No.2734

InsurTech Market for Life Insurance in Japan: Key Research Findings 2021

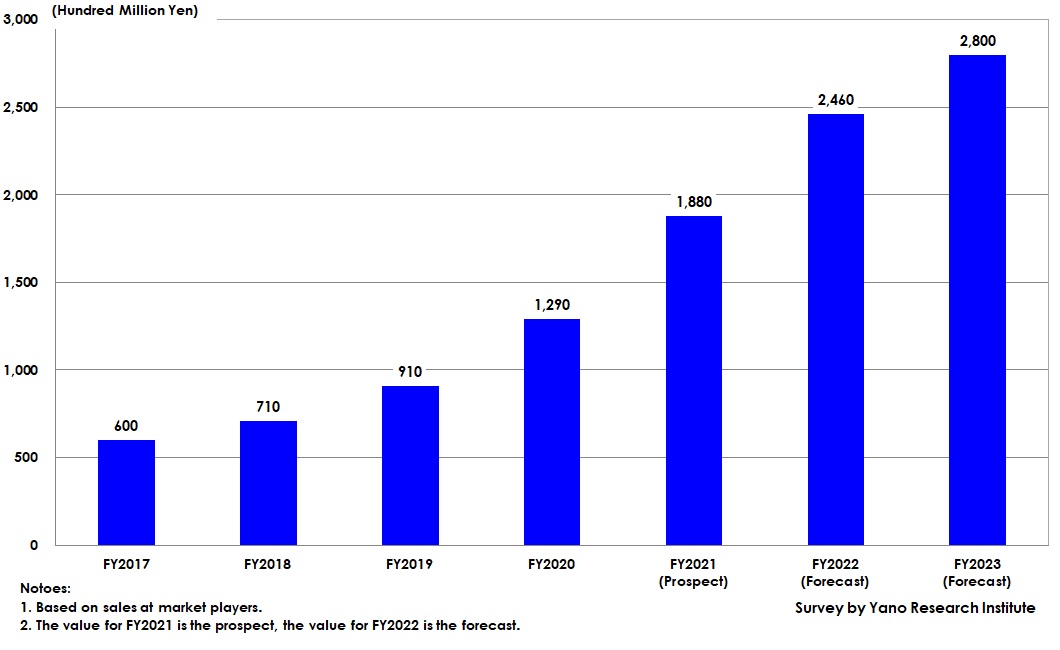

Domestic InsurTech Market Size for FY2021 Expected to Rise by 45.7% on YoY to 188,000 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic InsurTech market for life insurance and found out the current status, the trends by category, and the future outlook.

Market Overview

The domestic InsurTech market for FY2021 is likely to generate 188,000 million yen based on the sales at the market players, 145.7% of the size of the previous fiscal year. The COVID-19 pandemic encouraged rapid progress in office digitization for contract procedures, payment requests, etc., in addition to enhancement of advanced sales activities and absence of face-to-face communication channel. As for development of insurance products, sufficient numbers of health-promotion insurances*1 and disease control programs*2 for individuals have begun being provided, as so-called medical big data have been collected and utilized. In addition, group insurance products and services have gradually started covering not only health promotions but also early detection and intervention, since around 2019.

With regard to rules and regulations, “the bills for partial amendment of the banking act for enhancement and stability of financial functions in response to social and economic changes caused by COVID-19 infections, etc.” was implemented in May 2021. This partly affects insurance companies for holding advanced banking-service companies and deregulation of investment, etc. There have been some attempts to proactively utilize various mechanisms such as the “regulatory sandbox” that FSA (Financial Services Agency) has developed to encourage ingenuity at financial institutions.

The support environment has been in little progress since last year, as most events were performed online in the COVID-19 calamity. In addition to prior activities, there have been new events provided by private businesses and some acceleration programs emerged to help speed up the growth of startup companies. However, the supports are still restrictive, so that it is expected to build up and expand the environment where proactive support can be provided.

As for technological environment, cloud solutions, in the beginning, have started being reflected in the security guidelines on computer systems for banking and related financial institutions defined by FISC (The Center for Financial Industry Information Systems), lowering the hurdles for cloud to be implemented. With the support by FSA, shifting to cloud solutions is about to be on the way while making efficient use of the existing systems on premise mainly at major life insurance companies.

Noteworthy Topics

Health Promoting Insurance Saw Expansion, Suddenly Increasing Ecosystems

Insurance companies in and out of the country have begun enhancing conventional health promoting insurance products and disease control programs. In particular, health-promoting insurance products have been extensively diversified. First, the insurance companies have initiated such activities by collaborating with various enterprises to directly support the health promotion activities by means of smartphone apps, etc.

