No.3779

Medical Imaging Systems and PACS Market in Japan: Key Research Findings 2024

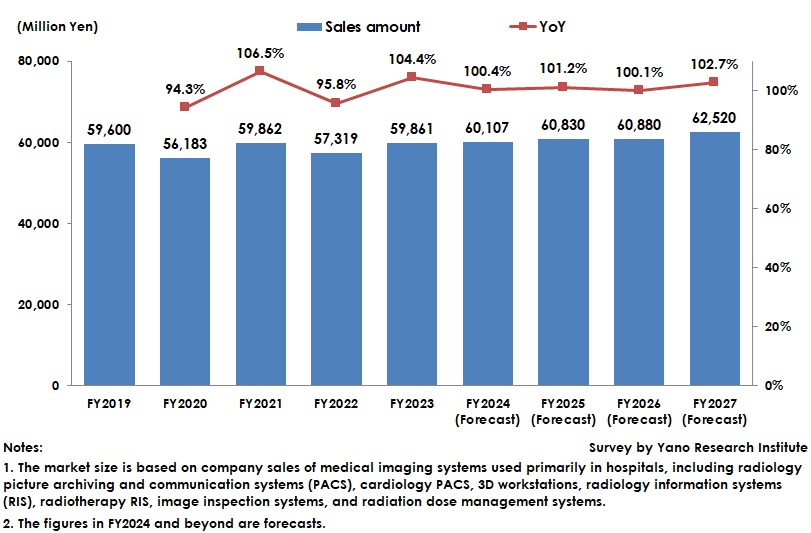

Medical Imaging Systems and PACS Market in Japan Increased by 4.4% YoY to 59,861 Million Yen in FY2023

Yano Research Institute (the President, Takashi Mizukoshi) surveyed the domestic medical imaging systems market and found out the market trend by segment, trend of market players, and market outlook.

Market Overview

This research, among medical imaging systems used primarily in hospitals, has surveyed and calculated the market size specifically for radiology picture archiving and communication systems (PACS), cardiology PACS, 3D workstations, radiology information systems (RIS), radiotherapy RIS, image quality assurance systems, and radiation dose management systems.

The market for radiology PACS, the core of medical imaging systems, has seen a shift in demand from new installations to replacement, and has continued to experience moderate negative growth. As peripheral systems such as RIS, radiotherapy RIS, image quality assurance system, etc. have also become a replacement market due to their full penetration, the overall PACS-related market is generally in a flat trend.

The market size of medical imaging systems (based on company sales) is estimated at 59,861 million yen, up 4.4% year on year. Specifically, while dose management systems have shown a tremendous decline, many other systems have increased by about 5% year on year. The market has experienced repeated ups and downs, with a significant decline immediately after the outbreak of the pandemic in 2020, an upturn in the aftermath, and a downturn from the upturn, but the impact of the pandemic is fading

Noteworthy Topics

Radiation Dose Management System Market Trend

Radiation dose management systems (DMS) are the systems that record and manage the radiation doses from X-ray equipment and help control the doses on a per-patient and per-inspection basis. In June 2018, the Study Group on the Appropriate Management of Medical Radiation issued a policy to make the recording and management of radiation doses and the related training of medical personnel mandatory for all medical facilities from April 2020, due to the need to control and record doses in radiology practice, where medical radiation doses are particularly high. This has expanded the facilities implementing DMS, not limited to those facilities that have gained the premium. The market for radiation DMS has been fully launched from 2018 to 2019, as new entrants from many companies such as medical imaging system manufacturers and modality manufacturers.

In such a situation, the DMS market maintained high growth rates from FY2018 to FY2020 but has been on the decline since FY2021.

As the replacement cycle of DMS is said to be five to seven years, just like other medical systems, the replacement cases are likely to pick up from around FY2025. There may be some changes in the market share of system vendors, as some vendors consider shifting the systems from other vendors to in-house.

Future Outlook

The market size of medical imaging systems is forecast to be around 60,000 million yen after FY2024. The reason for the flat market is the decreased influence of the pandemic and replacement occupies the market.

As the market struggles to gain market share by attracting new demand, the industry has undergone restructuring in recent years. In addition, increased costs due to inflation have made it difficult for manufacturers to pass on prices, making it harder to ensure profitability, which can lead to business exits and consolidations.

Many vendors of medical imaging systems have begun to offer AI services related to image diagnosis. Furthermore, PHR services, which allow a patient to access medical information including medical images within a hospital via a smartphone, etc., and other medical imaging solutions, such as digital camera image management, pathology image-related business, etc., are increasing and are expected to accelerate.

Research Outline

2.Research Object: Domestic manufacturers of PACS and devices, and distributors of imported products of such systems

3.Research Methogology: Face-to-face interviews (including online) by expert researchers and survey via telephone

The Medical Imaging Systems Market

This research has calculated the market size of medical imaging systems used primarily in hospitals, including radiology picture archiving and communication systems (PACS), cardiology PACS, 3D workstations, radiology information systems (RIS), radiotherapy RIS, image inspection systems, and radiation dose management systems.

<Products and Services in the Market>

Radiology picture archiving and communication systems (PACS), cardiology PACS, 3D workstations, radiology information systems (RIS), radiotherapy RIS, image quality assurance systems, and radiation dose management systems

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.