No.2418

Solo Consumer Markets in Japan: Key Research Findings 2020

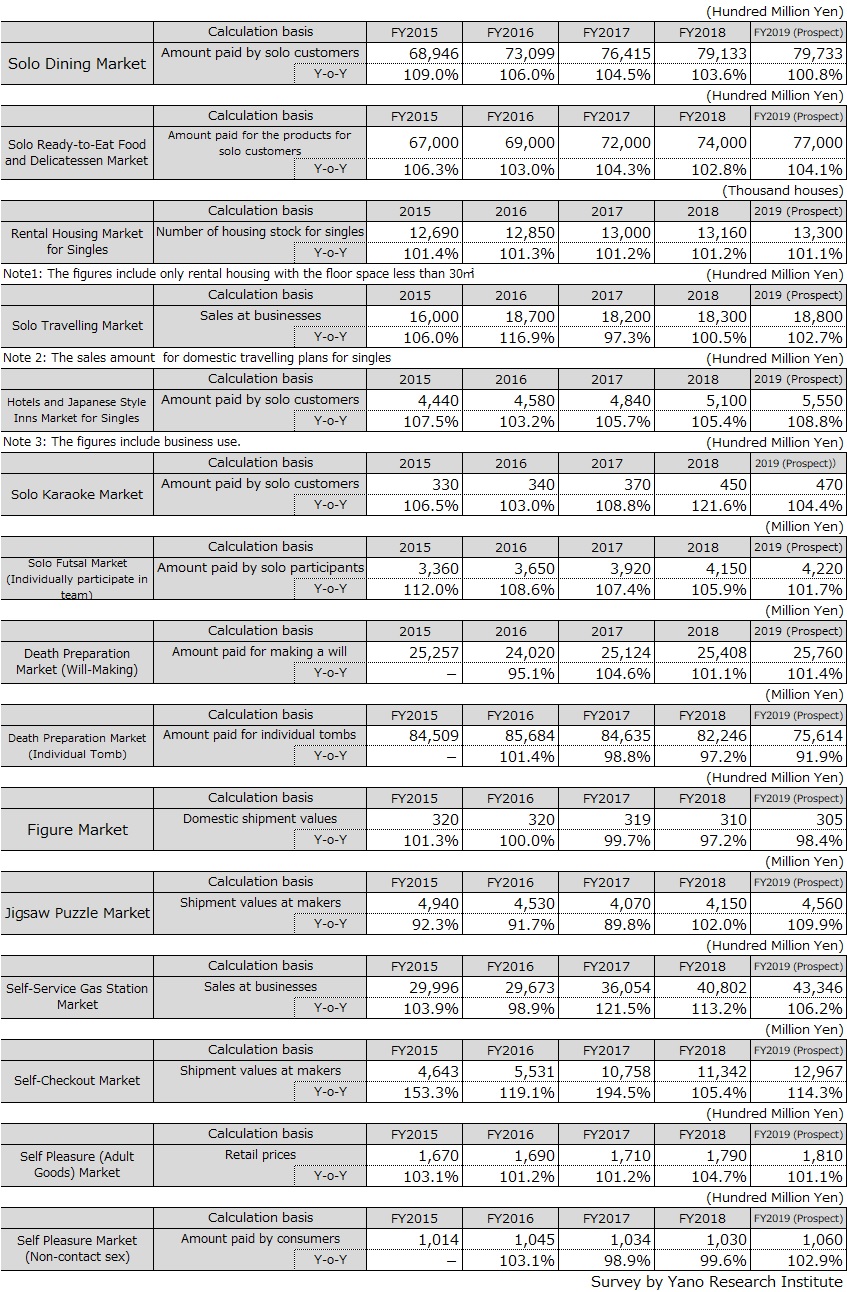

13 out of 15 Categories in Solo Consumer Markets Projected to Grow in 2019

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey on the domestic solo consumer markets (15 categories in 13 markets) and found out the respective market trends, the trends of market players, and future perspectives.

Market Overview

In Japan, not only single people and single households are increasing, but also more people have started acting and consuming all by themselves due to changes in lifestyles and diversified likings and hobbies. As a result, many industries have been invigorated by solo consumers that are gradually expanding the influence to the whole economy. This is the survey report of the 13 solo consumer markets consisting of 15 categories.

In (FY) 2018, of the 15 categories, 12 have exceeded the previous (fiscal) year. Especially, those with large amount involved were: Solo dining market (based on the amount paid by solo customers) showing 3.6% of rise on Y-o-Y to reach 7,913.3 billion yen; and solo ready-to-eat food and delicatessen (based on the amount paid for the products for solo) up by 2.8% on Y-o-Y to achieve 7,400 billion yen. The remarkable growth was seen for solo karaoke (the market size based on the amount paid by solo customers) with an increase of 21.6% to attain 45 billion yen.

