No.3485

Bags & Purses Market in Japan: Key Research Findings 2024

FY2023 Bags & Purses Retail Market Expected to Rise by 11.2% From Preceding Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the bags and purses market in Japan, and found out the trends by product segment, the trends of market players, and future perspective.

Market Overview

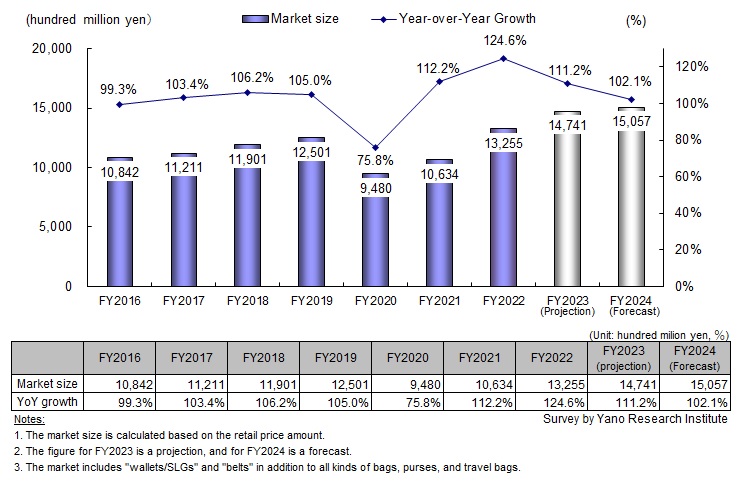

The size of the domestic bag and purses retail market in FY2022 grew to 1,325.5 billion yen, up by 24.6% from the previous year. Growth attributes to 1) strong sales of imported brand bags, mainly of luxury brands, among affluent consumers, 2) an overall increase in the unit price of products overall due to soaring prices of raw materials and fuel, 3) resumption of demand for bags for special occasions such as wedding, 4) an increase in sales of eco-friendly products such as market bags and shopping bags that can be used repeatedly, and 5) stable sales of business backpacks led by the penetration of business casual.

Noteworthy Topics

Travel Bag Retail Market

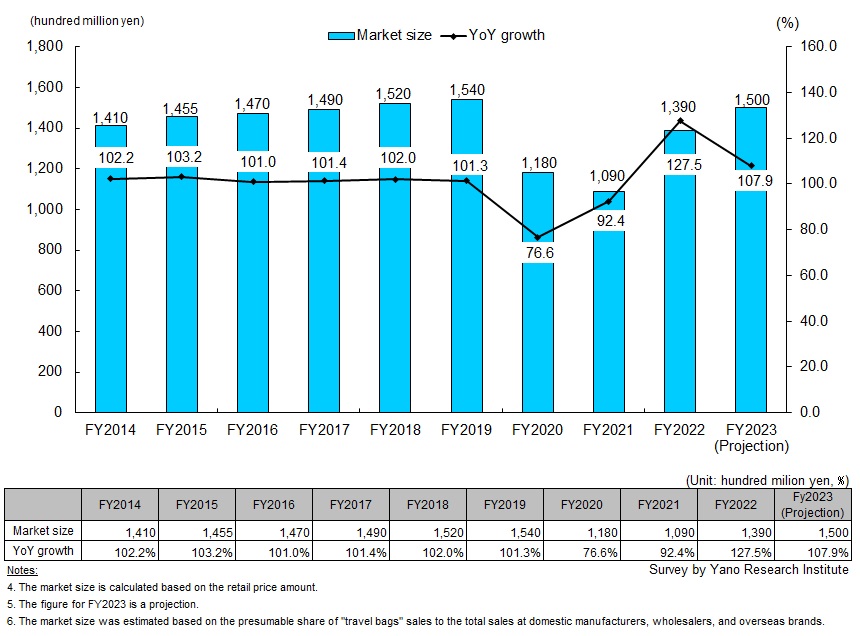

The size of the FY2022 travel bag retail market in Japan grew to 139 billion yen, up by 27.5% from the previous fiscal year. Sales of travel bags such as small-sized suitcases was propelled by the temporary increase of domestic travelling stimulated by “Go To Travel Campaign”. However, the demand did not stabilize due to reasons including suspension of the campaign. The market size for FY2022 stood at approximately 90 percent of that of FY2019.

