and R&D institutions/associations of CBD products

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), consumer survey, and literature research

What are the CBD Products?

CBD is short for cannabidiol, a chemical constituent found in cannabis plants (marijuana). It is thought to have a homeostatic effect on immune system, neural transmission system, and autonomic nervous system, and it is claimed to help treating conditions of anxiety, seizure disorder (epilepsy), cancer, and inflammation. As CBD became widely known around 2013 in Europe and the United States, a number of commercial products containing CBD became available in the market.

CBD products in this research refer to food (oil, supplement, gummies, cookies, etc.), vape (electronic cigarette), and cosmetic products (cream, serum, body care items, etc.) containing CBD. The market size of CBD products in Japan is calculated based on the retail price.

<Products and Services in the Market>

Food, vape (electronic cigarette), cosmetic products, and other products

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.