No.3314

Language Business Market in Japan: Key Research Findings 2023

Language Business Market (Total of 13 Major Categories) for FY2022 Declined Slightly by 0.8% to 780,600 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) performed a survey on the domestic language learning business (a total of 13 major submarkets), and found out the trends of market players, market trend by category, and future perspectives.

Market Overview

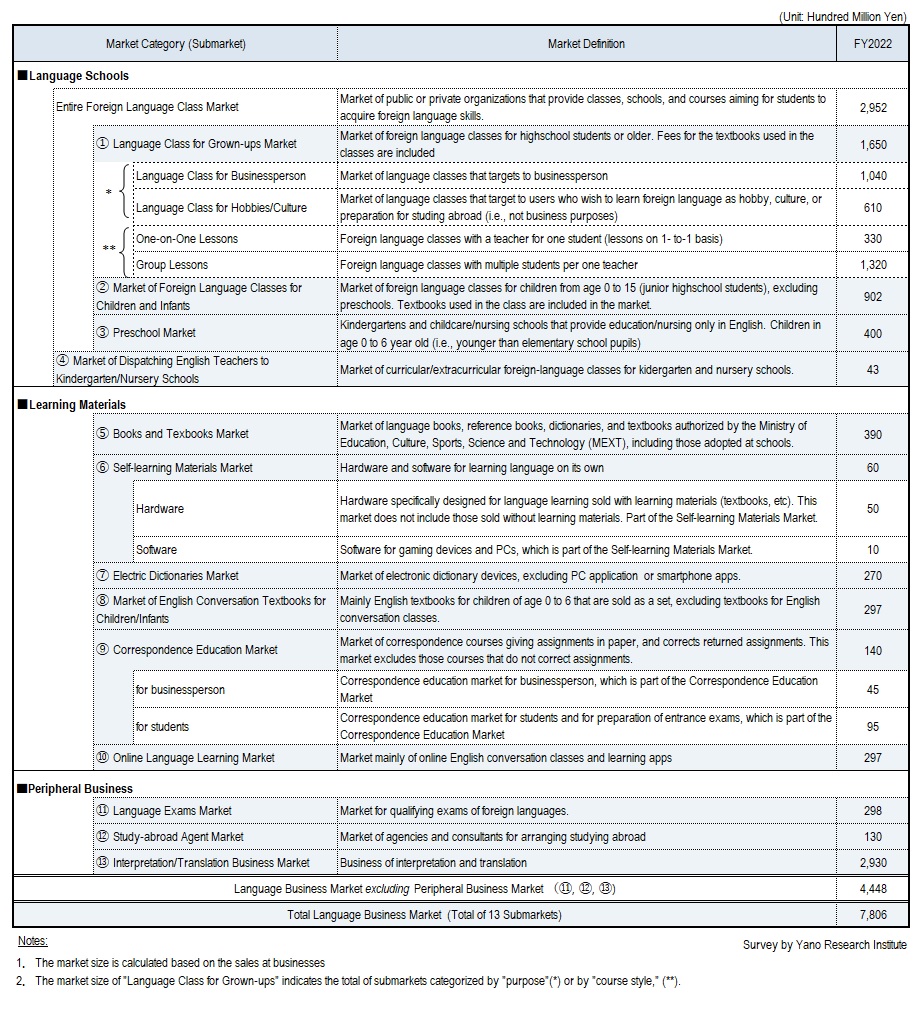

Language business market (total of 13 submarkets) declined slightly by 0.8% to 780,600 million yen for FY2022, based on the sales at businesses.

While COVID-19 crisis continued to boost the demand for online language learning courses, the 7 submarkets out of 13 submarkets showed decline in FY2022. In a meantime, the market of English language school for children indicated steady growth in reflection of the ease of activity restrictions that materialized the needs for starting English education at younger age, against the backdrop of ‘English Education Reform’ in 2020 (which mandated English teaching at elementary schools). In peripheral business market, contrary to the markets of study-abroad agents (consultants) and interpretation/translation business that showed signs of recovery from the steep drop led by the pandemic, the language exams market continued to fall.

Noteworthy Topics

Increase of Entrants to After-school English Programs Market

In the industry of language business for children, after-school English programs, mainly provided by private companies as English childcare service, is gathering attention. Various companies have entered the market, where the major programs are “Kids Duo” (by YARUKI Switch Group, which is known for its tutorial cram school businesses including ‘School IE’), “Kids Duo International”, and “KidsUP” (by P-UP World, a multi-industry company that operate in various industries, such as the phone shop ‘teluru’). The most recent market entry was “NOVA KIDS CLUB” by NOVA, the leading language school business company.

It is assumed that the offering of the after-school English programs is yet to penetrate nationwide. Most companies have their program available in metropolitan areas like Tokyo, Saitama, Kanagawa, and Osaka. While some companies are dedicated to this service, most market players already have their core in language business, such as English conversation classes or international preschool. There are also other services run by nursery businesses and clam school operators.

Future Outlook

Size of the language business market (total of 13 submarkets) for FY2023 is forecasted to grow by 4.0% on year-on-year basis to 811,900 million yen.

Associated with the termination of strict border measures and reclassification of COVID-19 to Category-5 disease conducted in FY2023, people that have tolerated with staying-home campaign during the pandemic are seemingly heading back to pre-pandemic lifestyle. It is speculated that the demand for English learning returns in tandem with the rise of the needs for overseas business trips and the demand for sightseeing travels. With the increase of businesspersons attending English conversation classes as well as students applying for study-abroad programs, the entire language business market is expected to recover steadily.

Research Outline

2.Research Object: Foreign-language school operators and organizations, distributors of language study materials, publishers, and other related businesses

3.Research Methogology: Face-to-face and online interviews by specialized researchers (including online interviews), surveys via telephone/email, and literature research

What is the Language Business Market?

The language business market in this research indicates the following 13 submarkets: 1) Foreign language classes for grown-ups, 2) Foreign language classes for children/infants, 3) Preschools, 4) Dispatching English teachers to kindergarten/day-care centers for children, 5) Textbooks, 6) Hardware/software for language self-learning, 7) Electronic dictionaries, 8)Textbooks of English conversation classes for children/infants, 9) Correspondence education, 10) Online learning classes, 11) Language exams, 12) Study-abroad agents (consultants), and 13) Interpretation/translation business. Each market size is calculated based on the sales at businesses.

The markets of 11), 12), and 13) are categorized as “Peripheral Businesses.”

<Products and Services in the Market>

Foreign language classes for grown-ups, Foreign language classes for children/infants, Preschools, Deployment of teachers to kindergarten/day-care centers for children, Textbooks, Hardware/software for self-learning, Electronic dictionaries, Textbooks of English conversation classes for children/infants, Correspondence education, Online learning classes, Language exams, Study-abroad agents (consultants), Interpretation/translation business

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.