Backed by the national travel support program, the travel and leisure sectors foresee travel demand recovery for FY2023, in both domestic trips and international trips, as “revenge travel”, reflecting travelers’ desire to make up for lost travel experiences during COVID-19 crisis. Along with the increase of demand among foreign tourists visiting Japan, the travel bag market is expected to follow on an upward trend. The demand for small-sized suitcases for one person and the carry-on luggage treated with antivirus and antibacterial processing is growing among foreign tourists visiting Japan, who wish to pack their souvenirs purchased while travelling. Weak yen is further propelling the purchase of these types of suitcases.

From FY2024 onward, we believe suppliers of bags and travel bags will accelerate the development eco-friendly products, particularly those that are recyclable, to accommodate rising demand for making pro-environmental choices at retailers and consumers.

Future Outlook

Our projection for the domestic bags and purses retail market for FY2023 is 1,474.1 billion yen, up by 11.2% from the preceding fiscal year. We also forecast that it will grow to 1,505.7 billion yen for FY2024, up by 2.1% from the previous fiscal year. Driven by the lift of activity restrictions enabled by reclassification of COVID-19 to class-5 under the Infectious Disease Act, people’s flow in FY2023 activated over that of FY2022.Events are recovering their sizes to pre-pandemic times, and at the same time, according to the Japan Tourism Agency's Travel and Tourism Consumption Trends Survey, there are signs of recovery in the number of Japanese traveling domestically to pre-pandemic levels. In addition, going forward, we believe the business focus of the bag and purses industry will be how to capture demand of foreign tourists visiting Japan. Although the market growth is underpinned by multiple encouraging factors, such as the full-scale recovery of Chinese group tourist demand in 2024 and yen’s continued depreciation, concerns remain in the purchase behavior of domestic Japanese customer base, as rising prices are affecting their price sensitivity and shopping behavior.

In addition, we believe the development of products that embrace the concept of “phase-free” and “eco-friendly” will be important going forward. “Phase-free” is a new approach originally developed in Japan to prepare for natural disaster, which advocates designing products and services to be useful not only in daily life but also in emergency situations. As seen in the market launch of products with “PHASE-FREE certification” that eyes to disaster preparation in recent years, this trend is expected to continue. Employing eco-friendly practices is also increasing importance in terms of branding, and for that manufacturers are increasingly selecting raw materials that impact environment less. Producing “phase-free” and “eco-friendly” products to add value and sell them at higher prices are imperative for the growth of bags and purses retail market.

Research Outline

2.Research Object: Manufacturers, wholesalers, and retailers in the bags/purses/belts industry, businesses in the supply chain (manufacturers, wholesalers, and suppliers of materials such as leather, fabrics, and synthetic leather), importers, exporters, related associations, etc.

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey by telephone and email, and literature research

What is the Bags & Purses Retail Market?

In this research, “bags” indicate mainly large-sized bags for men, and “purses” refer to handbags or small pouches designed typically for women. In addition to business bags, travel bags, and purses, the market includes wallets, small leather goods, and belts. Please note that the market size of travel bags was estimated based on the presumable share of “travel bags” sales to the total sales at domestic manufacturers, wholesalers, and overseas brands.

<Products and Services in the Market>

Shoulder bag, tote, rucksack/knapsack/backpack, Boston bag, messenger bag/cross-body, waist bag (fanny pack/belt bag/moon bag/belly bag, or bumbag), women’s and men’s clutches, briefcase, handbag, pochette, etc.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.