No.2354

InsurTech Market in Japan: Key Research Findings 2019

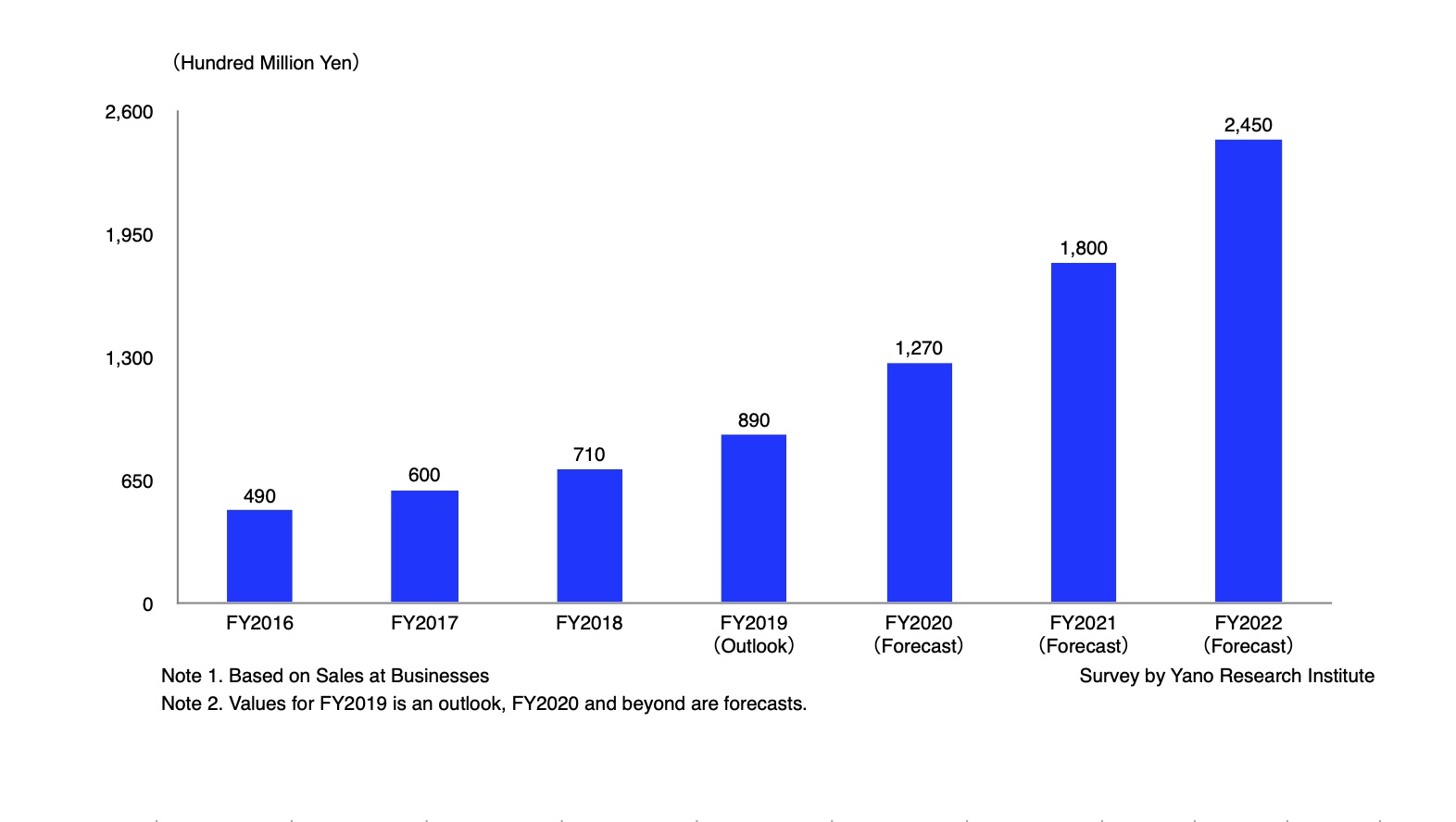

Domestic InsurTech Market in FY2019 is Projected to Attain 89,000 Million Yen, 125% of the Preceding Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the InsurTech market in Japan in the field of life insurance, and found out the current situation, the trend by field, and the future perspectives.

Market Overview

Domestic InsurTech market in FY2019 is projected to reach 89,000 million yen (based on the sales at business operators). Adoption of AI (Artificial Intelligence) technology is expanding particularly in the field of insurance/benefit payment such as: conventional claim examination process including fraud detection; underwriting; insurance product development; and sales activities by insurance agents. In addition, the life insurance companies are actively collecting customer data for development of health-promoting insurance (*1) and disease management program(*2).

As to the legislation, the Insurance Business Law was revised at first, including the deregulation on investment to InsurTech. Moreover, the “Comprehensive Guidelines for Supervision of Insurance Companies (FSA)” was partly amended to indicate a policy that ensures transparency and efficiency in the authorization of insurance products related to InsurTech. Furthermore, as the “Regulatory Sandbox” (*3) began, the framework has been contributing to bring on new insurance products.

