No.3945

Global Lithium-ion Battery Reusing and Recycling Market: Key Research Findings 2025

Development of Lithium-ion Battery Reusing and Recycling Ecosystem in Progress With a View to Economic Rationality and Environmental Value

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the global trends pertaining to reusing and recycling of lithium-ion batteries.

Market Overview

The market of lithium-ion battery is expanding chiefly in automotive applications. Despite the slowdown of BEV sales in 2023 and 2024 dampened the demand for Lithium-ion batteries, the market is still growing. Given the projection that there will be an increasing number of EVs to reach end-of-life, it is essential to develop a supply chain for reusing and recycling used batteries.

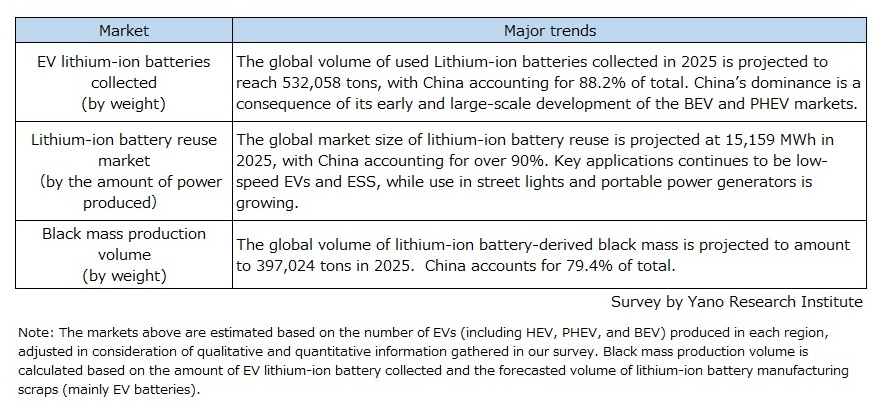

While development of a battery collection system remains a major challenge globally, China has dominance in the collection of used Lithium-ion batteries, reuse market size, and production volume of black mass*1. Battery reuse is growing against the backdrop of a high representation of lithium iron phosphate (LFP) battery batteries among batteries collected. The production volume of black mass is rising in tandem with the increase of used Lithium-ion batteries and battery production scraps, stemming from production capacity expansion.

*Black mass is black powder containing lithium, nickel, and cobalt, generated during the mechanical recycling process of lithium-ion batteries (roasting, crushing, etc.).

Noteworthy Topics

EV Battery Recycling

The global volume of used Lithium-ion batteries collected in 2025 is projected to reach 532,058 tons, with China accounting for 88.2% of total. China’s dominance reflects its early and large-scale development of the BEV and PHEV markets, which expanded ahead of other countries. Although Chinese government is taking the initiative to establish a comprehensive traceability system, actual collection volumes remain below expectations. A substantial share of end-of-life lithium-ion batteries continued to flow through unregulated channels, suppressing the utilization rates of whitelist recycling facilities.

Similarly, Lithium-ion battery collection infrastructure remains limited in Japan. Recycling volumes have fallen short of initial target, largely due to the increase in used electric vehicle exports between 2017 and 2024.

In Europe, the disappearance of millions of vehicles (the so-called “missing vehicle” issue) has raised concerns regarding lithium-ion battery collection. To address this, the EU has incorporated new traceability and monitoring requirements into its new ELV framework.

In the United States, although no federal law governs lithium-ion battery reuse or recycling, the Alliance for Automotive Innovation—the industry’s primary trade association and advocacy group—released a policy statement in 2022 promoting the reuse, repurposing, and recycling of electric vehicle battery components.

Future Outlook

The lithium-ion battery recycling market was brisk in 2023 supported by strong BEV market growth and surging lithium carbonate prices. However, as BEV expansion slows and lithium carbonate prices stabilize, battery recyclers are under pressure to rethink and rebuild their business models.

In China, “whitelist” recyclers (those operating certified facilities with costly but compliant environmental controls) are struggling to compete on material procurement (including black mass) amid volatile lithium carbonate prices and declining utilization rates. This has prompted China to import used batteries from Japan and Korea, which in turn is making Japan and Korea difficult to strengthen domestic circular economy frameworks.

Under the circumstances, shifting toward a contract manufacturing model has emerged as a strategic option for recyclers. Nonetheless, doing so will require the development of differentiated, highly sophisticated processing technologies to maintain competitive advantage. In addition, compliance with corporate due diligence regulations*2 will oblige recyclers to mitigate environmental risks across their operations.

Looking ahead, balancing economic viability with environmental value will demand a more coordinated recycling ecosystem—from "inflow" segment (collection and processing) to "outflow" segment (battery manufacturers and automakers). Supportive government policy will also become increasingly important.

*2 The EU Batteries Regulation framework place importance on due diligence, which will be enforced in upcoming years. Companies will be obliged to monitor and assess battery supply chain by actions, such as creating a documented policy verified by an independent auditor and publishing an annual report detailing their corrective measures, to prevent/mitigate human rights abuses or environmental degradation risks.

Research Outline

2.Research Object: Enterprises in the business of reusing and recycling lithium-ion batteries (for EVs, small consumer devices, and ESS) and related technologies

3.Research Methogology: Face-to-face interviews by our expert researchers (including online) and literature research

Lithium-ion Battery Reusing and Recycling

In this market research, reuse and recycling of lithium-ion batteries includes the recovery of lithium (Li), cobalt (Co), nickel (Ni) and other metallic materials from used lithium-ion batteries, and repurposing them for cathodes or other applications.

The amount of automotive lithium-ion batteries collected, size of the lithium-ion battery reuse market, and the black mass production volume are estimated based on the number of EVs (including HEV, PHEV, and BEV) produced in each region.

The volume of battery manufacturing scraps is estimated based on the production capacity of lithium-ion battery plants in each region and their capital investment plans.

All estimates have been adjusted in consideration of qualitative and quantitative information gathered during our survey.

<Products and Services in the Market>

Lithium-ion batteries for EVs, small consumer devices and ESS ; *Also includes some studies on reuse and recycle of nickel hydrogen battery

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.