No.3943

The Home and Office Furniture Market in Japan: Key Research Findings 2025

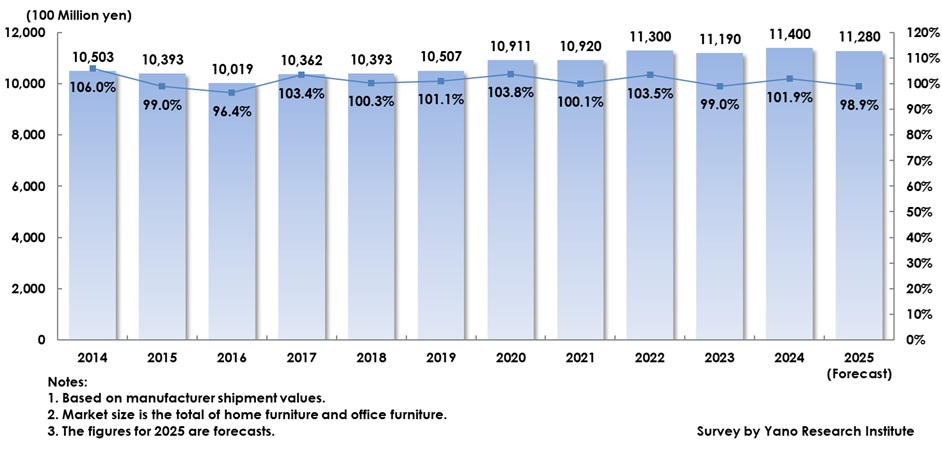

The Home and Office Furniture Market Reached 1.140 Trillion Yen in 2024, 101.9% of Previous Year’s Level

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of the domestic home and office furniture market, and found out the market size, the trends of market players, and future perspectives.

Market Overview

Based on manufacturer shipment values, the home and office furniture market reached 1.140 trillion yen in 2024, 101.9% of the previous year’s level. This slight growth reflects steady demand for both home and office furniture. Rising costs for raw materials, distribution, and labor have boosted the home furniture market, while increased office relocations and refurbishments aimed at improving employee engagement* and enhancing recruitment has supported growth in the office furniture market.

*Employee engagement refers to employees’ emotional connection and sense of trust toward their company, which fosters voluntary dedication to their work.

Noteworthy Topics

Acceleration in the Expansion of Offerings in Both Home the Furniture and Office Furniture Businesses

The home and office furniture market is facing challenges such as a declining population and number of households, fewer new housing starts, and a shrinking working population.

These external environmental changes are slowing traditional furniture sales. In response, furniture dealers, particularly those that deal in home furniture, are developing new products to attract customers and expanding into markets such as hotels. They are also launching new businesses, including furniture-focused interior renovation and furniture rental services.

Conversely, dealers that focus on office furniture are actively broadening their offerings to include office interior design, as well as related systems and services such as office consulting.

Future Outlook

Based on manufacturer shipment values, the home and office furniture market is forecast to reach 1.128 trillion yen, representing a 1.1% decrease from the previous year.

Due to the expected persistence of rising commodity prices in daily life, demand for furniture purchases is expected to decline, particularly in the home furniture segment. Meanwhile, investments in the office furniture segment continue to increase as companies strive to boost employee engagement and improve recruitment by creating more comfortable workspaces. Since this trend has expanded beyond major and urban companies to rural companies and SMEs, robust demand is expected in the office furniture market.

Despite the favorable outlook for the office furniture segment, the overall market, which includes both home and office furniture, is projected to decline, due to the shrinking home furniture segment, which accounts for approximately 60% of the total market.

Research Outline

2.Research Object: Manufacturers of home and office furniture, retailers of furniture, etc.

3.Research Methogology: Face-to-face interviews (including online interviews) by expert researchers, survey via telephone, and literature research

What is the Home and Office Furniture Market?

In this research, the home and office furniture market refers to wooden and metal furniture that is either manufactured domestically or imported for use in homes or offices. However, furniture produced domestically and then exported is not included in the market scope.

<Products and Services in the Market>

Wooden furniture, metal furniture

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.