No.3486

Mail-Order Food Business Market in Japan: Key Research Findings 2024

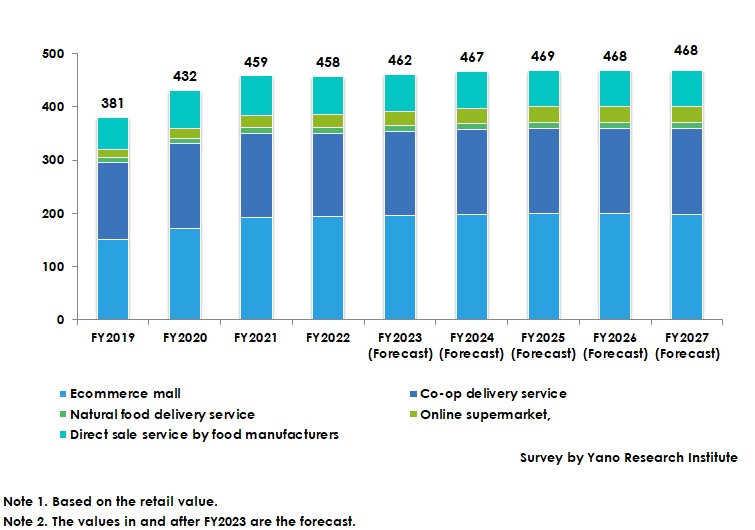

Mail-Order Food Business Market for FY2022 Declined by 0.3% to 4,575,200 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the mail-order food business market in Japan and found out the market trends, trends of market players, and future perspectives.

Market Overview

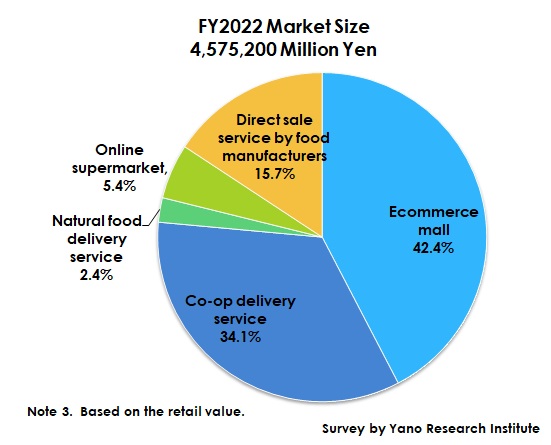

The mail-order food business market in FY2022 is estimated as 4,575,200 million yen, down by 0.3% from the previous fiscal year by retail value. The market has expanded during FY2020 and 2021 due to increase in at-home consumption amid COVID-19 crisis, but demand for mail-order food subdued as behavior restrictions gradually lifted since the latter half of FY2022 and as the rise of commodity prices encouraged saving sentiment among consumers, which slightly reduced the market size. When observing the market by mail-order channel, ecommerce shopping malls (including catalog sales) have shown robust demand from the previous fiscal year and online supermarkets have expanded due to new entries one after another, but other channels have shrunk.

The market for FY2023, too, seems to have affected by declined demand from being surged amid COVID-19 crisis and by the saving sentiment from commodity price rises. The market also seems to be affected seriously by delivery fee rises stemming from the 2024 logistics issue. Still, steadfast gift demand and increased sales prices to include commodity price rises have suppressed the scale of market shrinkage.

Noteworthy Topics

Influence of 2024 Logistics Issue Widespread

Anticipating the 2024 logistics issue, the delivery fees have fully been raised since April 2023, which seems to have started affecting the mail-order food market.

After the delivery fee has been raised at logistics companies, each of mail-order food companies have reviewed the delivery fees and reconsidered their thresholds of preferential treatment on delivery fees for customers (stricter condition for free delivery fees for customers such as raising their purchase amount). Because of announcement of administrative policy to overhaul displaying “free delivery fees” that have widespread among the mail-order industry, some businesses have commenced to change the “delivery fee inclusive” indications. Therefore, superficially displayed prices are on the rise. As food is low in unit price, the delivery fee for food is apt to make consumers feel higher rate than other commodities against the product price. This may cause a concern that consumers may refrain from buying food via mail orders.

Future Outlook

Growth of the mail-order food market is expected to slow down hereafter. Raising product prices may contribute to an increase of the market size by 1.0% on YoY to 4,620,000 million yen for FY2023, but the growth rate of ecommerce malls (including catalog sales) is likely to decelerate. This is because some consumers who want to save expenditure can shift to physical stores for food and look away from mail orders and online that raised prices with delivery fees inclusive, and because platformers may accelerate reviewing of their services to value profitability and switch the sales promotion measures or raise the delivery-fee preferential thresholds.

Research Outline

2.Research Object: Mail-order businesses, food-related businesses, Co-op, food retailers, food wholesalers, etc.

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, questionnaire, survey via telephone, and literature research

The Mail-Order Food Business Market

The mail-order food business market in this research targets the following mail order channels:

1) Ecommerce mall (including catalog sales), 2) Co-op delivery service (group delivery & individual delivery), 3) Natural food delivery service, 4) Online supermarket, and 5) Direct sale service by food manufacturers. The targeted merchandises are fresh food (marine products, meat, and vegetables & fruits), rice, beverages (mineral water is included, but not the home-delivered water), liquors, confectionery & sweets, health food, and other processed food. No sundries are included, but some non-food items provided at 3) natural food delivery services and 4) online supermarkets are included.

<Products and Services in the Market>

Mail-order food business, Perishable food (fishery, meat, and vegetables & fruits), rice, beverages (mineral water is included, but not the home-delivered water), liquors, confectionery & sweets, health food, and other processed foods

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.