No.2744

Consumer Trends of Japanese/Western Sweets in Japan: Key Research Findings 2021

Consumption of Japanese/Western Sweets for Gifts Had a Great Blow in COVID-19 Pandemic, but Consumption for Private Use Showed Steady Growth

Yano Research Institute (the President, Takashi Mizukoshi) carried out a consumer survey on the changes in purchasing trends of Japanese and Western sweets as the COVID-19 infections spread. It was a great blow for those sweets for gifts, but steady sales were observed for those for oneself or for ones’ family. To reinvigorate the sales in long-lasting COVID-19 calamity, how to encourage consumption for purchasers themselves seems to be the key.

Summary of Research Findings

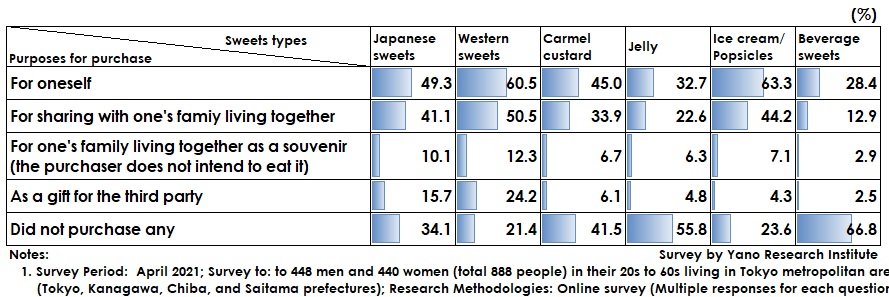

This consumer survey was performed to 448 men and 440 women (total 888 people) in their 20s to 60s living in Tokyo metropolitan areas in April 2021. When asked about the purposes of purchasing sweets during the past year, majority of people bought Ice cream/Popsicles and Western sweets “for oneself.” To be specific, those who bought ice cream/popsicles for oneself accounted for 63.3% and Western sweets for oneself occupied 60.5%, indicating more people started buying sweets for themselves.

Of the sweets types that obtained the lowest and second lowest rates for the option “Did not purchase any (i.e. most people’s favorite)” during the past year were also western sweets (21.4%) and ice cream/popsicles (23.6%). These two types were not only popular for majority of purchasers to consume for themselves, but they also were bought to share them with their respective families, which accounted for 40 to 50%.

When compared Japanese sweets with Western sweets, Japanese sweets obtained larger ratio for the option “Did not purchase any” which accounted for 34.1% than Western sweets accounting for 21.4%. Nevertheless, the respondents who bought Japanese sweets for themselves or for sharing with their family accounted for 49.3% and 41.1%,respectively, showing how firmly popular they are.

On the contrary, however, beverage sweets obtained a little less than 70% for the option “Did not purchase any.” It seems to be because the purchasers of such sweets were somewhat limited in the first place and because people have less opportunity to go outside in the COVID-19 calamity.

*Beverage sweets in this survey refer to the sweets that people can enjoy in the form of drinking, such as Frappuccino® provided by Starbucks, Chocolixir by GODIVA, bubble tea, and McShake®.

Noteworthy Topics

Regardless of COVID-19 Pandemic, Sweets Kept on Being Consumed Stably: More than 70% Responded that Frequency of Buying Sweets Has Not Changed from Before Pandemic

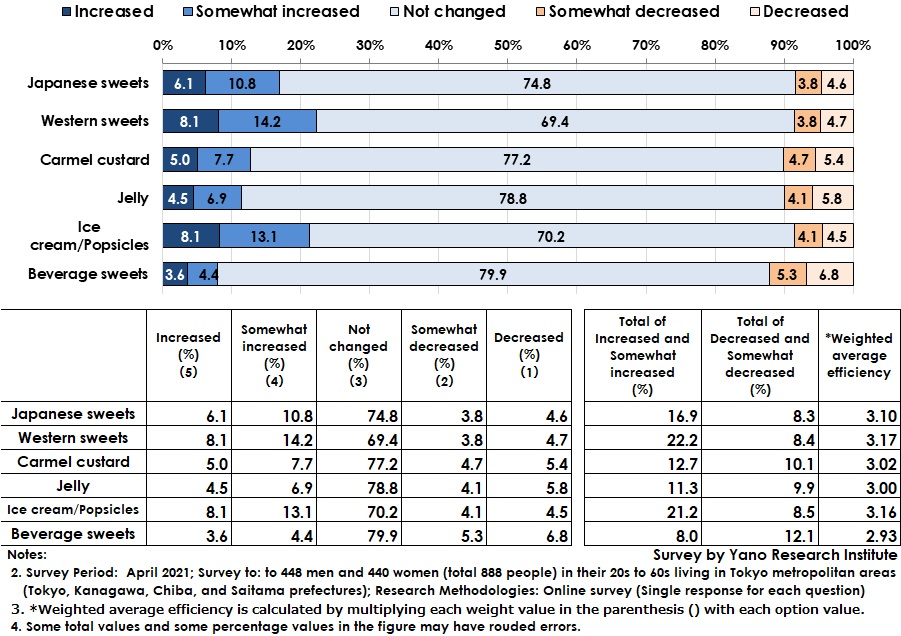

Whether there were any changes in the frequency of buying sweets before and after 2020 (i.e. any difference in frequency from before COVID-19 pandemic,) 70 to 80% of people responded that there were no changes in the frequency for all the sweet types. Although the Japanese and Western sweets (confectionery) market had a great blow in the gift category, the survey results indicated that people still bought sweets for oneself.

The sweets type that obtained the largest ratio for ‘the total of “Increased” and “Somewhat increased”’ was Western sweets occupying 22.2%, followed by ice cream/popsicles 21.2%. Japanese sweets accounted for a little less than 20%, lower than the two items mentioned earlier. On the other hand, the sweets types that obtained the largest ratio for ‘the total of “Decreased” and “Somewhat decreased”’ were beverage sweets and caramel custard, both accounting for about 10%.

The reason why people did not buy beverage sweets seemed to be because the decreased opportunity for people to go outside or to see friends due to the pandemic. As for the reason why caramel custard was not being purchased seemed to be because people tended to pursue something special during the specific extraordinary lives. As a result, people chose cakes and other western sweets rather than ordinarily purchased caramel custard.

Research Outline

2.Research Object: Men and women in their 20s to 60s living in Tokyo metropolitan areas (Tokyo, Kanagawa, Chiba, and Saitama prefectures)

3.Research Methogology: Online consumer survey

About the Consumer Survey on Japanese and Western Sweets

This consumer survey was performed to 448 men and 440 women in their 20s to 60s living in Tokyo metropolitan areas (Tokyo, Kanagawa, Chiba, and Saitama prefectures) in order to find out whether or not any changes in the tendency of purchase and consumption of Japanese and Western sweets before and in the middle of the COVID-19 pandemic, the impression of Japanese and Western sweets brands, and the purpose of buying such sweets. The survey also asked about the purchase of sweets by means of ecommerce, which is expanding the market, and about buying sweets via placing orders.

<Products and Services in the Market>

Japanese sweets, western sweets, desserts (caramel custard, jelly, ice cream/popsicles) beverage sweets, etc.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.