No.3482

Global Market of Residential & Corporate/Commercial Stationary Energy Storage Systems (ESS): Key Research Findings 2024

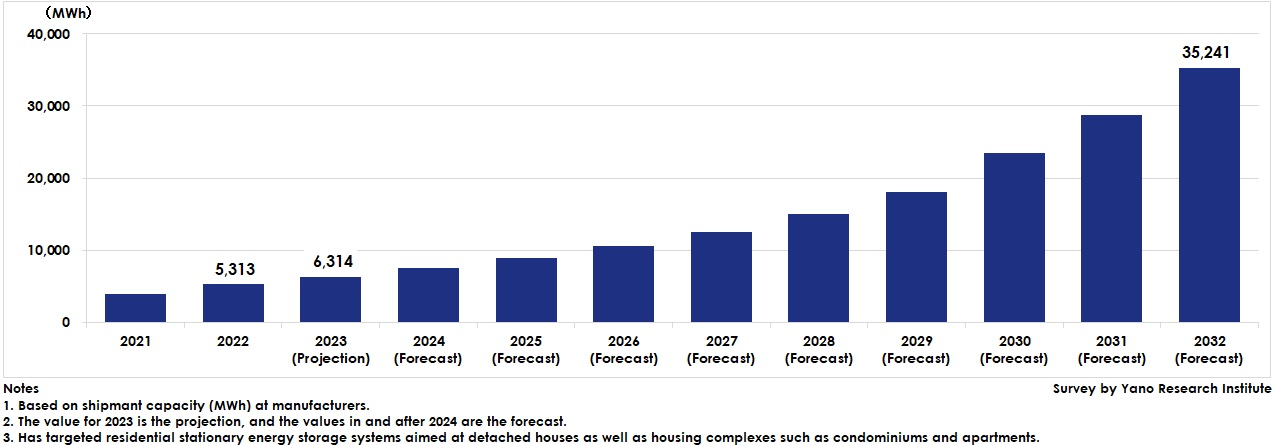

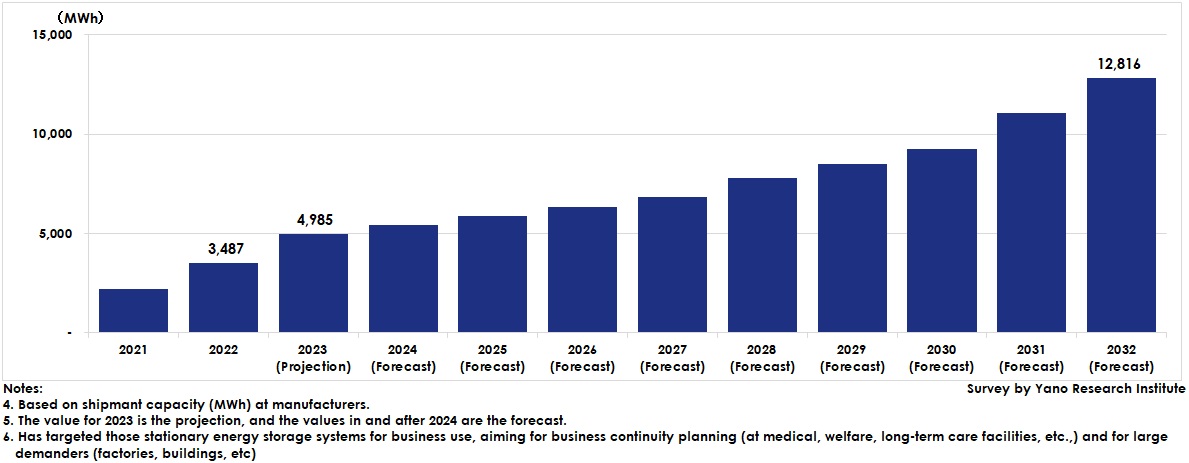

Global Residential and Corporate/Commercial ESS Respectively Expect 35.2GWh and 12.8GWh in 2032

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the global market of residential and corporate/commercial stationary energy storage systems (ESS) in 2024 and found out the market trends by installed location and by application, the trends by battery type, the trends of market players, and the future perspectives.

Market Overview

The estimated global stationary energy storage system (ESS) market size based on the shipment capacity at manufacturers was 5,313 MWh for home use and 3,487 MWh for business use or for enterprises in 2022. The year saw increased demand for electricity for cooling or warming because of extreme weathers caused mainly by global warming, and because of frequent blackouts in wide areas in the U.S. and other areas, which encouraged ESS deployment for emergency electricity sources and for business continuity planning (BCP) measures.

