No.3307

Children-Related Business Market in Japan: Key Research Findings 2023

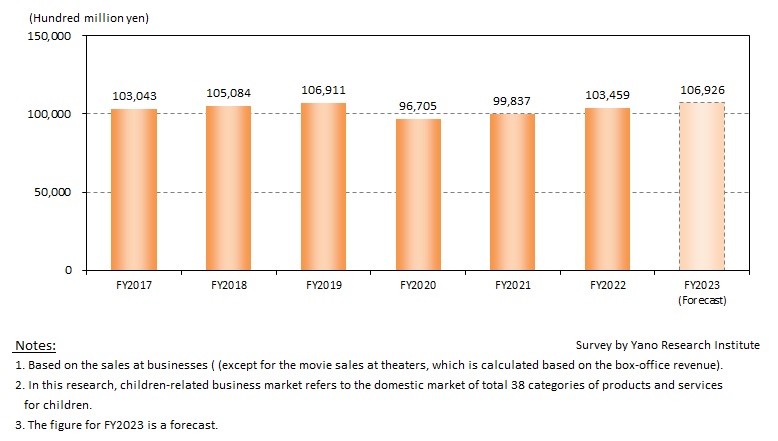

Children-related Business Market (Total 37 Categories) in FY2022 Grew to 10,345,900 Million Yen, Up 3.6% from Preceding Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic children-related business market and found out the market trends of children’s products and services by category, the trends of market players, and future perspective.

Market Overview

Size of the children-related business market for FY2022 is estimated at 10,345,900 million yen, up 3.6% from the previous fiscal year, based on the sales at businesses (except for movies at theaters, which is calculated based on the box-office revenue). Although the market plummeted by around 10% in FY2020 due to the Covid-19 crisis, in FY2022 sales turned for the better for many fields, showing growth at the level of preceding years. However, it is yet to recover to the pre-pandemic level (FY2019, 10,691,100 million yen). In fact, “food” and “childcare services” were the only categories that exceeded the sales of FY2019.

In comparison to FY2021, size of all six markets (i.e., amusement & leisure, educational services & products, foods, apparel, commodities & services for children, and childcare services) exceeded the preceding fiscal year. In particular, a rise of 12.7% from the previous fiscal year was witnessed for “amusement & leisure for children”, the market that showed the worst downfall by reason of the COVID-19 crisis.

Noteworthy Topics

Overview of Major 3 Categories in Children-related Business Market

Three categories that represent a major part of the children-related business market are “childcare services”, “educational services & products”, and “amusement & leisure”.

Of the “childcare services”, sluggishness is observed in its largest segment, “nursery schools”. The number of children on nursery waiting lists are decreasing across the country, due to the progress in increasing capacity (of existing nurseries or establishing new nurseries) in the last several years. Coupled with the declining birthrate and the decrease in the number of nursery enrollments, which led existing nurseries to run below capacity, growth of the childcare service market is slowing down. Meanwhile, “after-school care” segment is expanding as the number of children enrolled to the program as well as the number of privately-owned after school care facilities are rising. Considering the rising number of families with both parents working, while a number of students are already waitlisted, the demand for after-school care segment is poised to grow hereafter.

In the “educational services & products” market, “sports classes/sporting clubs for children” and “learning classes for children” have shown stable growth, recovering from the steep drop in FY2020. The market of “learning classes for children” is on recovery trend as the businesses have mostly come back to normality. Steady recovery of the “sports classes/sporting clubs for children” market stems from the reaffirmation of the importance of children’s physical fitness and sports. Concern for children’s lack of exercises and poorer athletic skills grew as the pandemic have taken away their opportunities for all kinds of physical activities, including going out (play outside), taking sports classes, and participating in learning schools, sporting clubs, and boy scouts. Meanwhile, the “cram school“ - the largest segment of this category - stayed at almost the same level as in the preceding fiscal year.

In view of the “amusement & leisure” market, “children’s & family movies shown in theaters”, “amusement parks/theme parks”, and “game arcades/gaming facilities” have been showing healthy growth from the droppage in FY2020, acting as a driver of the market recovery.

Future Outlook

As the government reclassified the novel coronavirus as Class 5 infectious disease, operation at much of the children-related businesses have gone back to normality, full-scale recovery is projected, especially in the leisure businesses. Even though the declining birthrate may affect demand unfavorably, with the price revisions in products and services, the market is expected to persevere, returning to the pre-pandemic level. In conclusion, the children-related business market for FY2023 is forecasted to rise by 3.4% from the previous fiscal year to reach 10,692,600 million yen.

Research Outline

2.Research Object: Businesses that provide services and products for children

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone/email, and literature research

What is the Children-related Business Market?

In this research, children-related business market refers to the domestic market of total 37 categories of products and services for children, based on the sales at businesses (except for the movie sales at theaters, which is calculated based on the box-office revenue). Age of children to whom the services and products are targeted to is between 0 and 15, though the range differs by category.

<Products and Services in the Market>

1. Amusement & leisure (toys, gaming consoles, children’s books, children’s & family DVDs/Blue-ray discs, kids’ bikes, children’s & family movies shown in theater, amusement parks/theme parks, game arcades/gaming facilities, indoor playgrounds) 2. Educational services and products (cram schools, private kindergartens, early childhood development classes [education & sports programs], English conversation classes for preschoolers/students, learning classes for children, sports classes/sporting clubs for children, correspondence courses for preschoolers/students, learning books/textbooks, kids’ stationeries, kids’ desks and chairs, school bags) 3. Foods (baby formula, baby foods, sweets for kids) 4. Children’s apparel (clothes, accessories, school uniforms, shoes) 5. Commodities and services for children (paper diapers, strollers, baby cot & comforters, child seats, studio photography for kids, mobile phones for children, safety/security goods & services for children) 6. Childcare services (nursery schools, after-school care)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.