In terms of support environment, the number of events held for InsurTech is still limited compared to FinTech, although related events have been promoted since late 2017 not only by the insurance companies and system integrators, but also by multiple supporting organizations. Establishment and expansion of the support environment is expected to continue further.

With regard to the technical environment, the life insurance operators, especially major ones, are actively showing their interests toward adopting cloud services. In the background is the cloud service vendors, leading companies in particular, proceeding compliance to the Security Guidelines on Computer Systems for Financial Institutions by FISC (Financial Information System Center). The movement is lowering hurdles for the life insurance companies to deploy cloud services.

Noteworthy Topics

Emerging Trend: Providing Total Support from Health-Promotion to Disease Management Program

To date, health-promoting insurance products have been an additional service for the existing insurance products, primarily provided by domestic leading life insurance companies that partners with startups. Meanwhile, disease management program that intends to prevent aggravation of diabetes etc., (*4) and recurrence of heart attack has been promoted by insurance companies, mainly foreign life insurance operators, through collaborations with startups.

However, from 2019, foreign life insurance companies are starting to deliver services increasingly in the field of health-promoting insurance. Meanwhile, in the field of disease management program, some domestic life insurance companies are making attempts to develop services for preventing aggravation of diabetes using smartphone applications by InsurTech startups. It can be said that providing total support from health promotion to disease management program is becoming a trend. In the future, these types of insurance products will become fundamental for all life insurance companies, domestic and international.

Future Outlook

Domestic InsurTech Market is Projected to Reach 245,000 Million Yen by FY2022.

As the application of AI and RPA (RoboticProcess Automation) expands, it is likely that the utilization of such advanced technologies will extend to the field of insurance product development and insurance sales (streamlining) in addition to the current fields such as insurance/benefit payment and underwriting.

Moreover, as the use of cloud service is getting underway, permeation of cloud migration may lead to heated discussion on exposure of API in the life insurance industry hereafter. Since the system configuration is getting more complex every year at the life insurers, especially the major companies, restructuring/renovation on their system configuration are required for API exposure. Thus, the exploitation of cloud is anticipated to increase over time from FY2022.

For the insurance products, it is assumed that more efforts will be made to support policyholders extensively from health promotion to disease management. With this regard, the entire domestic market of InsurTech in life insurance field is expected to rise hereafter.

(*1) Health-promoting insurance is, unlike conventional insurance that sets premiums based on actual age, a type of insurance product that allows premiums to fluctuate depending on health check results, lifelog data, policyholder’s health condition, and level of efforts made for health improvements.

(*2) Disease Management Program is an attempt of integrated support for policyholders, from provision of awareness raising programs to health promotion, referral to relevant medical institutions when problem is found, and benefit payments.

(*3) “Regulatory Sandbox” is a framework that temporarily suspends application of the current law in order to facilitate incubation of innovative businesses and services; business operators are to submit application to the statutory agency, consult with them, and execute the business tentatively.

(*4) Program for preventing aggravation is an agenda for patients of disorders with high recurrence rates, such as strokes and heart attacks, to prevent another relapse after recovery by surgery etc.

Research Outline

2.Research Object: Domestic insurance companies, small amount and short-term insurance companies, system integrators, InsurTech startups, etc.

3.Research Methogology: Face-to-face interviews by the expert researchers, surveys by telephone/email, and literature research

InsurTech Market in Japan

InsurTech is a coined term from “Insurance” and “Technology”. It refers to insurance-related services that exploits IT technologies for new insurance products/services incumbent insurance companies could not provide, and for streamlining/sophisticating their business operations.

In this research, InsurTech is classified into 8 fields: “Development of personalized (health-promoting) insurance products/services” , “Disease management system”, “Insurance consultation / Insurance sales support service using AI”, “Automation of underwriting with AI”, “Tracking from recommendation of health check to detailed examination on to treatments upon finding problems”, “After service for policyholders and their families”, “Solutions for automation of claim examination”, and “Services related to infrastructure (API/blockchain*).

This paper focuses on vendors and startups that support the development of new insurance products/services formerly not provided by the life insurance companies and streamline/sophisticate their business operations. Size of the domestic InsurTech market is calculated based on the sales at these business operators.

*Blockchain is a technology used in a cluster of computers networked P2P (peer-to-peer) to record and authorize data on transactions such as ownership transfer.

<Products and Services in the Market>

“Development of personalized (health-promoting) insurance products/services” , “Disease management system”, “Insurance consultation/insurance sales support service using AI”, “Automation of underwriting with AI”, “Tracking from recommendation of health check to detailed examination on to treatment upon finding problems”, “After service for policyholders and their families”, “Solutions for automation of claim examination”, “Services related to infrastructure (API/blockchain)”.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.