No.3326

Automotive Aftermarket in Japan: Key Research Findings 2023

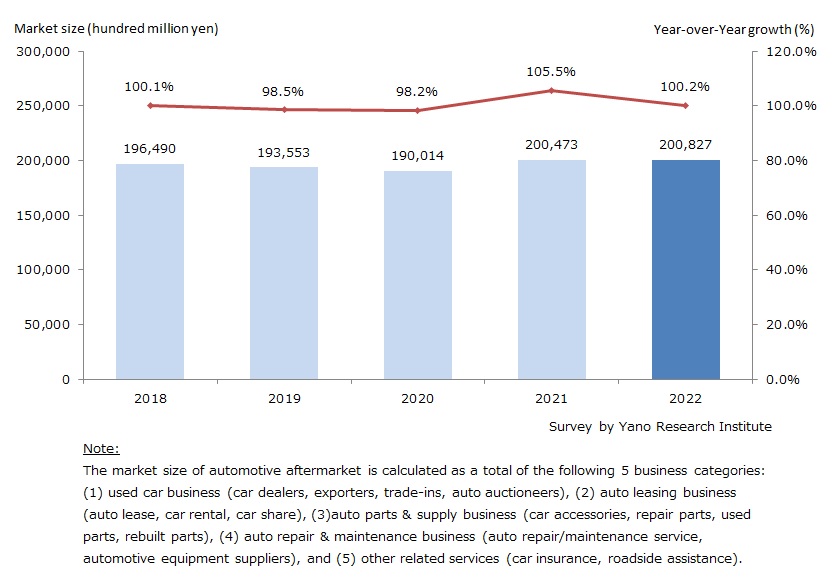

Automotive Aftermarket Valued at 20,082.7 Billion Yen in 2022

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic automotive aftermarket for 2022, and found out the trend by segment, the trends of market players, and future perspective.

Market Overview

Size of the automotive aftermarket for 2022 is estimated at 20,082.7 billion yen, 100.2% of the previous year. Retail sales of used cars fell considerably compared to the previous year.

Disruptions in the supply chain of semiconductors and other components that hobbled vehicle production led to a continuous decline of domestic new car sales, the starting point of the automotive aftermarket. While domestic car buyers remain reluctant to purchase new cars, the demand for used cars increased in and out of Japan. However, because the supply of used vehicles failed to keep up with robust demand, the price of used cars soared, affecting overall domestic sales.

The total number of four-wheel vehicles owned in 2022 deteriorated to 785,490,000 units*. (*Data source: Ministry of Land, Infrastructure, Transport and Tourism [MLIT]). Sales to consumers was hampered by the laggard production, which turned worse from the preceding year. Meanwhile, corporate sales also declined, by reason of enterprises slashing the number of company cars as a part of their cost cut, in conjunction with the penetration/promotion of telework. As a result, the increase was engulfed by the decrease

While the declines in new car sales and the number of four-wheeler vehicle owned in the domestic market imply a decline of the total automobile distribution, which is a denominator to gauge the automotive aftermarket, it does not necessarily represent demand decline for automotive aftermarket. Car buyers that have been priced out of the new-car market may have purchased used car or took their current vehicle to inspection or repair. Others may have turned to car sharing or car rentals. In other words, depending on the offerings, automotive aftermarket businesses can maintain or expand revenues. For this reason, it is increasingly important that the businesses in the automotive aftermarket comprehend customer needs and provide services at relevant timing.

Noteworthy Topics

Domestic Used Car Retail Sales Attained 3,640.2 Billion Yen

Demand for used cars expanded in 2022 as the stagnation in supply of new cars persisted. On the other hand, the price of used cars kept creeping up as serious shortage of used cars in the market intensified the procurement competition among domestic dealers and exporters. Because of the new car price hike, the supply shortage of new cars, fewer trade-ins of used cars, and surging global demand for used cars, the price of used cars exceeded the price of new cars for some popular models. The used-car market fell into a "bubble" (a condition described as frantic market-value inflation).

