No.2337

Non-Residential/Non-Dwelling Wooden Construction Market in Japan: Key Research Findings 2019

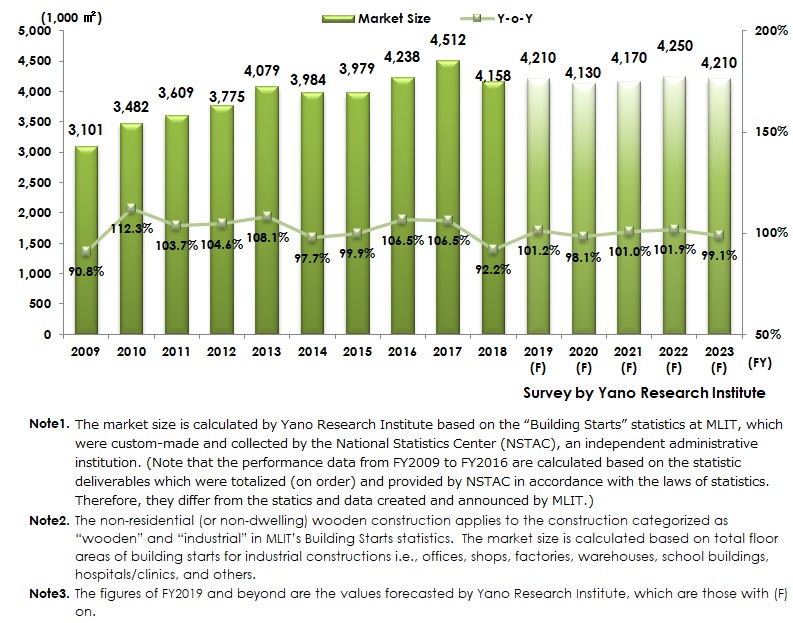

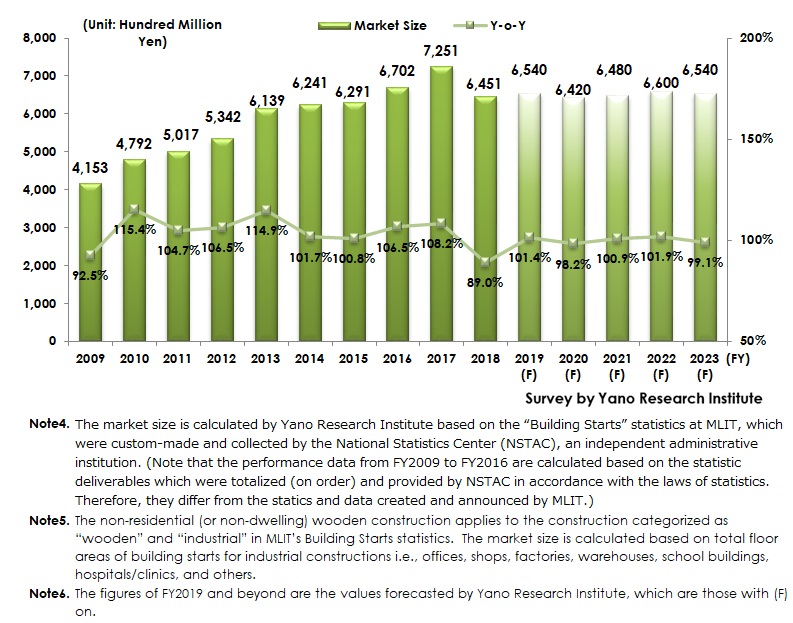

Non-Residential Wooden Construction Market Size for FY2019 Expected to Rise by 1.4% to Reach 654,000 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic non-residential wooden construction market and has found out the market size, trend by segment, and future outlook.

Market Overview

FY2018 by floor area decreased to 4,158,144 square meters, 92.2% of the size of preceding fiscal year, while the market size by estimated construction expenses declined to 645,100 million yen, 89.0% of the size of previous fiscal year. The non-dwelling wooden construction market size had kept on rising since FY2010 when “the Clean Wood Act,” which is to encourage use of legally harvested woods in public constructions, went into effect, but the market size in FY2018 declined both by floor area and construction expenses.

