No.2343

Hotel Market in Japan:Key Research Findings 2019

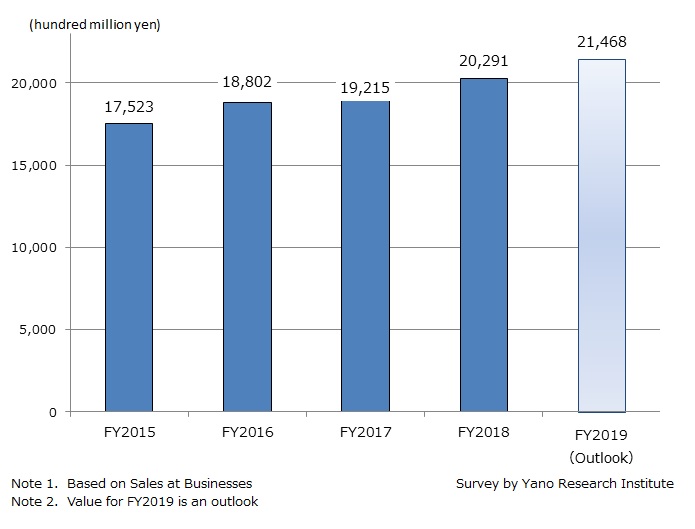

Domestic Hotel Industry Market in FY2018 Attained 2,029,100 Million Yen, 5.6% Increase from the Previous Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the hotel market in Japan, and found out the market size, the market size by division, the trends by market players, and the future outlook.

Market Overview

Domestic hotel market in FY2018 grew by 5.6% from the previous fiscal year, attaining 2,029,100 million yen (based on sales at businesses); increase for seven years in a row at the record-high standard. In addition to the stable growth in domestic travels and the increase in demand for business trips, significant rise in the number of inbound tourists was a strong driver for expanding solid demand for accommodations.

The hotel market in Japan had been sluggish due to the steep downturn caused by the Lehman shock in September 2008, followed by the Great East Japan Earthquake in March 2011. However, economic environment made an upward turn after FY2012, and the domestic tourism, which had been in a slump for long time, has also recovered. Moreover, the nationwide promotion efforts to attract foreign travelers proved effective, and have increased the number of inbound tourists significantly. Furthermore, the shift in trend of consumer spending from goods to experience, e.g. spending less on durable goods and more on travelling and sightseeing, is also driving growth for the hotel industry.

Noteworthy Topics

Hotel Industry Attracting Inbound Tourists

Today, in terms of customer acquisition strategy, the hotel industry is mostly dedicated to attracting inbound tourists. As Japan gets ready to host the 2020 Tokyo Olympic Games, industry’s move is noteworthy in expanding investments on opening of new hotels and on major renovations to attract ever-increasing inbound travelers. While high-end foreign hotel chains are already rushing to open their hotels centrally in Tokyo Metropolitan areas amid the influx of foreign tourists, domestic developers have demand for inviting famous international brands to establish new accommodations. On the other hand, domestic hotel chains are accelerating their hotel development in the areas popular for inbound tourists.

The hotel operators are actively working on refurbishing upper floors for luxury customers and renewing rooms for group guests, both in consideration of inbound tourists. Notable example is the refurnishing with an essence of Japanese-style, hoping that the guests would feel the appeal of Japan. Because the foreign travelers often come in family groups, hotels have also designed the rooms for more than two guests per room. As a part of the renovation, free Wi-Fi service, which is often requested by the inbound travelers, have also been introduced. Some hotels provide multilingual tablet devices on the bedside, which is a controller for lights, air conditioning, opening/closing of curtains, and ordering of room services.

Further, to invite more inbound tourists, some hotels have extended their marketing activities abroad. They establish sales branch overseas and form alliance with the foreign hotels to develop loyal customer base with the partner hotels. Increasing number of hotel operators are participating in the travel exhibitions and trade fairs held overseas. Some hotel chains opened group hotels in emerging countries in Asia to acquire booming tourists within those countries, while expecting to become high-profile hotels so that the tourists choose their hotels when they visit Japan.

Future Outlook

In FY2017, growth of the hotel industry slowed down temporarily as the customer churn increased due to sharp rise in accommodation prices, coupled with diversified demand for accommodation driven by the establishment of non-hotel facilities like capsule hotels, guest houses, and minpaku (private lodges). Moreover, in FY2018, a series of natural disasters such as earthquakes and typhoons have affected demand for many hotels, especially in Kansai and Hokkaido areas.

Despite the negative impacts, demand for the entire hotel industry remains sound. The hotels in major cities such as central Tokyo and other famous tourist destinations have high occupancy rate, and the price per room is hovering at high level. Market expansion is triggered by the opening of new hotels one after another, in addition to the active renewals at existing hotels that increased the market capacity as well as average spending per guest. Since big international events will continue to take place in Japan beyond FY2019, demand for accommodations by the inbound travelers is expected to increase hereafter. Moreover, there are also potentials for expansion of MICE such as international meetings and academic conferences. Therefore, the hotel market is forecasted to continue its growth for years to come. The market size of FY2019 is estimated to expand to 2,146,800 million yen, 5.8% increase from the previous fiscal year.

Research Outline

2.Research Object: Enterprises operating hotels in Japan

3.Research Methogology: Face-to-face interviews to headquarters of leading hotel chains etc., surveys to companies operating hotels etc., and analysis on related statistical data, etc.

Hotel Market in Japan

Hotels and other accommodations alike

<Products and Services in the Market>

Accommodations such as hotels, etc.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.