2025/02/18

Honda and Nissan Enter Final Stages of Management Integration: Is There a Leader Qualified to Guide a Giant Group?

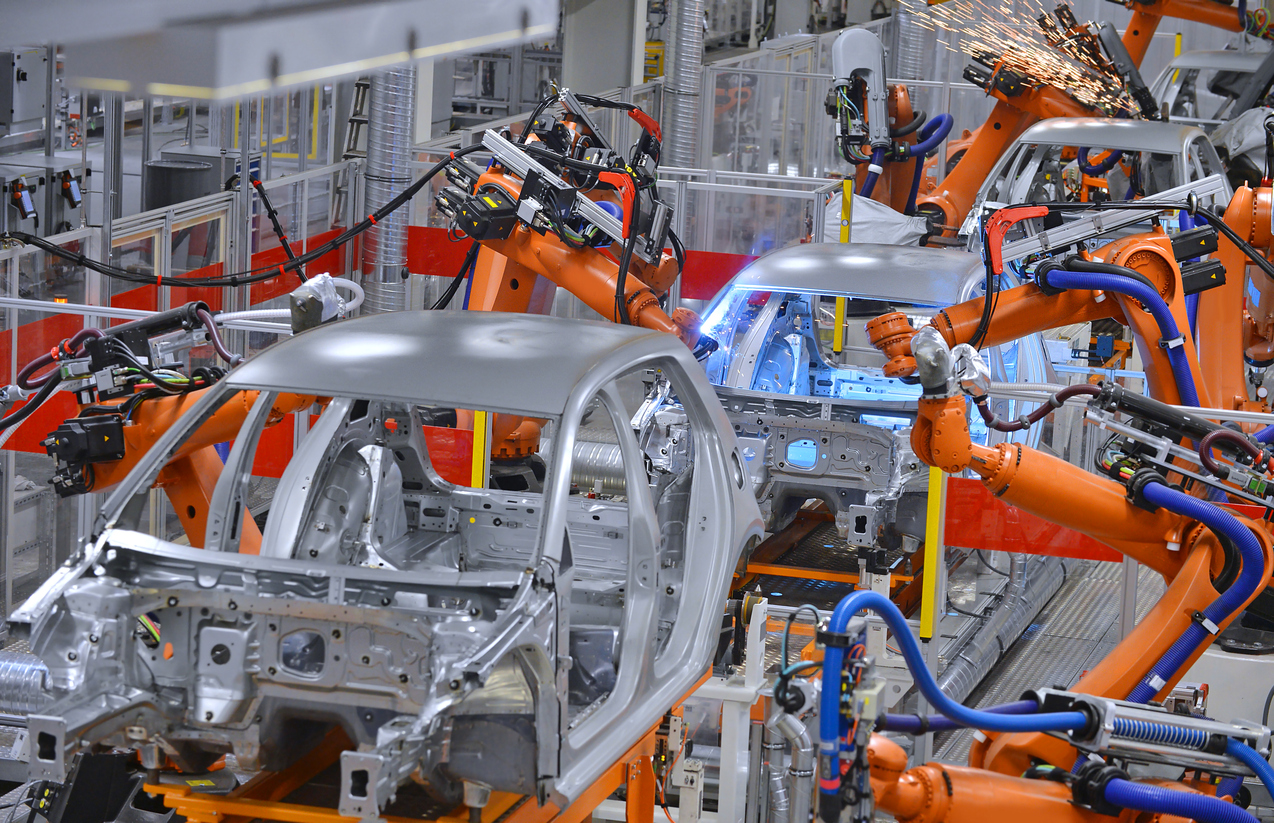

Honda Motor Co. Ltd. and Nissan Motor Co. Ltd. have entered the final stages of negotiations for a business merger. The two companies plan to establish a joint holding company, under which both Honda and Nissan will become wholly owned subsidiaries, while Mitsubishi Motors Corporation is considering joining the merger. If the business integration of all three companies is realized, the resulting group would become the world's third-largest automaker, following the Toyota Group and Germany's Volkswagen Group.

In November 2024, Nissan, struggling with poor business performance, announced the core elements of its structural reforms, which include a 20% reduction in production capacity and the downsizing of 9,000 global workers. Some attribute Nissan’s severe situation of being forced into repeated large-scale restructuring to the “distortions caused by aggressive business expansion” under former Chairman Carlos Ghosn. However, it has been eight fiscal periods since management transitioned from Mr. Ghosn, and there is no doubt that the “post-Ghosn” management bears responsibility for failing to address the company's ongoing challenges, evident in its inability to keep pace with competitors in electric vehicle (EV) development, the absence of hybrid vehicle (HV) offerings, and the need to rely on sales incentives to compete.

Earlier in March 2024, the two companies agreed to conduct joint research on fundamental technologies in the field of EV development. In August, they announced further details of the strategic partnership, including plans to share a basic software platform for in-vehicle computers. The announcement also revealed that Mitsubishi Motors has been participating in the partnership framework. However, it is alleged that these strategic movements rapidly evolved into discussions on business integration due to the potential acquisition of Nissan shares by Taiwanese electronics giant Foxconn, formally known as Hon Hai Precision Industry Co. In other words, external pressure prompted the integration, and the timely announcement of the business reorganization appears to be a defensive action to prevent a takeover by Foxconn.

According to news reports, the two companies have “almost reached an agreement” on management integration. If this is accurate, the next point of negotiation will focus on the management structure. While they proceed with the process of integration, it essentially reflects a stronger aspect of being a bailout by Honda. And yet at the same time, Honda, operating at its current scale, cannot compete with rivals in the EV market, which demands large-scale development investment. It is easy to anticipate Nissan pushing for a strategic partnership on equal terms. However, a key reason for Nissan’s struggles lies in the failure to exhibit strong resolve and strategy by top management—such as boldly declaring, “We are ready to strike a deal with Foxconn to bring Honda under our umbrella!” For this reason, any management structure based on the premise of an equal partnership seems unlikely to succeed. To bridge the critical differences in corporate culture between Honda and Nissan and manage an automotive giant capable of competing with Tesla, Inc. and BYD Co. Ltd. in the global markets, Nissan must cultivate leadership and decision-making capabilities that surpass even those of Mr. Ghosn.

This Week’s Focus, 12.15 – 12.19

Takashi Mizukoshi, the President