No.2982

Monthly Subscription Community Platform Service Market in Japan: Key Research Findings 2022

Expansion Trend Expected for Monthly Subscription Community Platform Service Market Due to Growing Demand for Closed Online Community and Increase of Content Creators Utilizing Online Space during the Pandemic

Yano Research Institute (the President, Takashi Mizukoshi) has carried out the research on the domestic market of monthly subscription community platform service, and found out the trend of each platform, the number of paid online communities, the number of paid users, future perspectives, and challenges.

Market Overview

In accordance with the diversification of hobbies, tastes, and work styles, use of online community platform service as a new place to meet and connect with people with similar values is increasing in Japan. In addition, while the owner of traditional fan club had been limited to a few celebrities and sports teams due to high cost of building and managing such clubs, online community platform services made it much easier for anyone to establish and run their own fan club.

Because of the growing need, new market players increased around 2019. As networking through social media became a norm for anyone anywhere, closed online platforms have attracted hardcore fans and people with commonalities to use as a community space with smaller risks, compared to the risks associated with the Internet. Awareness for the online communities increased further as influencers and celebrities that have power over a huge audience on Internet have opened their online communities.

Due to the COVID-19 restrictions on musicians’ and pop idol groups’ live performances, creator events (anime/manga sales events), and sporting events, performers and creators have shifted their activities online from 2020. Meanwhile, they had to go through burdensome processes not only in building the online communities, but also in management such as user list management and checking payments using settlement systems.

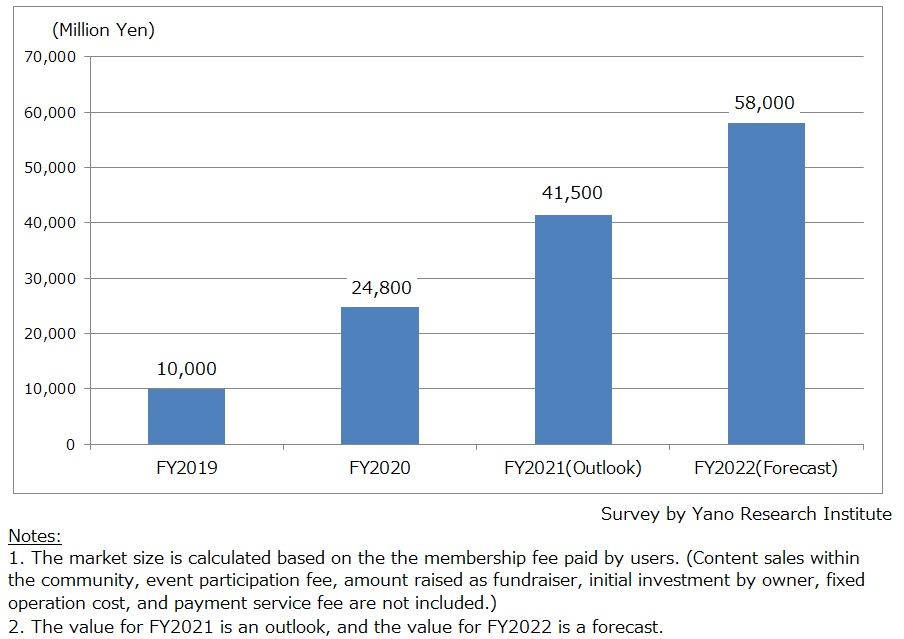

As all-in-one platform for managing online community become widely available, it enabled celebrities and content creators to concentrate on their show biz activities and/or creative activities. The situation has contributed to the increase of members (paid users) to sign up for online communities. Under the circumstances, the monthly subscription community platform services market for FY2020 is estimated to 24,800 million yen (based on the membership fee paid by users), and it is projected to jump by 67.3% from the preceding fiscal year to 41,500 million yen for FY2021.

