No.3343

POCT Market in Japan: Key Research Findings 2023

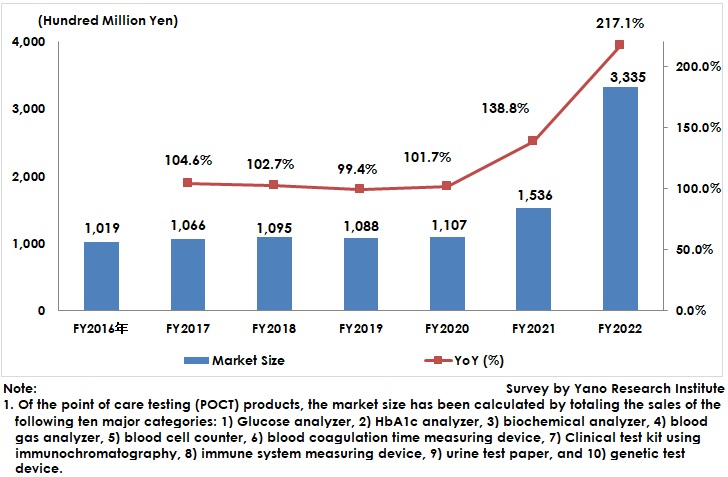

POCT Market for FY2022 Rose to 333,500 Million Yen, 217.1% of Previous Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the domestic point-of-care testing (POCT) market and has found out the market size, the trend of market players, and future perspectives.

Market Overview

1.市場概況

The domestic point-of-care testing (POCT) market size (total 10 major categories) expanded to 333,500 million yen, 217.1% of the size of the previous fiscal year.

After FY2020, many companies released rapid antigen test kits for COVID-19 that use immunochromatography and expanded the sales. These test kits were developed for testing at medical institutions, but upsurge of feverish outpatient care at medical facilities since 2022 encouraged these kits to be recommended for self-testing at home. In addition, municipalities waged to secure a significant volume of the test kits.

While COVID-19 rapid antigen test kits were used numerously for self-checking at home rather than at medical institutions, extracorporeal diagnostic agents with the similar-level quality were widespread as a product, which has been regarded as an inclusion of the POCT market in this research.

Noteworthy Topics

Foreign Companies and New Market Entrants Enhanced Sales of COVID-19 Rapid Antigen Test Kits Geared to Municipalities

Expansion of COVID-19 infections in 2022 caused the demand for securing COVID-19 rapid antigen test kits to surge particularly at municipalities. These domestic test kits, mainly sold to medical institutions, however, became obviously short of supplies against the entire number of those infected. This encouraged foreign affiliate companies or new market entrants with advanced abilities in procuring products from overseas to provide COVID-19 rapid antigen test kits to wider range of fields.

The market share for sharply grown COVID-19 rapid antigen test kits by manufacturer sales for FY2022 dramatically changed from that until 2021, with foreign companies and new market entrants dominating the market.

Future Outlook

In May 2023, as COVID-19 has been downgraded to “Class 5,” the same category as common infectious diseases such as seasonal influenza, according to the Infectious Disease Law, the demand for COVID-19 rapid antigen test kits is showing some changes. While the test kit storage demand by municipality budgets, which has been said as special demand in FY2022, is shrinking, the number of the test kits geared to medical institutions in which they are directly applied to patients is on the rise. The COVID-19 rapid antigen test kit demand to be used at medical institutions is regarded to remain at a certain level.

Nevertheless, those kits are already facing excessive market entrants, bringing about product price competitions. While the POCT market has grown by depending on COVID-19 testing in FY2021 and FY2022, the market expansion is likely to stop a while after FY2023. In such a situation, rapid testing kits for the CoV-flu combination to prepare for simultaneous spread of both the corona and influenza viruses are projected to be the significant item to support the future POCT market.

Research Outline

2.Research Object: Companies developing clinical reagents and devices (Japanese companies as well as Japanese subsidiaries of overseas companies)

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, surveys via telephone and email

About POCT Market

POCT (Point-of-care testing) is the laboratory tests (such as on blood, urine, feces, tissues, etc.) carried out by medical institutions not at a central laboratory of a hospital or external testing centers, but the rapid testing conducted close to the patient by the medical staff.

The POCT market size in this research has been calculated by totaling the sales of the following ten major categories at businesses: 1) Glucose analyzer, 2) HbA1c analyzer, 3) biochemical analyzer, 4) blood gas analyzer, 5) blood cell counter, 6) blood coagulation time measuring device, 7) Clinical test kit using immunochromatography, 8) immune system measuring device, 9) urine test paper, and 10) genetic test device.

The glucose analyzers do not include self-monitoring device for blood glucose.

<Products and Services in the Market>

Clinical reagents and devices including 1) Glucose analyzer, 2) HbA1c analyzer, 3) biochemical analyzer, 4) blood gas analyzer, 5) blood cell counter, 6) blood coagulation time measuring device, 7) Clinical test kit using immunochromatography, 8) immune system measuring device, 9) urine test paper, and 10) genetic test device.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.