In addition, it is assumed that a certain number of consumers had been drawn back from purchasing used cars as they have been squeezed by the soaring cost of raw materials and energy due to Russia-Ukraine War, as well as the inflation of cost of living brought about by these factors.

As a result, the domestic sales of used cars declined from the preceding year by volume (although an average list price of used car in 2022 is estimated to have risen to 1,576,000 yen).

Export of used vehicles overseas were buoyed by the stagnant supply of new vehicles in other countries, growing demand for used Japanese cars. Boosted further by the depreciation of yen throughout the year, the export volume rose to 1,238,000 units*, 101.1% of the previous year. (*Data source: “Trade Statistics”, Ministry of Finance)

Since the volume and price of used cars generated in Japan are influenced by the trends of new car sales, as domestic new car sales recover and grow steadily it is likely to ease ‘overheating’ used car market.

Future Outlook

In 2022, continued supply chain disorder of vehicle parts such as semiconductors stagnated the production of new cars, resulting to low new car sales. The number of vehicles owned in Japan declined for two consecutive years*. (*Data source: MLIT)

However, on the flip side of stagnated new car sales, current car owners kept their cars, which increased the demand for car maintenance, such as repair parts and car inspection services. Amid the increases of inquiries in and out of Japan, auto auctions and export of used cars thrived against the back of weak yen. Moreover, easing of pandemic measures spurred the demand for car rental, car sharing, and roadside assistance services.

These situations show that threats can turn into opportunities. Not all segments indicate the same trend. It is important that each aftermarket businesses grasp customer needs and provide products and services right on point.

In addition, automotive aftermarket companies will be required to adapt to the transformation of the automotive industry toward electrification hereafter. While the global movement toward decarbonization is accelerating, automakers are increasingly embarking on achieving carbon neutrality through the electrification of vehicles.

As per new car sales, it is true that electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) are still minor compared to gasoline cars, and its secondary market is still unestablished. However, businesses that rely on revenue from gasoline cars (typically those selling engine oil and oil filters) are definitely at risk of losing sales due to the decrease of parts and difference in the type of powertrains.

As automobile manufacturers increasingly engage in electrification, adapting to electrification is imperative for the automotive aftermarket. Market players in the automotive aftermarket must allocate resources (human resources, funds for capital investment, etc.) for accumulating know-how while they can, to enjoy first-mover advantage and respond smoothly to changes in the market environment. At current, automotive aftermarket companies are still in the preparation phase, where they enhance competitiveness in existing business to increase resilience for upcoming challenges.

Research Outline

2.Research Object: Companies and groups in automotive aftermarket business and competent authorities

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone and email, and literature research

What is the Automotive Aftermarket?

Automotive aftermarket in this research indicates the following 5 businesses segments: (1) Used car business (car dealers, exporters, trade-ins, auto auctioneers), (2) auto leasing business (auto lease, car rental, car share), (3)auto parts & supply business (car accessories, repair parts, used parts, rebuilt parts), (4) auto repair & maintenance business (auto repair/maintenance service, automotive equipment suppliers), and (5) other related services (car insurance, roadside assistance).

The automotive aftermarket size is estimated by Yano Research Institute based on the publicized data.

<Products and Services in the Market>

New cars, used cars, used car export, auto auction, one-off bidding (nyu-satsu kai), auto lease, auto lease for individuals, lease maintenance, car financing, car rental, care share, car subscription, car supplies, tires, aluminum wheels, car stereos, GPS navigation systems, drive recorders (dashcams), car interior accessories, oils/solvents, genuine parts, JAPA recommended parts (JAPA: Japan Automotive Parts Association), repair parts, recycled parts, reused parts, rebuilt parts, car repair, vehicle inspection, periodic maintenance, auto collision repair, prepaid maintenance plans, car inspection equipment, car insurance, compulsory automobile liability insurance, voluntary insurance, direct non-life insurance, roadside assistance, gasoline, self-service fueling

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.