Next, some companies have provided indirect support such as helping the clients in maintaining the motivation for health promotion activities in the form of discount or cashback. Also, as can see from mortality life insurance programs or cancer insurance products directed at nonsmokers, there is a tendency to provide insurance products to those who have low risks in their health conditions.

In addition to the products and services for individuals, the development of health-promotion or disease control programs has gradually extended to group insurance categories since around 2019. They have started being found as health management support for company owners, or as health maintenance services for employees as a part of their welfare services, covering not only health promotions but also early detection and intervention.

Furthermore, some attempts to build ecosystems mainly of health promotions have become active recently. Though such an effort was already made by some small businesses, even major enterprises such as Dai-ichi Life Insurance Company and Nippon Life Insurance Company have started it. Hereafter, multiple ecosystems are likely to be emerged chiefly around major insurance companies, which allow proactive connections and alignment with healthcare companies. Such moves are worthwhile to keep on paying attention to.

Future Outlook

The domestic InsurTech market for FY2023 is forecasted to achieve 280,000 million yen based on the sales of the market players.

As the environment to encourage cloud implementations and external alignments have been prepared in the form of establishment of "Enterprise System and Frontrunner Support-Hub” at FSA, implementation of cloud solutions at major life insurance companies has been on the way, and building of platforms for DX deployment has started. These activities are likely to further facilitate collaborations with startup companies. In addition, implementing of AI has been increasing, aiming at fraud detection in insurance adjusting, and streamlining/advancement of underwriting processes.

From now onward, spread of cloud solutions is expected to bring about active discussions on disclosure of API in life insurance industry. For life insurance companies, collaboration with external companies that come along with API disclosure leads to increase of touchpoints, so that API disclosure should be promoted eagerly. As insurance products seem to continue expanding the support from health promotions to disease control, the domestic InsurTech market as a whole is expected to keep on growing.

*1. “Health-promotion insurance products are those with the insurance premium based on the health check results, life-log data, etc., which fluctuates according to the health conditions of the client, unlike those conventional ones with the insurance premium decided by the age of the client.

*2. A “disease control program” supports the client consistently from awareness building to actual behavior therapy, to appropriate medical access when any abnormalities are found, and to pay the benefit.

*3. A “regulatory sandbox” is a framework that temporarily lifts the current regulations in order to allow innovative business and services many of which in the financial area to grow up. It requires registration at competent authorities, after which the innovative experiments can be performed.

*4. “Program to prevent progression of diseases” is the program to prevent the second and more recurrence of such diseases with high recurrence rate like cerebral infarction and cardiac infarction after cured through surgical operation.

Research Outline

2.Research Object: Domestic Life Insurance Companies, Small Amount & Short Term Insurance companies, Siers, and InsurTech Ventures, and etc.

3.Research Methogology: Face-to-face interviews by the expert researchers, surveys via telephone and email, and literature research

What is InsurTech in Life Insurance Category?

InsurTech is a coined word made from insurance and technology. It means life insurance-related services using IT that allow developing new insurance products and services and/or streamlining and upgrading business processes, not available by the conventional life insurance companies.

InsurTech in this research can be categorized into the following 8 categories: 1) Development of personalized health-promotion insurance products and services, 2) Disease control program, 3) AI-used insurance consultation service/AI-used insurance sales support service, 4) Automation of underwriting using AI, 5) Tracking services from recommending to seek a diagnosis to an actual diagnosis, or tracking a process until being diagnosed when informed of abnormality, 6) An after sales service for contractors and their families by means of applications and other methods, 7) Automation of assessment utilizing AI and/or BRMS (Business Rule Management System), and 8) Infrastructure-related services (insurance cloud services/API/blockchain*.)

The domestic InsurTech market size is calculated based on the sales of the market players who are the vendors and venture companies that develop new insurance products and services and support streamlining and upgrading of business processes that were unable to provide by the conventional life insurance companies.

*A blockchain is a database of recording and authorizing the transactions of transfer of rights by utilizing computers on the P2P network that links the users.

<Products and Services in the Market>

Development of personalized health-promotion insurance products and services, Disease control program, AI-used insurance consultation service/AI-used insurance sales support service, Automation of underwriting using AI, Tracking services from recommending to seek a diagnosis to an actual diagnosis, or tracking a process until being diagnosed when informed of abnormality, An after sales service for contractors and their families by means of applications and other methods, Automation of assessment utilizing AI and/or BRMS (Business Rule Management System), and Infrastructure-related services (insurance cloud services/API/blockchain*.)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.