No.2485

Global Power Semiconductors Market: Key Research Findings 2020

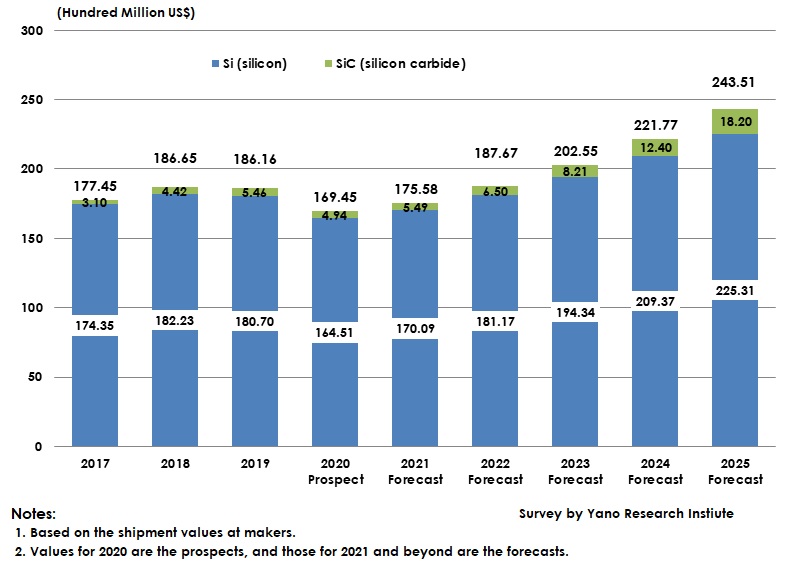

Global Power Semiconductors Market Expected to Recover in 2021 and Expand to US$24,351 Million by 2025

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of the global power semiconductors market to find out the current market conditions, trends of adoption, and business strategy at individual makers, and forecasted the global market size by 2025.

Market Overview

The global power semiconductors market size in 2019 based on the shipment values at makers declined by 0.3% from the previous year to generate US$18,616 million. The market size had expanded steadily, with the growth rate 12.2% on a year-to-year basis to attain US$17,745 million in 2017, and 5.2% on the same basis to achieve US$18,665 million in 2018. However, the demand slowed down in industrial machinery and automobiles, which diminished the global market size in 2019.

Affected by COVID-19 pandemics, the global power semiconductors market is likely to shrink in 2020 by 9.0% on a year-to-year basis, ending up with US$16,945 million. Nevertheless, the market size reduction by US$1,671 million of 2020 remained at almost half of at the time of the collapse of Leiman Brothers.

The four largest demand sectors of power semiconductors are telecommunications, consumer goods, industry and automobiles. Among the four, the largest decline in demand can be observed in automobiles, because the global number of new cars sold between 2018 and 2019 failed to attain the results of the preceding year. In addition, the pandemics forced the plants and factories of automakers to stop the operation in March and April of 2020. Therefore, the global market of power semiconductors for automobiles in 2020 is expected to decline by 18.4% from the previous year to generate US$3,526 million.

On the other hand, the demand for power semiconductors in telecommunications and consumer goods has remained relatively smaller reduction than in industry and automobiles, and is likely to continue making stable growth, due to intensive capital investment for data centers and 5G base stations.

Noteworthy Topics

Global SiC Power Semiconductors Market Reached US$546 Million in 2019, Boosted by Demand in xEVs

The global market of SiC (Silicon Carbide) power semiconductors in 2019 grew by 23.5% to reach US$ 546 million based on the shipment values at makers.

SiC power semiconductors are mainly utilized for servers at data centers, power conditioners in photovoltaic power generation, power source in industrial equipment, EV charging stations, and automobile on board chargers (OBC). Not only SiC-Schottky diodes but SiC-MOSFET (Metal Oxide Semiconductor Field Effect Transistors) is also eagerly used. However, as the demand sectors of “telecommunications” and “industry” slowed down after the latter half of 2019, the growth rate of SiC power semiconductors remained minimal.

On the other hand, SiC power semiconductors for automobiles have shown significant growth since 2018. SiC power semiconductors conventionally have been used only for OBCs for EVs due to high cost, but they have started being used for inverters that drives some EV motors, which expanded the market size in 2019 to more than twice as larger than the previous year. Since expected to be used for the inverters of high-end EVs that employ 800-V charging systems, the global SiC power semiconductors market size is projected to reach US$1,820 million by 2025, driven by the demand in EV inverters.

Future Outlook

Although the global power semiconductor market in 2020 is likely to be affected by COVID-19 pandemics, it is projected to upturn in some demand sectors by 2021 and to exceed the market size of 2019 by 2022. With CAGR from 2019 to 2025 expected to be 4.6%, the global power semiconductor market size based on shipment values at makers is projected to achieve US$ 24,351 million by 2025.

Especially, the demand sector of telecommunications is expected to be on the rise as capital investment to data centers and 5G base stations increases in 2021 and on. 5G base stations require more MOSFET and diodes than 4G base stations by several times in sum of money. Therefore, permeation of 5G is considered to boost the entire power semiconductor market. The demand sectors of consumer goods and industry are also projected to recover by 2022 and turn for stable growth by 2023. On the other hand, recovery of the automobile sector is likely to delay. It is because unlike in Japan and China where the number of new cars sold is projected to recover relatively fast, the early recovery in other countries and regions cannot be expected. Therefore, the demand for power semiconductors in automobiles is forecasted to grow only slightly.

Research Outline

2.Research Object: Manufacturers of power semiconductor devices, wafers, and systems

3.Research Methogology: Face-to-face interviews by the specialized researchers, telephone/email surveys, and literature research

The Power Semiconductors Market

Power semiconductors are mainly used in inverters/converter circuits needed for switching, converting and controlling of electricity, and for supplying electricity to motors.

The power semiconductors market in this research includes those using MOSFET (Metal Oxide Semiconductor Field Effect Transistors) /IPD (Intelligent Power Devices) or diodes, IGBT (Insulated Gate Bipolar Transistors), power modules, bipolar transistors, and SiC.

<Products and Services in the Market>

MOSFET (Metal Oxide Semiconductor Field Effect Transistors), IPD (Intelligent Power Devices), diodes, IGBT (Insulated Gate Bipolar Transistors), power modules, bipolar transistors, SiC/GaN, power semiconductor

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.