No.2967

Global Market of Connected Services for Trucks and Buses: Key Research Findings 2022

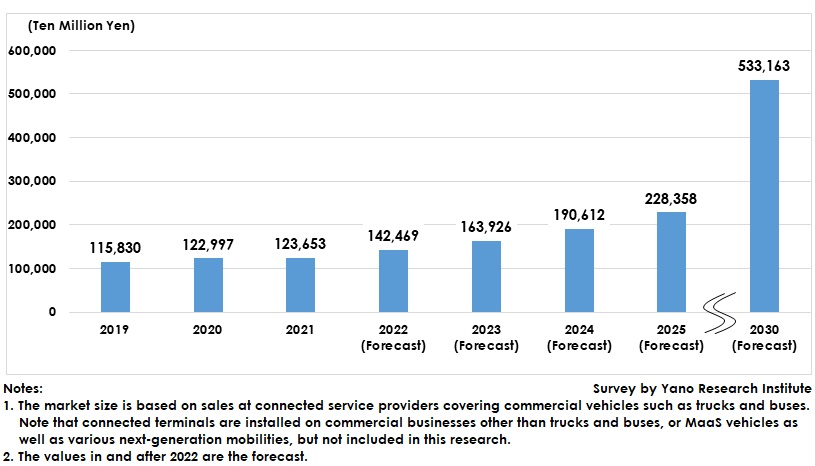

Global Trucks-&-Buses Connected Services Market Projected to Achieve 5,331,600 Million Yen by 2030

Yano Research Institute (the President, Takashi Mizukoshi) surveyed the global market of fleet vehicles (business-use vehicles and MaaS vehicles), connected terminals installed in such vehicles, and connected services, and found out the market size transitions and trends by item, changes in market structures, and future perspectives. In addition, the survey covered the business status, alliance strategies and future strategies of connected service providers that count 500 and more. This press release discloses the global market size forecast on connected services for trucks and buses until 2030.

Market Overview

As to connected services for trucks and buses, there are services provided by add-on terminals (terminals of digital tachograph, commercial dashcams, fleet dynamics management systems, etc.) and also those services by automakers (OEM)’s genuine connected terminals. The services via genuine terminals include those services for logistic businesses, MaaS service providers, and vehicle OS terminals.

With size of the services likely to expand due to increasing number of terminals-installed vehicles, the global market of connected services for trucks and buses, based on the sales at service providers, is projected to achieve 1,283,500 million yen by 2025, and 5,331,630 million yen by 2030. Note that these figures do not include the connected services for fleet vehicles other than trucks and buses, fleet vehicles possessed by MaaS service providers, autonomous EVs with automation level 4 and above, and next-generation mobilities such as delivery robots and e-bikes.

Noteworthy Topics

Connected Apps launched from Fleet Vehicles in COVID-19 Calamity

In the COVID-19 calamity, increase in teleworking expanded the demand for home delivery and food delivery services, while mobility limitations and refraining from going outside increased online purchase and delivery demands. In addition, restrictions to share riding led single-seated e-bikes and e-scooters to gain popularity, which grew the next-generation mobility MaaS business, whose demand has continued expanding and does not seem to stop even in 2022. It can be said that the lifestyle with the use of these services has already become normal.

This phenomenon is not limited in Japan, but has spread around the world, though some differences according to the business style. Delivery MaaS business, including food delivery, home delivery services and online retail stores, is increasing globally. In particular, customer transportation MaaS operators such as Uber, Lift, Grab, and Gojek, which had experienced negative demand due to a reluctance to share rides, have succeeded in making up for that negative demand by expanding laterally into these delivery MaaS businesses.

Future Outlook

Last mile delivery logistics including food delivery, home delivery and MaaS using next-generation mobility can be said now as a part of lifestyle, with the demand projected to continue growing even after coronavirus infections quietened down. As “teleworking”, “mobility limitation” and “share-ride restrictions” that were promoted around the world in the coronavirus crisis will encourage deployment of in-vehicle connected terminals such as commercial dashcams, fleet dynamics management system terminals, digital tachograph, etc., eventually lead to the development of integrated platforms for these devices. Some of the integrated platforms will be centered on Toyota, while platforms by other companies are expected to emerge in the future.

Next-generation mobilities such as single seat e-bikes and e-scooters, which are expanding the market due to share-ride restrictions in the coronavirus crisis, are equipped with low-cost in-vehicle connected terminals to manage location tracking. The calamity has triggered to connect the markets of commercial vehicles for last mile delivery that used to be disparate and to share various data among them.

Eventually, these terminals and applications are projected to be consolidated into integrated platforms.

Research Outline

2.Research Object: OEM (automakers) in Japan, Europe, North America, China, Asia, etc., suppliers connected terminal manufacturers, connected apps vendors, MaaS service vendors, delivery service businesses, etc.

3.Research Methogology: Face-to-face interviews (including online), interviews via telephone/email, analysis from the research data within the database kept at Yano Research Institute, and literature research

In-Vehicle Connected Services for Fleet Vehicles and MaaS Vehicles

In-vehicle connected services for MaaS vehicles and fleet vehicles in this research covered not only commercial vehicles such as trucks and buses but also fleet vehicles such as taxis and rental cars, fleet vehicles possessed by MaaS service providers, autonomous EVs with automation level 4 and above, and next-generation mobilities such as autonomous robotic carriers, delivery robots, e-bikes, and e-scooters.

As for connected service providers, the research covered OEM (automakers), suppliers, IT vendors, platformers, application-providing companies, last-mile delivery companies including food delivery service providers.

<Products and Services in the Market>

Domestic 285 companies and global 280 companies of connected service providers for fleet vehicles and MaaS vehicles (i.e. OEM, suppliers, IT vendors, delivery service providers including food delivery service businesses, etc.)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.