When observing the breakdown, the decline was not only seen in private sector that had led the entire market but also in the floor area of construction starts for public sector, failing to reach 300 thousand square meters for the first time ever since “the Clean Wood Act” was enacted, which diminished the entire market. It stemmed from decreased floor areas of building starts for small-size buildings (i.e., buildings with the floor area less than 300 square meters) that cover majority of the market as well as that for large-size (3,000 square meters) building starts, though the market share is not large.

On the other hand, the market size in FY2018 also fell by estimated construction fees, 3 points less than the size by floor areas, because of significant drop in labor cost that used to soar due to shortage of construction workers.

Noteworthy Topics

While Component Suppliers Increasingly Entered Market, Constructors Focus on Mid-to-High Story “Woody” Buildings

The enterprises constructing non-dwelling wooden constructions can be divided into component suppliers and constructors.

Component suppliers apply to laminated wood makers, structural material (pre-cut) makers, architectural hardware makers, etc., basically pressing ahead to use in-house components mainly for mid-to-small size constructions with floor size less than 1,000 square meters, as the size can most appropriately appeal the cost advantage of “wooden” built. They also ally with major construction companies, i.e. the prime contractors, to take part in supplying components and in constructing wooden buildings.

On the other hand, major construction companies and house makers are basically the prime contractors for non-residential wooden constructions. They develop fire-resisting structural components for building mid-to-high story “woody” constructions in crowded urban areas. Unlike component suppliers trying to use their own in-house products, major construction companies use the right materials, not limited to wooden ones, to the right place for building wooden or woody constructions.

Future Outlook

Because the influence of surge in demand just before the tax hike in 2019 and the sudden decline in demand afterwards is likely to be small, the domestic non-residential wooden construction market (both new and renovated) in FY2019 is expected to attain 4,210 thousand square meters by floor area, 101.2% of the size of preceding fiscal year, and 654,000 million yen by estimated construction expenses, 101.4% of the size of previous fiscal year.

Because non-residential wooden constructions are highly demanded in the private sector, the market is significantly affected by the trends there. The demand in the private sector has started declining, as the facilities for infants and toddlers, such as preschools and kindergartens, that had boosted the demand have somewhat matured in some regions.

On the other hand, wooden constructions for the facilities for elderly have been stably demanded. Among the facilities for the aged, while demand is decreasing for mid-to-large scale facilities such as intensive care homes and residences for the elderly with services equipped, demand for relatively small-scale homes for the aged is on the rise. In addition, office buildings built during the “bubble economy” are projected to be remodeled, promising for the wooden mid-to-high story constructions to replace them.

As the domestic non-residential wooden construction market is likely to stay flat or slightly increase, the market size by floor area is projected to achieve 4,210,000 square meters for FY2023, 101.2% of the size of FY2018, while the market size by estimated construction expenses to attain 654,000 million yen, 101.4% likewise.

Research Outline

2.Research Object: Businesses constructing non-residential wooden buildings (general constructors, house makers, laminated wood makers, structural material (pre-cut) makers, architectural hardware makers, etc.)

3.Research Methogology: Face-to-face interviews by the specialized researchers, supported by survey via telephone, collection and analysis of public information and documents.

Non-Residential/Non-Dwelling Wooden Construction Market

Non-residential/non-dwelling wooden construction in this research applies to the construction categorized as “wooden” and “industrial construction (offices, shops, factories, warehouses, school buildings, hospitals/clinics, and others)” in MLIT’s Building Starts statistics. The market size is calculated based on floor areas of building starts and estimated construction expenses. In addition to new constructions, those for addition and renovation are included.

*The market size is calculated by Yano Research Institute based on the “Building Starts” statistics at MLIT, which were custom-made and collected by the National Statistics Center (NSTAC), an independent administrative institution. (Note that the performance data from FY2009 to FY2016 are calculated based on the statistic deliverables which were totalized (on order) and provided by NSTAC in accordance with the laws of statistics. Therefore, they differ from the statics and data created and announced by MLIT.)

<Products and Services in the Market>

Non-residential wooden construction, non-dwelling wooden construction

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.