2023 expects the global ESS market to grow by 18.8% for home use at 6,314 MWh, and by 43.0% for corporate or business use at 4,985MWh. The market is expanding mainly in North America (especially the U.S.), Europe and China, backed by the financial support for ESS deployment by each government. In that year, energy prices have skyrocketed due to Ukraine situations and other reasons, causing the global electricity rates to soar. Aiming to alleviate the burden of paying electricity rates, demand for generating and consuming electricity at home is rising, which is driving the global energy storage systems market.

Noteworthy Topics

Lithium-ion Batteries Dominate the ESS Market Due to Overwhelming Superiority, With Adoption Rate Estimated to Exceed 90%

Lithium-ion battery is the mainstream to be adopted for residential ESS, but sometimes lead-acid batteries are chosen due to price and safety.

Redox flow batteries have the challenges in installation areas and cost, which make them remained at small-scale introductions. Sodium-based batteries are still in the development phase.

Demand is shifting from lead-acid batteries to lithium-ion batteries because the latter have higher energy density, longer life, larger capacity, and compactness, which is increasing the adoption rate. For residential ESS, the adoption rate of lithium-ion batteries expects to reach almost 100% after 2030.

For corporate/commercial ESS, lithium-ion batteries show the largest adoption rate, but introduction of lead-acid batteries, redox flow batteries, sodium-based batteries (sodium-sulfur [NAS], sodium-nickel chloride, sodium-ion batteries), and nickel-hydrogen batteries is underway, depending on the conditions of price, long life, large capacity, and high energy density. The adoption rate of lithium-ion batteries to corporate/commercial ESS for 2023 is likely to occupy 91.8%. As the cost for lithium-ion batteries reduces, the adoption rate is projected to rise to 94.4% in 2032.

Future Outlook

Residential ESS is highly demanded for emergency electric sources in case of disaster. Deployment of the system has been in progress in Japan, Europe, and North America where residences in the form of detached houses exist and where household electricity rates are expensive. The installation rate of photovoltaic power generation systems at households in these countries is not high at around 2 to 4% of an entire number of households, and the installation rate of residential ESS account for 10% or less of those households equipped with photovoltaic power systems. This indicates that there is room for residential ESS to grow more.

On the other hand, corporate/commercial ESS seems to need more time to spread when compared to residential or grid-scale systems. However, with demonstrative business being underway, the market expansion may be a matter of time, if a nation-level financial support is strengthened.

While corporate/commercial ESS has long had the challenge of profitability, a business model that can expect economic rationality has been built backed by battery price decline, which can increase deployment even at cost-sensitive commercial or industrial facilities.

At major countries, financial support for ESS deployment has been underway, reducing the burden on expenses. In addition, manufacturers of such systems are striving to improve performance by better materials and designs, and to reduce introduction costs, increasing the advantages of ESS deployment. The global ESS market size based on shipment capacity by manufacturers projects to reach 35,241 MWh for residential systems and 12,816MWh for corporate/business-use systems.

Research Outline

2.Research Object: DDomestic and overseas manufacturers of or related to ESS

3.Research Methogology: Face-to-face interviews (including online) by expert researchers and literature research

Residential or Corporate/Commercial Stationary Energy Storage Systems (ESS)

Residential ESS in this research refers to those used at detached houses or housing complexes such as condominiums and apartments. However, home-use lead-acid batteries that are used in developing countries and regions (such as parts of India and Africa) with fragile electric infrastructure are not included.

This research also targets those corporate or commercial ESS used at public facilities, office buildings (financial institutions, securities businesses, etc.,) medical/welfare/long-term care facilities, factories, logistics warehouses, commercial facilities (shopping malls, convenience stores, etc.,) aiming for emergency electric sources, business continuity planning (BCP) measures, and for large-scale electricity demanders.

ESS in this research refers to chemical energy storage system utilizing lithium-ion battery, lead storage battery, nickel hydrogen battery, redox flow (RF) battery, or sodium-based batteries (sodium-sulfur battery, sodium-nickel chloride battery, sodium-ion battery, sodium molten-salt battery, etc.)

*Reference:

Global Market of Grid-Scale Stationary Energy Storage Systems (ESS): Key Research Findings 2024

https://www.yanoresearch.com/en/press-release/show/press_id/3469

<Products and Services in the Market>

Residential or Business-Use Stationary Energy Storage Systems

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.