No.2283

ERAB (Energy Resource Aggregation Business) Market in Japan: Key Research Findings 2019

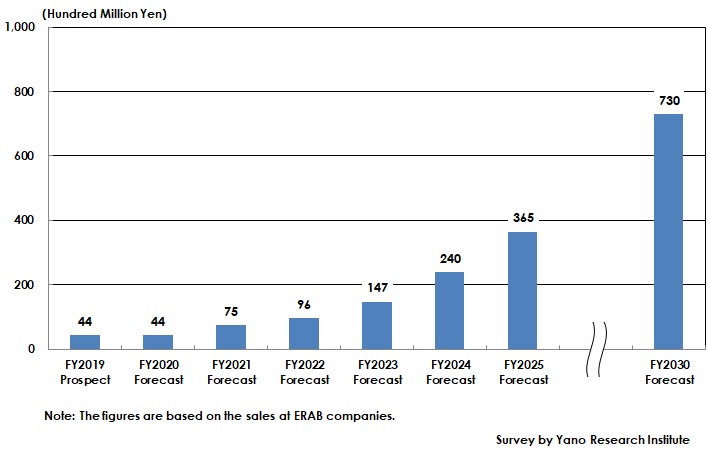

ERAB (Energy Resource Aggregation Business) Market Size Expecting to Attain 73.0 Billion Yen by FY2030

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic ERAB market for FY2019 and has found out the characteristics of energy resources, the trends of market players, and the future outlook.

Market Overview

First of all, electric power companies basically have the policy of supplying exactly the same volume of electricity demanded at the demanders every moment of time. Electric power companies are liable for stable power supply, because the quality of electricity deteriorates and the electrical grid becomes instable if the supply and demand does not coincide. Conventionally, power suppliers had to prepare for excess electricity just in case of an excessive demand. In recent years, however, a new idea has become pervasive, which is to consider the excess electricity or saved electricity at demanders as the “power generated.” This made power suppliers easier to control or restrain using of energy by granting incentives or by concluding power restraint contracts. DR (demand response) is the reaction (power saving) by demanders for DSR (demand side resources) as a result of such incentives and contracts, while VPP (virtual power plants) is the system to assume being a large power plant that controls various consumer-side energy which is called DER (distributed energy resources) by means of IoT technologies.

Conventionally, restraint of using power has been driven by concluding an adjustment contract between former general electric utilities and large power demanders, or concluding power restraint contract between the retailers of new electricity and some of the demanders of such power. Now that DR and VPP are expected to expand, aggregators that bind together many demanders play the role of mediator of DSR and DER, which is expected to lead to efficient utilization of energy resources, and to successfully involve diverse demanders, including general households, in the electricity transactions.

The ERAB (energy resource aggregation business) market size is calculated based on the total income from DR and VPP (total of compensation or reward for supplying electricity based on the DR/VPP contract) at ERAB-related businesses. In addition to transmission and distribution companies (10 companies) selected to gain the adjustment power through public offering in accordance with the guidelines by METI, balancing with the market of new power companies, the ERAB market is sure to expand further as the capacity market launches in 2020 and the market of supply and demand adjustment in 2021. The ERAB market size based on the sales at ERAB-related businesses is expected to attain 44 hundred million yen for FY2019.

Noteworthy Topics

Storage Batteries as Energy Resources

Storage batteries are the most important energy resource in the future of DR and VPP. Expansion of the ERAB market depends on user acceptance and potential usability of storage batteries. Since storage batteries have highly responsive controllability, they are considered as a resource to replace thermal power generation. If such a case occurs, however, the price of power sold should be reduced because storage batteries are unable to generate energy. Storage batteries are not likely to proactively replace thermal power generation plants. They are in the position to supply power at low cost, after storage batteries, EV (electric vehicles), PHV (plug-in hybrid vehicles) are well accepted and only if there is excessive power in the capacity.

For the future, storage batteries installed in EVs are expected as a power resource for DR and VPP, being able to contribute in the form of V2X (V2H, V2B, and V2G). Since EVs move around, understanding of positional information and charging state of each EV leads highly accurate control of mobile battery resources. In order to achieve highly accurate DR and VPP, it is necessary to build a system to forecast electricity demand and EV trends, while the method to control discharging and charging of each EV should not be burdensome to EV users.

Future Outlook

It has not been able to foresee the level of rewards that ERAB-related businesses and energy resources can earn from the supply-and-demand adjustment market or the capacity market which are to be launched. Since these markets used to be originally dealt as the in-house operations later outsourced at the former utilities, it is difficult to clarify their economic values at this time. Nevertheless, it is sure that the ERAB market, which contributes in DR and VPP, is to increase its importance, as it expands the market of renewable-energy derived power and complements thermal power generation.

The market size of ERAB, based on the sales at ERAB-related businesses, is projected to increase to 7,500 million yen by FY2021, 36,500 million yen by FY2025 and 73,000 million yen by FY2030.

Research Outline

2.Research Object: Major Electric utilities, Electromechanics, System Engineering Companies, Trading Companies, System Engineering Companies for Regenerated-Energy-Used Power Generation and Energy Storage, Energy Management Service Providers

3.Research Methogology: Face-to-face interviews by the expert researchers, surveys via telephone/email, and literature research

What is the ERAB (Energy Resource Aggregation Business) Market?

The electric power industry in Japan has been in progress to prepare for DR (demand response) to control DSR (demand side resources) and VPP (Virtual Power Plant) to control DER (Distributed Energy Resources), in order to keep the consistency of both rapid expansion in introducing renewable energy including photovoltaic power generation and of stable supply of electricity even at the time when wholesale power price soared and when a critical shortage in power supply occurred.

Electric power companies basically have the policy of supplying exactly the same volume of electricity demanded at the demanders every moment of the time. Electric power companies are liable for stable power supply, because the quality of electricity deteriorates and the electrical grid becomes instable if the supply and demand does not coincide. Conventionally, power suppliers had to prepare for excess electricity just in case of an excessive demand. In recent years, however, a new idea has become pervasive, which is to consider the excess electricity or saved electricity at demanders as the “power generated.” This made power suppliers easier to control or restrain using of energy by granting incentives or by concluding power restraint contracts.

Conventionally, restraint of using power has been driven by concluding an adjustment contract between former general electric utilities and large power demanders, or concluding power restraint contract between the retailers of new electricity and some of the demanders of such power. Now that DR and VPP are expected to expand, aggregators that bind together many demanders play the role of mediator of DSR and DER, which is expected to lead to efficient utilization of energy resources, and to successfully involve diverse demanders, including general households, in the electricity transactions.

ERAB (Energy Resource Aggregation Business) in this research indicate energy resource aggregation business taken place by the aggregators of DR or VPP. The market size of ERAB is calculated based on the total income through DR and VPP at ERAB-related businesses.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.