Noteworthy Topics

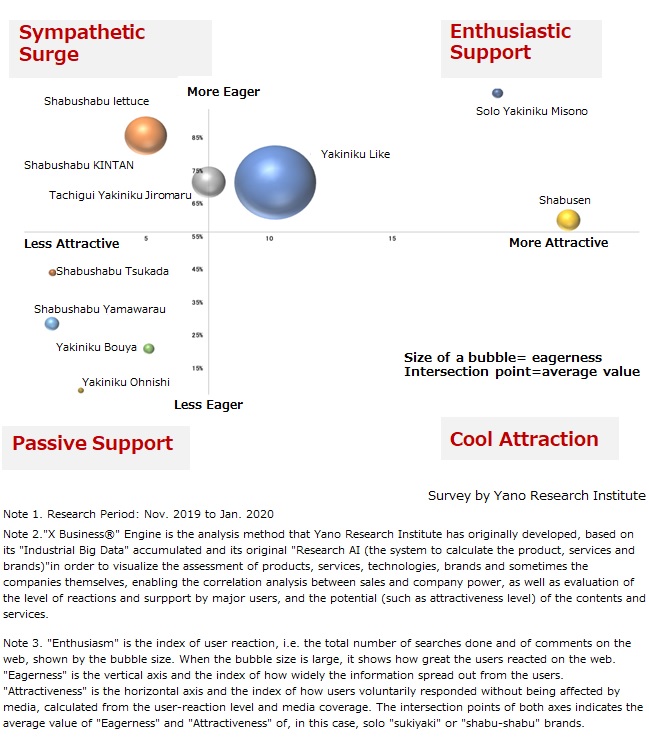

Comparison among Solo Yakiniku and Solo Shabushabu Restaurants by Using "X Business®" Engine

Figure 1 shows major solo shabushabu and solo yakiniku (Korean BBQ) restaurants analyzed through “X Business ®” Engine, an analysis method that Yano Research Institute has originally developed (the research took place during the three months from November 2019 to January 2020).

As a result of the research, the restaurant “Yakiniku Like” acquired the highest enthusiasm, shown by the largest bubble, calculated based on the total volume of online research and user remarks. Those that obtained high scores both in attractiveness and eagerness were the following three brands, i.e., “Yakiniku Like,” “Shabusen,” and “Solo Yakiniku Misono.” While attractiveness can be an index of how strong impact was generated by a single media exposure, eagerness is shown by the secondary information sharing among people interested in the brands. “Solo Yakiniku Misono” earned low “eagerness (on the web)” but a single media exposure seems to have caused some level of sensation which then led to vigorous secondary information sharing among large number of consumers.

Future Outlook

Of the 15 categories in the solo consumer market, 13 categories are likely to grow during (FY) 2019. When observing the prospective growth rate, the self-checkout market is expected to attain double-digit growth of 14.3% to attain 12,967 million yen, whereas negative growth is likely to continue for the market of individual tombs for death preparation and the figure market.

The double digit growth in the self-checkout market stems from increasing demand for large-scale replacement (upgrading) at major retailers. Meanwhile, although demand for individual tombs is likely to keep expanding, lower-cost burial method has attracted more attention and generated large demand, bringing down the individual tomb market to negative growth. The model figure market is also expected to be on the decrease, because of lack of popular contents to boost the market.

The entire market of solo consumers is on the rise for the time being, due to growing numbers of single households caused by increase of unmarried or non-married people and also of the aged. In addition, the services for solos in every industry are expanding, together with those services for single person to share the time with people with the same hobbies and taste. Also, there is a rising tendency of going solo or consume for one’s own sake among people who are not necessarily the single households or living alone. Therefore the entire solo-consumer market is likely to expand from hereon.

Research Outline

2.Research Object: Market players and organizations that have to do with the 13 singles-related markets consisting of 15 categories

3.Research Methogology: Face-to-face interviews by the specialized researchers, interviews via telephone, online questionnaire, and literature research

The Solo Consumer Market

The word “Singles” and “solo” have various meanings which not only includes single households and unmarried or non-married people, but also the people who care for doing and consuming things alone due to diversifying lifestyles, hobbies and preferences. Also, self-servicing area, in a broad sense, is included in the market.

The the 13 solo consumer markets consisting of 15 categories in this research indicate the followings: solo dining, solo ready-to-eat food and delicatessen, rental housing for singles, solo domestic travelling plans, domestic hotels and Japanese style inns for singles, solo karaoke, solo futsal (individually participates in a team), death preparation (will-making, individual tombs), figures, jigsaw puzzles, self-service gas stations, self-checkout, and self-pleasure (adult goods, non-contact sex (image or video provision business).

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.