No.2687

Medical Imaging Systems and PACS Market in Japan: Key Research Findings 2020

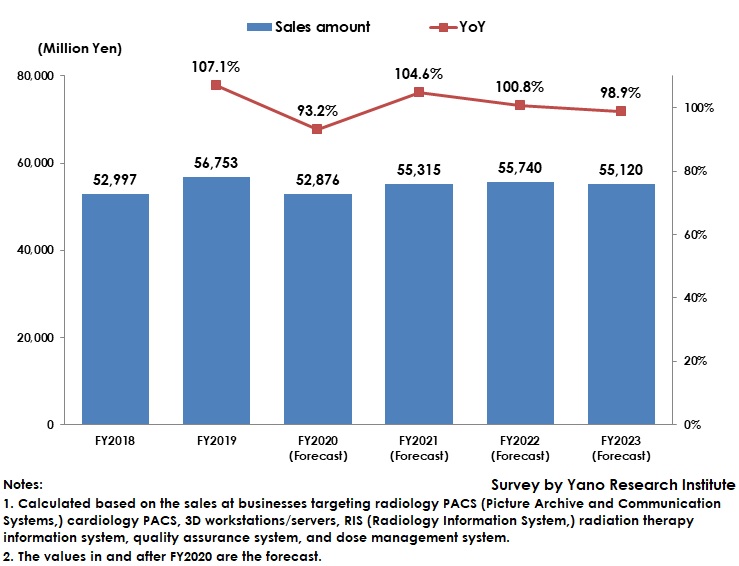

Domestic Medical Imaging Systems and PACS Market Size Rose by 7.1% on YoY to 56,753 Million Yen in FY2019 and Expected to Decline in FY2020

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic medical imaging systems and PACS market and found out the market trends by segment, trends of market players, and future outlook.

Market Overview

Among the various medical/diagnosis imaging equipment used in hospitals, this research surveyed specifically on radiology PACS (Picture Archive and Communication System,) cardiology PACS, 3D workstation, RIS (Radiology Information System,) radiation therapy information system, quality assurance system, and dose management system, from which the market size was calculated.

Radiology PACS, that play the main role of all the diagnostic imaging systems, started being fully deployed chiefly at mid-scale hospitals (i.e. hospitals with 200 or more of beds) since around the beginning of 2000s when filmless imaging were promoted. After around mid-2010s, more hospitals faced replacement of existing systems rather than new deployment. As the replacement period prolonged, however, due to curbed IT investment at hospitals, the market has been on a gradual negative growth.

RIS and image inspection systems positioned as peripheral systems of radiology PACS have already been widespread and their replacement and deployment are mainly carried out n package with radiology PACS. These peripheral systems tend to be substantially affected by the sales trend of radiology PACS, likewise showing gradual negative growth.

In such a situation, the medical imaging system and PACS market size (based on the sales at businesses) in FY2019 was estimated to have risen by 7.1% on a YoY basis to 56,753 million yen. The growth factors were surge in demand just before the consumption tax hike in October 2019 and the rapid growth of dose management systems at the facilities equipped with the appliance concerned, as recording and management of radiation doses were to become mandatory from FY2020.

Noteworthy Topics

Rapid Expansion of Dose Management System Market

A dose management system is a system that records and manages the dosage from radiation exposure by each x-ray apparatus in order to help control the radiation doses for each patient and for each inspection. In Japan, some large-scale hospitals have deployed the system in around FY2010, because of the importance of recording and managing of doses. In such a status, “the premium system for promotion of diagnosis imaging management 3” was newly established in the revision of the Medical Payment System in FY2018, stipulating the dosage recording and management to be mandatory for the facilities equipped with diagnostic imaging appliances to acquire the premium.

In the “Meeting for Reviewing Adequate Medical Radiation Management” in June 2018, MHLW showed its policy to oblige the recording of radiation doses as well as the training for medical workers from April 2020 due to the necessity of radiation dose management and recording for the radiotherapy with especially high doses. This remarkably expanded the deployment target of dose recording systems to the facilities other than those gaining the premium. Also, in the period between 2018 and 2019, there were many manufacturers of diagnostic imaging systems and of modality equipment entering the business, which led to a full launch of the market.

The dose management system market has risen sharply since FY2018, and is likely to maintain the extremely high growth rate in FY2020, despite anticipation of negative influences of tax hike and of COVID-19 pandemic. Dose management systems are likely to continue the rapid deployment during the next several years.

Future Outlook

The medical imaging system and PACS market size for FY2020 is estimated to decline by 6.8% on a YoY basis to 52,876 million yen, due to retreat from sudden surge in demand just before consumption tax hike and to the COVID-19 pandemic. The market size for FY2021 is expected to rise from the previous-year slump by 4.6% to achieve 55,315 million yen, though there are uncertain factors including COVID-19 infections.

In and after FY2022, the market size is likely to flatten or to go through slight decline, because of decreased unit price per deployment and of longer period of replacement at middle-class hospitals with 200 or more of beds where medical imaging system deployment is mostly completed, and also because of popularization of cloud PACS that requires smaller deployment cost.

Research Outline

2.Research Object: Domestic manufacturers of medical imaging systems and PACS, distributors of imported products

3.Research Methogology: Face-to-face interviews (online interviews included) by the expert researchers and survey via telephone

The Medical Imaging Systems and PACS Market

The medical imaging systems and PACS market in this research refers to the market of radiology PACS (Picture Archive and Communication Systems,) cardiology PACS, 3D workstations/servers, RIS (Radiology Information System,) radiation therapy information system, quality assurance system, and dose management system, from which the market size was calculated.

<Products and Services in the Market>

Medical Image Processing Network System (Radiology PACS), Cardiology PACS, Image viewer (CR/DR workstations and mammography viewer), 3D workstation, RIS (Radiology information system), Image inspection system, radiation therapy information system, Teleradiology, Dose Management System, analog to digital converter (CR i.e. computerized radiography and DR i.e. digital radiography, film digitizer), image output devices (laser imager, high-performance monitor, thermal video printer (endoscope, ultrasound), automatic processor, disk publisher), modality (X-ray CT, nuclear magnetic resonance (MRI), nuclear medicine diagnostic apparatus, angiography equipment, general X‐ray apparatus, fluoroscopic X‐ray apparatus, Surgical C-arm, round-visit/medical-checkup ultrasound diagnostic apparatus, endoscope

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.