No.3823

Beverage Co-Packer (Contract Packer) Market in Japan: Key Research Findings 2025

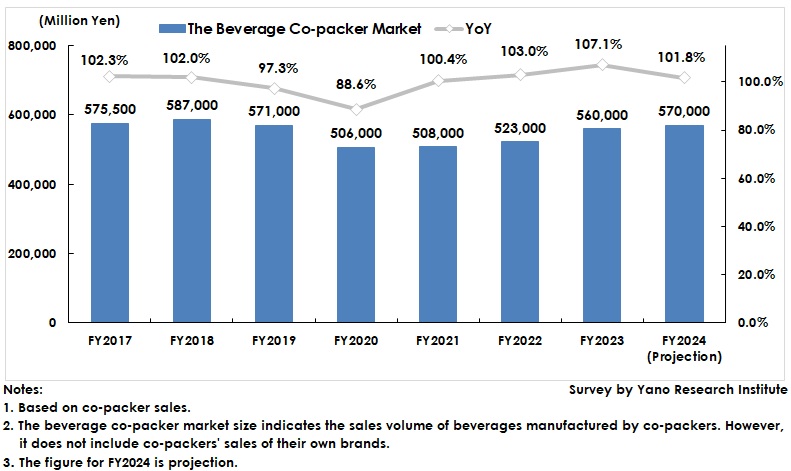

Beverage Co-Packer Market Expanded in Value due to Rising Unit Prices for Processing, But Increased Only Slightly in Volume

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic beverage co-packer (contract packer) market and has found out the trends by area and by product category, the trends of market players, and the outlook.

Market Overview

The domestic beverage contract packer (co-packer) market reached 560,000 million yen in FY2023, a 7.1% increase from the previous fiscal year, based on beverage co-packer sales. The market is projected to reach 570,000 million yen in FY2024, marking the fourth consecutive year of growth and representing a 1.8% increase from the previous fiscal year. Although the market once precipitated due to the pandemic, it is expected to return to the FY2019 level by FY2024.

The main growth factor in FY2023 was the increased unit prices for processing, which many beverage manufacturers (hereinafter referred to as brand owners) accepted. This increase occurred alongside increased demand for beverages stemming from heat waves. These factors led to a dramatic increase in the value of the beverage co-packer market. However, the actual market size by volume expanded only slightly, just like the beverage market size.

Noteworthy Topics

PET Bottle Production Structure in Brand Owners and Packers

Currently, PET bottles are the standard container for the beverage market. Therefore, manufacturing PET bottles is a pivotal investment for both brand owners and beverage contract packers (or co-packers). Since many brand owners use PET bottles to package their beverages, co-packers are needed to strengthen production lines that cater to PET bottles.

Large brand owners primarily invest in aseptic production lines aiming to reduce product volume, costs, and weight. However, many co-packers have hot-fill production lines. To receive more orders from major brand owners, co-packers need to introduce aseptic production lines. This is an expensive investment, so only a few co-packers can implement these lines.

Future Outlook

Brand owners strive to produce as much as possible in-house to minimize quality, cost, and supply risks. However, not all products can be produced in-house; therefore, co-packers are essential. Close alignment with co-packers are needed particularly for products that require flexible production systems or adaptability to changes. The growing number of private brand products also increases the opportunity for co-packers to accept orders.

In the future, the relationship between brand owners and co-packers will likely evolve into strategic partnerships because engagement and role assignment will be the key to gaining a competitive market edge.

Research Outline

2.Research Object: Beverage contract packers (co-packers) and beverage manufacturers (brand owner companies)

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, survey via telephone/email, and literature research

What is the Beverage Co-packer Market?

In this research, a beverage co-packer indicates a company that produces beverages for clients (beverage brand owners) on a contract basis. The beverage co-packer market indicates the sales volume of beverages manufactured by co-packers. The market size does not include sales of brands that are owned by the co-packers.

<Products and Services in the Market>

Carbonated beverages, beverages with fruit juice, tea drinks, coffee drinks, mineral water, soy milks, vegetable juices, functional sports drinks, dairy beverages, and other soft drinks.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.