No.3869

Global Market of Grid-Scale Stationary Energy Storage Systems (ESS): Key Research Findings 2025

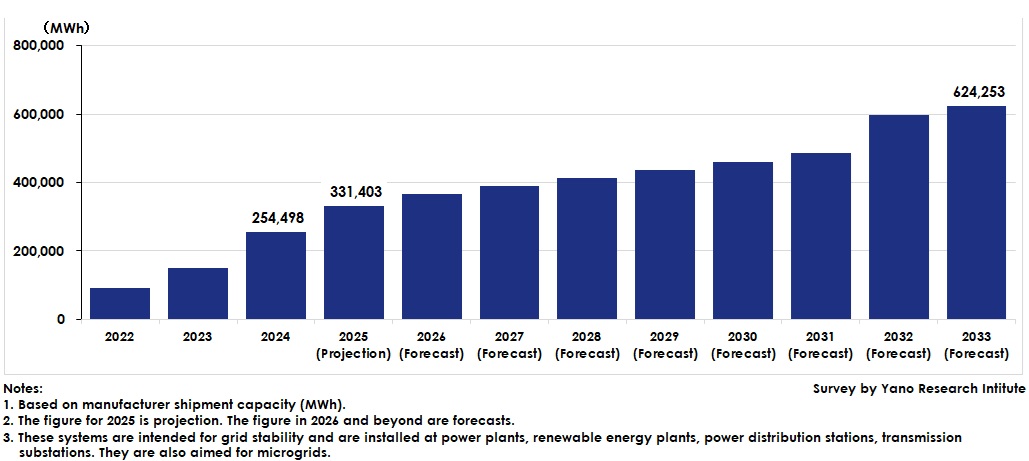

Global Shipment Capacity for Grid-Scale Stationary ESS Is Forecast to Reach 624 GWh by 2033

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey on the global grid-scale stationary energy storage systems (ESS) for 2025. The survey revealed the market trends by installed location and by application, the trends by battery type, the trends of market players, and the future perspectives.

Market Overview

The global market size of grid-scale stationary energy storage systems (ESS) by shipment capacity in manufacturers was estimated at 254,498 MWh in 2024. Growth in ESS shipments was fueled by strengthened support for the deployments of renewable energy plants and ESS in major countries, as well as improved electrical sales revenue caused by lower renewable energy generation costs. North America, China, and Europe are particularly rapidly increasing their shipment capacity of these systems, accounting for 80% of the global total.

To combat global warming and abnormal weather patterns, as well as to achieve carbon neutrality, countries worldwide are striving to phase out coal and nuclear power and deploy renewable energy plants. Energy storage systems (ESS) help stabilize the power generated by these plants and manage maximum loads. This is expected to improve power quality and energy usage efficiency. Storing the power generated by renewable energy plants in ESS and using it during peak demand hours improve the usage rate of power plants and transmission infrastructure. ESS has also been implemented as a distributed power source to provide a stable power supply in the event of grid deterioration due to aging infrastructure or blackouts during a disaster.

Against this backdrop, grid-scale ESS deployments are expected to continue expanding alongside increased renewable energy plant deployments in 2025. Consequently, the global grid-scale ESS market size is expected to reach 331,403 MWh, marking a 30.2% increase from the previous year. In the United States, deployments of large-scale, grid-connected ESS deployments are expanding, particularly in California, Texas, and Nevada, where renewable energy plant construction is increasing. Germany, Italy, France and Britain are projected to drive market growth as major European countries deploying ESS.

Noteworthy Topics

Rapid Advancements Are Being Made in New Battery Technologies including NMx, LMFP, Solid-State, and Sodium-ion

Until around 2020, the main components of lithium-ion batteries used in energy storage systems (ESS) were nickel-cobalt-manganese (NCM) or nickel-cobalt-aluminum (NCA). These batteries were primarily manufactured by Japanese and South Korean companies. However, shipments of lithium-ion batteries using lithium iron phosphate (LFP) from Chinese manufacturers have overturned the landscape. LFP-based lithium-ion batteries have now become the mainstream for ESS. This situation continues in 2025, with LFP-based lithium-ion batteries for ESS accounting for over 90%. Meanwhile, the development of cobalt-free lithium-ion batteries that use manganese in the cathode material is underway. Examples include the use of nickel manganese oxide (NMx) and lithium manganese iron phosphate (LMFP), the latter of which provides high energy density.

Other battery technologies using new materials are also emerging. These technologies have the potential to outperform lithium-ion batteries. These technologies gaining attention include solid-state batteries and sodium-ion batteries. Solid-state batteries are safer than lithium-ion batteries and are said to provide higher energy density. Sodium-ion batteries have the advantages of lower material costs and a smaller environmental impact, which are expected to contribute to a more sustainable energy society.

Future Outlook

Countries around the world are deploying renewable energy plants in an effort to achieve carbon neutrality, and this trend is likely to accelerate. Concurrently, the global market for grid-scale stationary energy storage systems (ESS) is expected to continue growing steadily.

Furthermore, major countries are increasing their financial support through subsidies and tax incentives. This reduces cost burdens for user companies. Meanwhile, ESS manufacturers are improving material properties and optimizing design methods to enhance performance and reduce material costs. These economic and technological advantages increase the benefits of ESS deployment.

Due to these factors, the global grid-scale stationary ESS market is projected to reach 624,253 MWh by 2033 based on manufacturer shipment capacity. China and North America are expected to lead the global market expansion as the largest system implementers.

Research Outline

2.Research Object: Manufacturers of stationary energy storage systems and related equipment in Japan and overseas

3.Research Methogology: Research methodologies: Face-to-face interviews (including online interviews) by expert researchers and literature research

About Grid-Scale Stationary Energy Storage Systems

In this research, grid-scale stationary energy storage systems refer to systems used in electrical grids. These systems are installed at power plants, including thermal and nuclear power plants, as well as at renewable energy plants, power distribution stations, transmission substations, and microgrid systems, thereby securing the stability of power supply networks and improving power quality by adjusting frequency and leveling loads.

They utilize various types of batteries, including lithium-ion, lead storage, nickel-hydrogen, and redox flow (RF), and sodium-based batteries, such as sodium-sulfur, sodium-nickel chloride, sodium-ion, and sodium molten salt.

<Products and Services in the Market>

Grid-Scale Stationary Energy Storage Systems, lithium-ion batteries, lead storage batteries, nickel hydrogen batteries, redox flow (RF) batteries, or sodium-based batteries

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.