No.1904

Insurance Shops Market in Japan: Key Research Findings 2018

Insurance Shops Market in Japan: Key Research Findings 2018

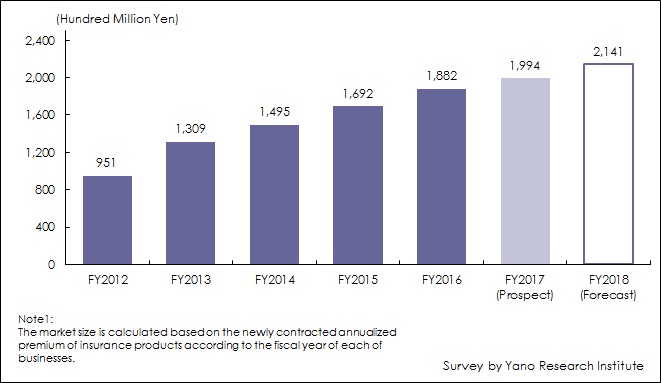

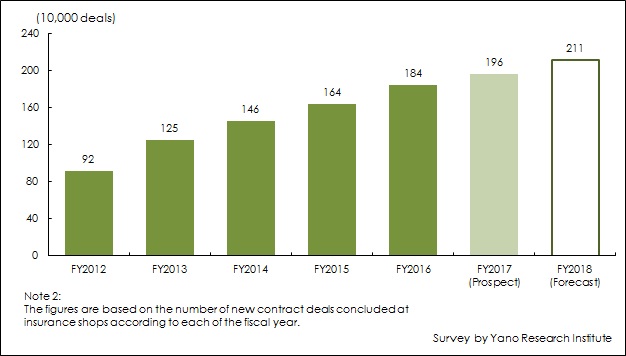

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic insurance shops market for FY2018 and has clarified the market trends, market size (based on the newly contracted annualized premium of insurance products according to the fiscal year of each of businesses), number of new contract deals, and the future outlook.

Market Overview

The insurance shops market in FY2016 rose by 11.2% to attain 188,200 million yen, based on the newly contracted annualized premium of insurance products according to the fiscal year of each of businesses. The number of new contract deals in FY2016 rose by 12.2% to achieve 1,840 thousand. For the last one or two years, the market has been wavered by the government policies and trend of insurance companies, which were shown by sales termination of some of insurance products and revision of insurance premiums with a backdrop of the standard prospective yield for life insurance and assumed mortality rate lowered.

On the other hand, however, increasing number of insurance shops has successfully discovered new demands through delivering on the obligations to understand customers’ intentions and providing appropriate information to customers, and has focused more on communications with customers by approaching and guiding them according to their lifestyles. Furthermore, growing number of companies have tried to diversify their business, for instance by expanding the sales of life insurance products for corporations. As a result, although the growth rate has slowed down, the insurance shops market size is likely to expand by 6.0% from the preceding fiscal year to attain 199,400 million yen in FY2017, based on the premium of insurance products that have been converted into the new fiscal-year contract of each of the businesses.

Noteworthy Topics

Number of insurance shops operated by the companies developing insurance shops is estimated to be 2,646 as of April, 2018. The industry sees continuous opening of new shops one after another, but there is no denying of slowdown in the momentum, as both the mid-size and large companies have progressively reorganized some shops that do not make profits.

In addition, although stagnancy in opening new shops one after another has improved, the shops are facing fierce competition with nearby shops. Therefore, reorganization of shops is unavoidable especially in the local areas where number of shops had originally been scarce.

Research Outline

2.Research Object: Joint agencies operating insurance shops, life insurance companies, and etc.

3.Research Methogology: Face-to-face interviews by the expert researchers

What are Insurance Shops?

The insurance shops in this research shall be the joint agencies selling insurance products from multiple insurance companies. The market size is calculated based on the newly contracted annualized premium of insurance products according to the fiscal year of each of businesses.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.