No.2476

Trends and Strategies at Pachinko Parlors and Parlor Operators in Japan: Key Research Findings 2020

Pachinko Parlor Operators Show Cautious Attitude in Management Strategy

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on pachinko parlors and the operators, and found out the trends of parlor closures nationwide, and store strategies at 196 groups of leading pachinko operators.

Summary of Research Findings

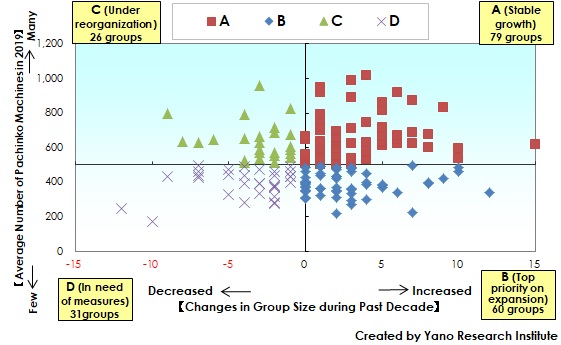

Yano Research Institute surveyed the leading 196 pachinko parlor operators operating 10 or more of parlors as of the end of December 2019 by analyzing the two indicators from the YANO Pachinko Database: Changes in group size during the past decade (fluctuation in the number of parlors within a company group during the past decade); and the average number of pachinko machines in group. To find out the current statuses, the strategies at pachinko parlor operators were categorized into the following four types: 1) Stable growth, 2) Top priority on expansion, 3) Under reorganization and curtailment, and 4) In need of measures. As a result, 79 pachinko parlor operator groups were in “Stable growth,” 60 groups were “Top priority on expansion,” 26 groups were “Under reorganization and curtailment,” and 31 groups were “In need of measures.”

The “Stable growth” pachinko operator groups were those that increased their group-wise business size and had larger number of machines than average which was more than 500 (therefore, the parlor size was larger than nationwide average), indicating that they had competitive edge both in group and parlor. Among the 10 leading pachinko parlor operator groups, those that fell into “Stable growth” were: Maruhan Corporation, Nobuta Group, NEXUS, NIRAKU CORPORATION, The Palazzo Tokyo Plaza Group, GARDEN GROUP CO., Ltd., and VEGASVEGAS.

The “Top priority on expansion” pachinko operator groups were those that increased their group-wise business size, but had smaller number of machines than average which was smaller than 500 (therefore, the parlor size was smaller than nationwide average). The size of the group was increasing, but the parlor size was not stable. Among the 10 leading pachinko parlor operator groups, those that fell into “Top priority on expansion” were: DYNAM Co., Ltd. and Undertree Corporation.

The “Under reorganization and curtailment” pachinko operator groups were those that reduced their group-wise business size, but had larger number of machines than average which was larger than 500 (therefore, the parlor size was larger than nationwide average). The groups might be either those that had already finished liquidizing non-profit-making parlors, or those that were currently in the process of doing it. Among the 10 leading pachinko parlor operator groups, the one that fell into “Under reorganization and curtailment” was: GAIA Co., Ltd.

The “In need of measures” pachinko operator groups were those that reduced their group-wise business size, and had smaller number of machines than average which was smaller than 500 (therefore, the parlor size was smaller than nationwide average). They were in a predicament where appropriate “scrap & build” must be done as soon as possible. The long-established companies that had opened multiple parlors simultaneously in their early days tended to fall into this category. These pachinko parlor operators seemed to be in the following statuses: Not able to stop closing parlors one after another though having closed some desperate ones, or left with small-scale parlors after larger ones (or promising ones) were already sold to other companies. No company among the 10 leading pachinko parlor operator groups fell into “In need of measures.”

Noteworthy Topics

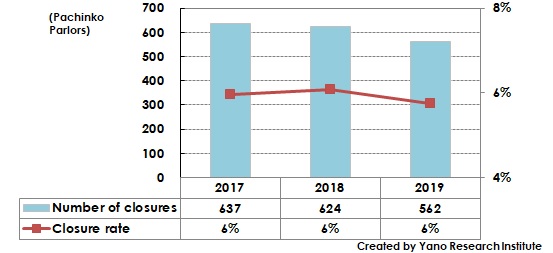

With 562 Pachinko Parlors Closed in 2019, Closure Rate 6%

The research took place by extracting 9,783 parlors in operation as of end of December 2018 from YANO pachinko database to find out the business statuses (closed or continued being in operation) at the end of December 2019. As a result, the number of parlors closed by the end of December 2019 was 562 and the rate of closure was 6%.

When compared this with the previous year, the number of closures decreased by 62. Although the number of closures decreased for 2 years in a row, it can rapidly expand in 2020, as many parlor operators face predicament of being forced to replace pachinko and pachislot models (from #5 to #6 machines) to comply with the new standards, in the status where they cannot avoid sales decrease as COVID-19 pandemics forcing them to refrain from opening their parlors or shorten the business hours.

Research Outline

2.Research Object: Nationwide pachinko parlor operators and their pachinko parlors

3.Research Methogology: Collected and analyzed the data from YANO Pachinko database (the database owned by Yano Research Institute on pachinko parlors and pachinko parlor operators)

The research was carried out based on the Pachinko data in the database at Yano Research Institute to find out characteristics and challenges at upper-ranking 196 groups of pachinko operators (grouping companies related by capital, management, etc.) by categorizing their current status of business strategies into the following four types: Stable growth, Top priority on expansion, Under reorganization and curtailment, and In need of measures. Also, 10 leading pachinko operators were analyzed in details by collecting statistical data for the past 7 years (number of parlors opened, number of parlors closed, average number of pachinko machines per parlor, average number of market players, etc.) The research covered the items necessary to hammer out pachinko parlor strategies, such as key points for making new parlors to a success, and the status of closures.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.