2025/01/31

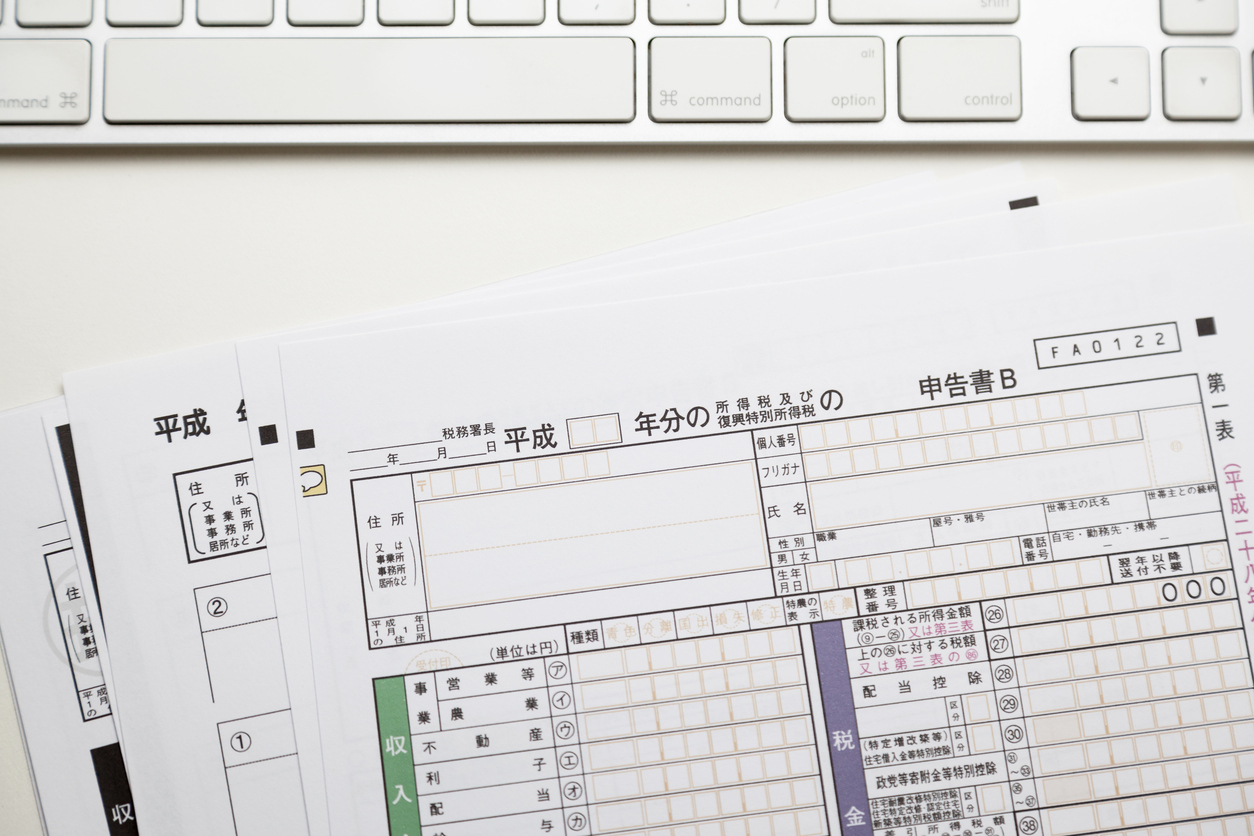

Breaking the "1.03 Million Yen Barrier": A Call for Comprehensive System Reform with a Long-Term Vision

On November 20, Japan's ruling coalition parties held discussions with the Democratic Party for the People (DPP) regarding the framework of comprehensive economic measures. They reached an agreement to broadly accept the DPP's proposal, which includes raising the so-called "1.03 million yen barrier"—an income threshold above which individuals become subject to income tax. Following this agreement, the focus has shifted to determining the extent of the increase in the tax-free income threshold.

The DPP has proposed raising the threshold to 1.78 million yen, based on the rate of minimum wage increase. However, there are criticisms that the threshold should be linked to the cost of living essentials, in line with the purpose of the basic deduction. Another key issue is how to secure funding for the estimated 7 to 8 trillion yen in revenue losses for both local and national governments.

Social insurance, special dependent deductions, and the special exemption for spouses cannot be left as they are either. The Ministry of Health, Labour and Welfare is considering abolishing the “1.06 million yen barrier,” the income threshold determining social insurance eligibility. Meanwhile, to align with the DPP’s pledge to increase take-home pay for salaried workers, a workaround is being considered where companies would shoulder the burden of newly insured employees. However, this issue relates to the core principles of the tax and social insurance systems, and addressing it with superficial measures will inevitably lead to future complications.

Expectations that labor shortages will be resolved are similarly misplaced. According to the Ministry of Internal Affairs and Communications, 5.37 million non-regular workers are adjusting their working hours, with 80% doing so to stay within the “barrier.” However, a recent survey by JOBS Research Center, Recruit Co., Ltd. (September 2024) found that the top reason for adjusting working hours is “to work healthily both physically and mentally” (41.3%), followed by the so-called “income barrier” (27.8%), and “having other priorities such as housework, childcare, or caregiving” (23.7%). This indicates that addressing labor shortages requires an integrated approach encompassing work style reforms, gender issues, and measures to counter Japan’s declining birthrate and aging population.

In any case, the “1.03 million yen barrier” issue symbolizes the gap between reality and the system. This should be an opportunity to re-examine the entire system and engage in open discussions with a long-term perspective. In this sense, it is welcome that the Japanese Diet is regaining diversity and restoring its function as a forum for debate. After all, even without referencing José Ortega y Gasset’s philosophy, liberal democracy is fundamentally about the majority granting rights to the minority while embodying tolerance and coexistence with those who hold differing opinions.

This Week’s Focus, November17 – November 21

Takashi Mizukoshi, the President