Noteworthy Topics

Usage Rates and Brand Awareness of Monthly Subscription Community Platforms

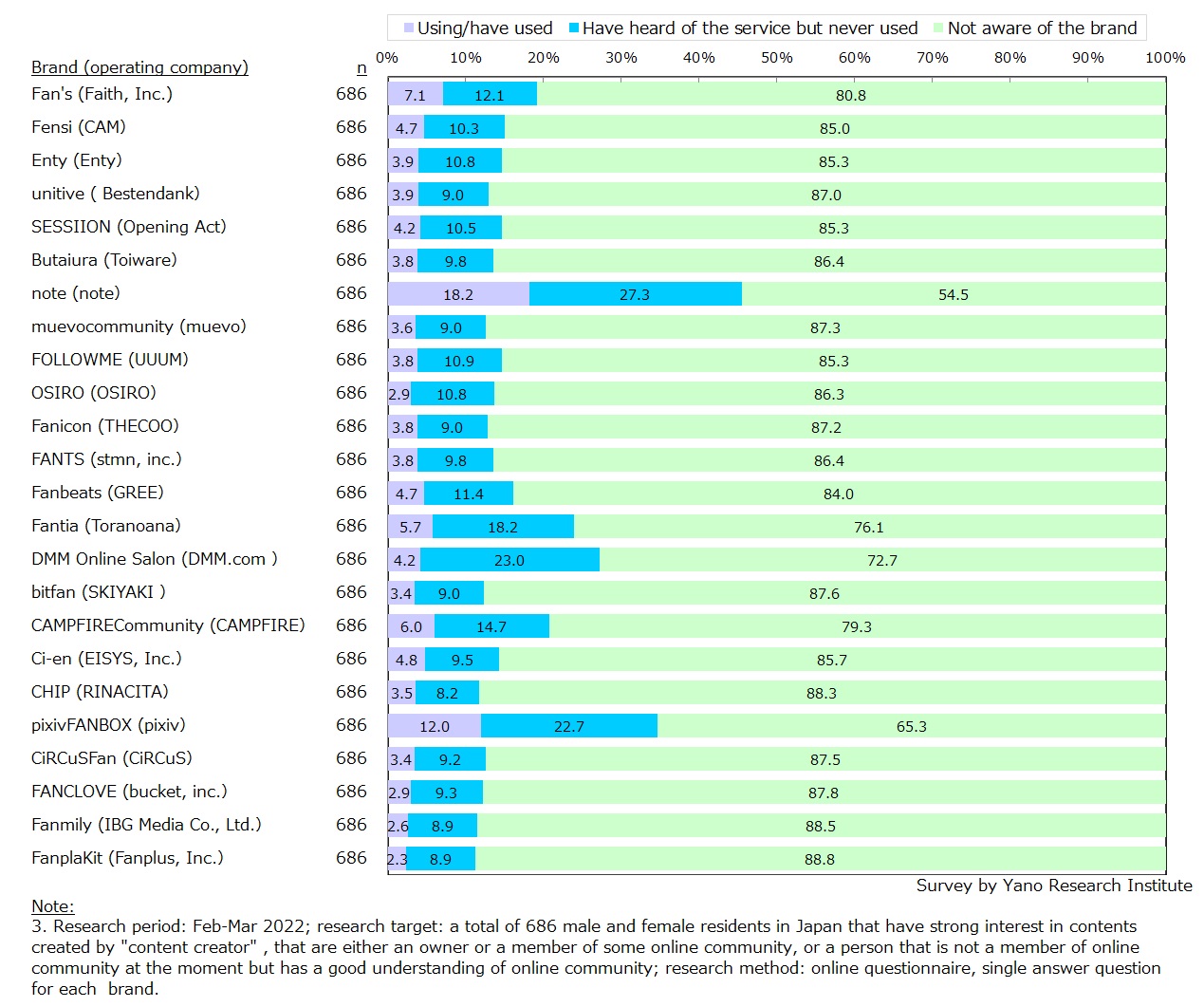

In this research, an online questionnaire targeting to persons that have strong interest in contents created by contents creators was carried out from February to March 2022. Respondents were 686 persons that are owners/members of some online communities, or, someone that has a good understanding of online communities even if they are not currently an owner or a member of any. An objective of the questionnaire was to find out the usage rates and brand awareness of monthly subscription community platforms.

