No.2539

Pachinko Equipment Market in Japan: Key Research Findings 2020

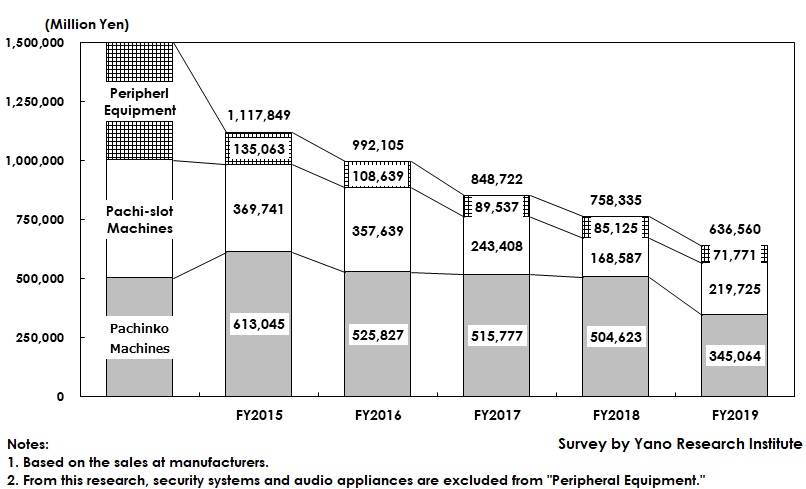

Pachinko Equipment Market for FY2019 Diminishes by 121,700 Million Yen to 636,500 Million Yen, 83.9% of Size of Previous Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic pachinko equipment market and found out the current status, market size by product segment, and the future perspectives.

Market Overview

The pachinko equipment market size (the total market size of pachinko machines, pachi-slot machines, and peripheral equipment) in FY2019 generated 636,500 million yen, 83.9% of that of the previous fiscal year, a decline by 121,700 million yen, based on the sales value at manufacturers. The size of the markets by product segment is as follows: The pachinko machine market ended up with 345,000 million yen, 68.4% on a year-to-year basis, the pachi-slot machine market reached 219,700 million yen, 130.3% on the same basis, and the peripheral equipment market down to 71,700 million yen, 84.3% on the same basis. The results showed significant decrease in the pachinko machine market.

The pachinko machine market size for FY2019 substantially declined from FY2018, because of several reasons: Slows down of new machines releases stemming from low relevance ratio to conform to revision of the regulations in February 2018; Difficult for newly installed machines to attract customers in pachinko parlors where new and old machines placed side by side despite older ones arouse more passion for gambling than new ones; Lengthy stagnancy in the pachinko industry as a whole; and the conditions of pachinko halls wanting to use profitable older types until the last allowable minute.

*According to Japan Gaming Machine Industry Association, which places a certificate stamp to every new machine to count the number of machines supplied, the number of certificates representing the new machines supplied to pachinko parlors have increased to 1,320 thousand units, 105.6% of the previous fiscal year. The difference from this research is caused by when the counting occurred. While the number of certificates counted by the Association occurred from April to March of each year, our counting period of gaming machines is based on the fiscal year at each company.

Because the replacement of pachinko machines from old to new ones became difficult due to the COVID-19 pandemic, the industry has extended the period to allow placing older machines at pachinko parlors from the end of January 2021 to the end of November 2021, which is likely to discourage the parlor operators to purchase new machines conforming to revised rules.

On the other hand, the sales of pachi-slot machines increased from the previous fiscal year, but it was because FY2018 had been particularly sluggish year, seemingly not indicating the pachi-slot machine market to be on the recovery, shown by the number of machines sold being below the worst past level i.e. when Unit-4 machines had been completely removed from the parlors in 2007. Such sluggish sales were because of considerably slower releases of new machines due to low relevance ratio to conform to the revised regulations. Just like pachinko machines, customers apt to choose old pachi-slot machines, which further discourages the parlor operators to purchase new machines conforming to revised rules to suppress passion for gambling.

Noteworthy Topics

Imperative to Improve Cost Structure to Save Rapidly Deteriorating New Gaming Machine Market

As removal of older machines postponed to November 2021, sluggish sales of new gaming machines meeting the revised regulations are likely to continue. In such an environment, the development competition of pachinko and pachi-slot machines among the manufacturers has been fiercer than before, which is increasing the development cost as well as the manufacturing cost to soar year by year, resulting in rapid decrease of profitability among such manufacturers. In order to breakthrough such a situation, attempts led by gaming manufacturers to improve cost have been in progress for the past several years but many cases these attempts end up with requesting subcontractors to reduce their price, or reducing the number of projects.

While the gaming market continues diminishing, the market players are required to manage the cost by prioritizing and streamlining through minute examinations. In addition, while scaling down the cost for materials and product development is in progress, the most effective method must be elaboration of the development schedule. As redoing can result in occupying almost half the entire development expenses, minute considerations at the planning stage and the shortest-distant development can slash the development cost of gaming machines.

The sales price of gaming machines has been soaring, inversely proportional to deteriorating profits at pachinko parlors. There are not many companies that can afford to spend 400,000 yen to 500,000 yen per new machine in the situation where the parlors had to voluntarily restrain operations due to COVID-19 pandemic, making their earnings keep on declining and no returning to normal can expected even after the state of emergency announcement was lifted. Soaring price of gaming machines can squeeze the earnings of pachinko parlor operators and can be more burdens to the players-side (pahinko and pachi-slot fans), which reduces the number of players as well as closure of the parlors, and deteriorate the sales of such machines, leading eventually to torment the gaming machine manufacturers . It is imperative to break off such a negative spiral.

Future Outlook

As the replacement of pachinko machines from older ones to new ones became difficult in the COVID-19 calamity, the industry has extended the period to remove the older machines that do not conform to the revised regulations from the end of January 2021 to the end of November 2021. For pachinko parlor operators, being allowed to place older machines for a longer period is a welcome matter, whereas for gaming machine manufacturers, selling both old and new machines at the same timing is unavoidable, requiring to sluggish sales of new machines for a longer time period. As the choice of gaming machines by the parlors is to be stricter, the parlor operators are expected to introduce the least necessary number of new machines.

In order to cope with the situation where no large-scale sales with tens and thousands of gaming machine can be expected, the manufacturers have been using small-lot production for various types since a several years ago. With lot size per machine becoming even smaller, recently, provision of a wide variety of machine types has been difficult. Although the manufacturers need to secure multiple popular titles that can expect sales of 20 thousand or at least 15 thousand of machines per title, they need significant investment to obtain the patents of promising titles.

Gaming machine manufacturers are projected to rapidly bipolarize between those with large organization scales as well as capital making them affordable for such investment and those that not. The survival is likely to be harsher for those small-and-mid-size manufacturers.

Research Outline

2.Research Object: Manufacturers of pachinko machines, pachi-slot machines, and peripheral equipment

3.Research Methogology: Face-to-face research by the expert researchers, surveys via telephone/email, and literature research

What is the Pachinko Equipment Market?

The pachinko equipment market in this research indicates a collective term of the markets of pachinko machines, pachi-slot machines, and peripheral equipment. Note that the peripheral equipment market is a collective term of the markets of equipment and devices installed in pachinko parlors including hall computers, ball/token supply systems, and etc.

<Products and Services in the Market>

Pachinko machines, pachi-slot machines, gaming machine parts, hall computers, prize POS, ball and medal counting machine, membership management systems, call lamp, ball/token supply systems,

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.