No.3500

E-commerce Payment Service Market in Japan: Key Research Findings 2024

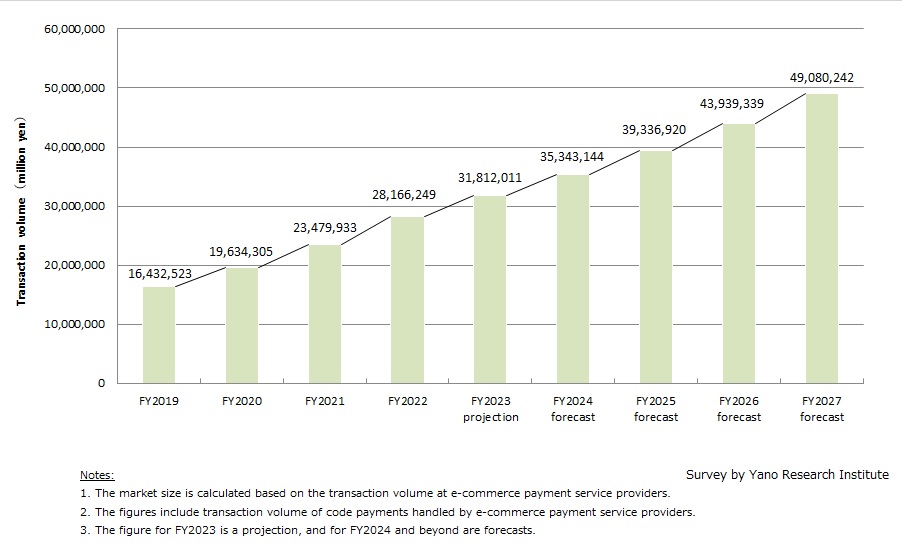

E-commerce Payment Service Market Projected To Exceed 28 Trillion Yen for FY2022, Forecasted to Grow to 49 Trillion Yen-Level by FY2027

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the domestic e-commerce payment service market, and found out the current situation, the trends at market players, and future perspective.

Market Overview

In accordance with the expansion of the e-commerce market, the e-commerce payment service market is growing. E-commerce payment service providers are focused on service improvement by introducing a payment option like BNPL (post-pay credit service) in addition to a variety of other types of payments.

In addition, e-commerce payment service providers are expanding business by reinforcing in-person payments, as well as providing financing services like transaction lending service (*1) and remittance service.

Furthermore, online payment services are vigorously embarking on expanding business domain to B2B by offering BPSP (* 2) and pay-on-credit.

Against these backgrounds, the e-commerce payment service market is projected to attain 28,166,200 million yen (120.0% on year-on-year basis) for FY2022, and 31,812,000 million yen for FY2023 (112.9% on year-on-year basis,) based on the transaction volume at online payment service providers.

(* 1) Transaction lending involves using transaction history data to evaluate the state of a business to make loan decisions instead of making decisions based on financial data.

(* 2) BPSP is a short for Business Payment Solution Provider, a type of providers that offers B2B solution for connecting buyer companies that wants to pay by credit card and seller companies that do not accept credit card payments.

Noteworthy Topics

BNPL Providers Expanding Business Domain

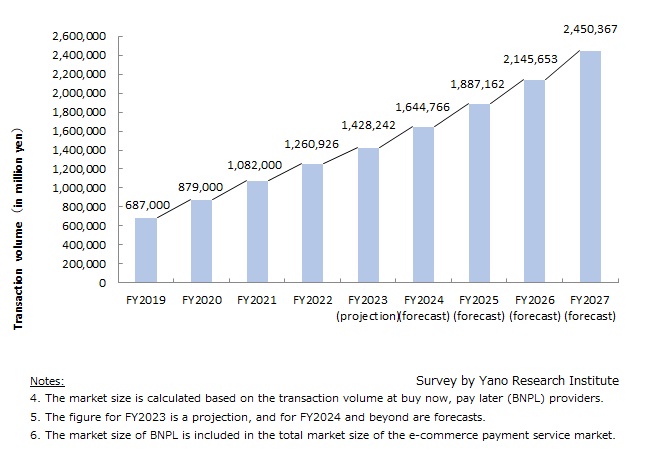

Buy Now Pay Later (BNPL), a B2C post-pay credit service, is expanding stably, and the market size is estimated at 1,260,900 million yen for FY2022 (based on the transaction volume at BNPL service providers).

Acceptance of BNPL as payment option at major e-commerce marketplaces and physical stores has propelled the market growth. With further improvements in the usage environment and widening of customer base, we assume that transaction volume increases accordingly.

Since BNPL is said to be “highly compatible” with large payments, we believe the environment for customers to opt for deferred payment, including long-term installments, will be established hereafter. Instead of being used as an alternative to conventional cash on delivery, BNPL services may arouse potential demand of credit card users. By capturing those needs, BNPL service market may expand further.

In respect of the expansion of use environment and the rise of average transaction value per customer, the BNPL market is forecasted to expand to 2 trillion yen-level by FY2026.

Future Outlook

In addition to the expansion of e-commerce market, the advancements in digitalization of public services, and the increase of payment services needs in B2B, omnichannel retailers, and the offline market are expected. Considering these market drivers, we projected that the e-commerce payment market to reach 4.9 trillion yen-level by FY2027.

Going forward, we believe the market growth will be propelled by the recovery in industries that were severely impacted by COVID-19, like travel and leisure, as well as by the developments of NFTs and Web3.0 that give a rise to the use of digital payments for digital contents.

Research Outline

2.Research Object: Payment processing services for EC operators, related businesses

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews) and literature research

What is the E-commerce Payment Service Market?

In this research, e-commerce payment service provides payment-related services chiefly for EC operators, for example, complete payment operation on behalf of EC site operator.

The market size of e-commerce payment service in this research is calculated based on the transaction volume at e-commerce payment services.

<Products and Services in the Market>

Payment processing services for EC operators, etc. (payment agencies, payment service providers, BNPL providers, etc.)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.