Viewing at community platform brands (service names) by usage rate, the top platform is “note”, used by 18.2% of the respondents, followed by “pixivFANBOX“, “Fan’s”, “CAMPFIRE Community”, and “Fantia”, with usage rates 12.0%, 7.1%, 6.0%, and 5.7%, respectively.

To compare the brands wholly by adding the percentages of usage rate and brand awareness, “note”, the number one brand, totaled to 45.5 percentage points (usage rate 18.2%, brand awareness 27.3%). The second brand “pixivFANBOX“ was 34.7 percentage points (usage rate 12%, brand awareness 22.7%), followed by “DMM Online Salon” which added up the percentage points to 27.2 (usage rate 4.2%, brand awareness 23.0%). Fourth in line was “Fantia”, with 23.9 percentage points (usage rate 5.7%, brand awareness 18.2%), and the fifth was “CAMPFIRE Community”, with 20.7 percentage points (usage rate 6.0%, brand awareness 14.7%). It revealed that while the top five brands exceed 20 percentage points, rest of the brands remained between 10 to 20 percentage points.

The result shows that “notes” is unrivaled in the monthly subscription community platform industry, where “pixivFANBOX” is next in line. Meanwhile, brands like “Fan’s”, “DMM Online Salon”, “Fantia”, and “CAMPFIRE Community” have achieved high brand awareness, yet by usage rate they are outdistanced by the top 2 brands. Other platforms are known by respondents to a certain degree, but their awareness rates are all stagnated at around 10%.

Future Outlook

The monthly subscription community platform services market for FY2022 is forecasted to rise by 39.8% year on year to 58,000 million yen (based on the membership fee paid by users). The market is projected to expand with continued increase in both the number of paid communities and the number of paid users. As was seen in FY2021, new players are expected to enter the market in FY2022, too, although the momentum may be lost compared to the time between FY2019 and FY2020.

Increasing the number of online communities and member sign ups are critical for the business of platform service providers. The providers devoted in acquisition of new community owners and new members (paid users) pitch to influencers in social media that can drive fans to sign up for communities, as well as to prospective community owners that are likely to engage with fans steadily. Moreover, they reinforce support for owner applicants that wish to build their online communities. As many community owners tend to get exhausted in developing and delivering contents favored by their fans after a while, it became necessary for the community platform service providers to help them come up with contents that constantly interest their community users. Some service providers are organizing meetup events to showcase best practices and promote networking among owners to keep them motivated.

From the viewpoint of the functionality of community platforms, most of the platforms have been improved during the COVID-19 crisis as online communities grew into a mainstream of fan community activities. The enhancements made platform providers difficult to differentiate themselves from others by functionality. Nonetheless, as more than 2 years has passed since the first outbreak of the COVID-19 infection, increasing number of users are craving for ‘real’ communication and events; offline activities are expected to gain momentum.

Therefore, it is important for the platform service providers to empower community owners to continue their activities freely by brushing up their services continually, both customer support-wise and system-wise.

Research Outline

2.Research Object: Service providers of monthly subscription community platform, businesses and associations related to the industry

3.Research Methogology: Face-to-face interviews by the specialized researchers (including online interviews), survey by telephone and email, online questionnaire, and literature research

<What is the Monthly Subscription Community Platform Service?>

The monthly subscription community platform service in this research refers to the fan community business that offer online platform as a subscription service, which is relatively easy to use for anyone to create a fan community like a fan club or an online community.

<What is the Monthly Subscription Community Platform Service Market?>

In this research, size of the monthly subscription community platform service market is calculated based on the membership fee paid by users. It does not include the sales of contents within the community, event participation fee, amount raised as fundraiser, initial investment by owner (creator/leader that builds the community), fixed operation cost, and payment service fee.

It includes all kinds of online community platform services regardless of payment type (for instance, the membership fee may be annual, semi-annual, or quarterly), as long as they are subscription-based. The communities without paid plans (offered for free only) are excluded.

<Products and Services in the Market>

Paid online communities using monthly subscription community platform services

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.