No.4008

Stationery and Office Supply Market in Japan: Key Research Findings 2025

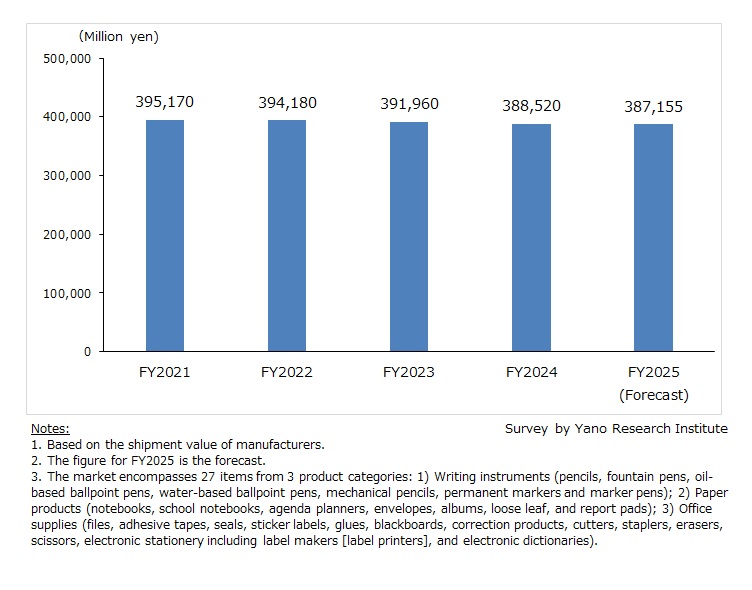

Stationery and Office Supply Market Size Declined by 0.8% YoY to 388,520 Million Yen in FY2024

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the stationery and office supply market in Japan and has found out the trends (by product category and industry players) and market outlook.

Market Overview

The Japanese stationery and office supply market was sized at 388,520 million yen in FY2024, marking 0.9% decline year-on-year, based on shipment value of manufacturers. Following the sharp contraction of FY2020, the market continued to soften across both the office and school segments. This decline was driven by a shift toward digital, paperless environments and the widespread adoption of remote work. Similarly, the school segment faced headwinds from a shrinking student population and the ongoing digitalization of educational curricula.

While writing instruments achieved year-on-year growth in FY2024, this was offset by sluggish sales in paper products and general office supplies, leading to an overall market downturn. Although consumer interest in hobbyist tools and self-expression products remained strong, the market’s total value was sustained primarily by price increases implemented to counter rising costs.

Noteworthy Topics

From "Daily Necessities" to "Little Indulgences"

In response to the structural softness of the traditional office segment, stationery manufacturers are pivotally redirecting their focus toward the consumer and personal-use markets. Companies are aggressively diversifying their product portfolios to address increasingly nuanced individual needs, benefiting from a market environment characterized by strong premium value perception. This shift has allowed for higher price points, most notably in the mechanical pencil category. Despite prices reaching several thousand yen, highly functional and value-added models have gained significant traction among their core demographic of junior high and high school students.

Beyond functional tools, demand for hobbyist and self-expression products remains robust, particularly for writing instruments featuring extensive color palettes. This growth is further bolstered by the lifelogging trend, which has fueled the popularity of notebooks for journaling and recording personal experiences. Simultaneously, a burgeoning niche has emerged around oshi-katsu (fan culture), where storage and filing items for organizing oshi-kastu-related items are seeing rapid growth. Collectively, these trends signal a fundamental evolution in the stationery industry: stationery has transitioned from a category of "daily necessities" into one of "little indulgences".

Future Outlook

The domestic market size of stationeries and office supplies is projected to decrease to 387,155 million yen in FY2025, down by 0.4% from the previous fiscal year. On a product-by-product basis, the writing instruments category is projected to expand, whereas the paper products and general office supplies segments are expected to contract.

Driven by the ongoing structural softness of the office supply segment, manufacturers are increasingly pivoting their focus toward consumer products. Furthermore, from a medium to long-term strategic perspective, companies are expanding into international markets—with a particular emphasis on emerging economies—to offset the long-term decline in domestic demand.

Research Outline

2.Research Object: Companies in business of stationery and office supplies

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), surveys via telephone and email, and literature research

Stationery and Office Supply Market

Stationery and office supplies in this research indicate the following 27 items of 3 product categories: 1) Writing instruments (pencils, fountain pens, oil-based ballpoint pens, water-based ballpoint pens, mechanical pencils, permanent markers and marker pens); 2) Paper products (notebooks, school notebooks, agenda planners, envelopes, albums, loose leaf, and report pads); 3) Office supplies (files, adhesive tapes, seals, sticker labels, glues, blackboards, correction products, cutters, staplers, erasers, scissors, electronic stationery including label makers [label printers], and electronic dictionaries). Gel-ink ballpoint pens are included in water-based ballpoint pens.

<Products and Services in the Market>

Pencils, fountain pens, water-based ballpoint pens, oil-based ballpoint pens, mechanical pencils, permanent markers, marker pens, notebooks, school notebooks, agenda planners, envelopes, albums, loose leaf, and report pads, files, adhesive tapes, seals, sticker labels, glues, blackboards, correction products, cutters, staplers, erasers, scissors, electronic stationery including label makers [label printers], and electronic dictionaries

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.