No.2975

Cashless Payment Market in Japan: Key Research Findings 2021

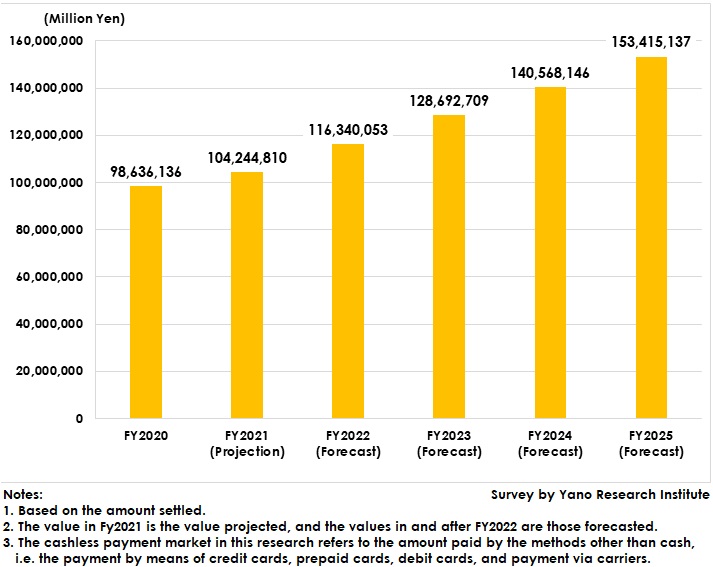

Domestic Cashless Payment Market Projected to Expand to 153 Trillion Yen by FY2025

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic cashless payment market, and found out the market overview, business strategies at service providers, and future perspectives until FY2025.

Market Overview

A cashless payment service consists of the service providers (that settle payments made through credit, prepaid, and debit cards, and payments via carriers, convenient stores, post-pay, etc.,) and the acquirers that manage member merchants and explore new such merchants.

While coronavirus infections have slowed down some consumption activities, consumption through mobile payment services are likely to further expand, as the payment by means of smartphones has already spread in daily lives, with rising demand for contactless payment services and increased use of code payments.

The domestic cashless payment service market (the total amount paid via methods other than cash) in FY2020 has generated approximately 98 trillion yen, driven by increased payments via codes, in-house prepaid systems, and post-pay electric money, though the settlement of credit card payment that occupy majority of the entire market size remained leveling off. The market is projected to reach 104 trillion yen in FY2021.

Noteworthy Topics

Increased Use of Cashless Payment via Mobile Apps

In the COVID-19 calamity, ecommerce has grown for the sales of products and digital contents, while recovery of customer visits is required at physical stores. As a measure against it, more frequent communications between merchants and customers are needed. As a measure to support member merchants, cashless payment service providers are focusing on offering mobile apps.

For instance, code payment service providers use mobile apps to attempt OMO (Online Merges with Offline) by delivering limited use-range reward coupons, or sending messages to app users from member merchants, thereby to send customers to member merchants.

Mobile apps are becoming super apps equipped with mini-apps with various functions such as shopping, order-ahead system for dining, taxi allocation, games, etc., in addition to cashless payment, which are expected to increase the opportunity to use the apps and expand the amount paid by codes furthermore.

Future Outlook

Hereafter, due to regaining consumption activities which had been suppressed by the coronavirus infections, and to governmental stimulations to increase the cases of cashless payment, the use of credit cards as well as various prepaid methods including code payment is expected to increase furthermore. The cashless payment market is projected to expand to 153 trillion yen by FY2025.

Research Outline

2.Research Object: Cashless payment service providers

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, and literature research

Cashless Payment Market

The cashless payment market in this research refers to the amount paid by the methods other than cash, i.e. the payment by means of credit cards, prepaid cards, debit cards, and payment via carriers. The market size is calculated based on the amount paid.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.