No.3941

Imported Luxury Brand Market in Japan: Key Research Findings 2025

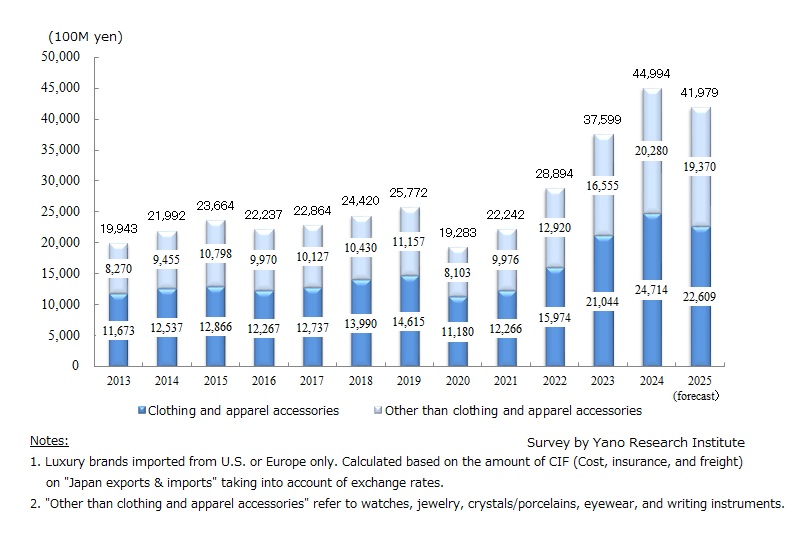

Weak Yen Drives Inbound Tourism / Imported Luxury Retail Market Surges 19.7% in 2024

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic imported luxury brand market and found out the market status, the trends of brands, and future perspectives.

Market Overview

The domestic imported luxury brand (major 15 items) retail market in 2024 was estimated to have risen by 19.7% from the previous year to 4,499,400 million yen. Market expansion in 2024 was fueled by strong spending from affluent Japanese consumers driven by high stock prices, alongside increased consumption from inbound tourists benefiting from the weak yen.

According to the statistics by the Japan National Tourism Organization (JNTO), the number of inbound tourists hit a record-high of 36,870,000, a rise by 47.1% from the previous year. Consequently, we estimate that the size of the imported brand retail market in 2024 expanded to 181.9% of its 2023 level. The persistent weakness of the yen since the pandemic has made shopping a primary objective for visitors to Japan, and the increase in spending has outpaced the growth in tourist arrivals. A major reason for this surge in consumption is the sharp increase in Chinese tourists. According to the Survey of Overseas Visitor's Consumption Habits by the Japan Tourism Agency, per-capita spending by Chinese tourists far exceeds that of visitors from other countries, a trend also confirmed in our interviews with imported luxury brands. Although Chinese tourists were slow to return after the pandemic, their numbers are now surging; in 2024, the number of Chinese tourists reached 287.9% of the preceding year (source: JNTO). This strong rebound has played a significant role in expanding the imported luxury brand retail market.

On the other hand. the surge in tourists has affected the market in multiple ways. For instance, popular boutiques in metropolitan areas have had long lines of foreigners for days, prompting the stores to constantly restrict entry. This has discouraged Japanese customers, who dislike shopping in crowded stores. Stores have experienced issues such lost sales due to stock shortages, as well as operational challenges like staff fatigue due to overwork. Luxury brands have implemented countermeasures, such as improving inventory management and allocating resources more efficiently.

Noteworthy Topics

Persistent Price Increases Slow Demand From Younger and Middle-Class Consumers

Product prices rose repeatedly throughout 2024, driven by post-pandemic surge in raw material costs, labor expenses, and transportation fees—a trend exacerbated by the sharp depreciation of the yen.

Among the brands surveyed, price increases averaged over 10%, ranging from 5% to 20%. Jewelers led the way with steeper hikes, and popular brands generally raised prices more aggressively, though exceptions existed. While 2022 and 2023 saw larger year-over-year increases, the cumulative effect of successive price hikes since 2021 have pushed product prices to over 1.5 times their pre-pandemic (2019) levels.

Younger and middle class consumers—traditionally drawn to certain import brands for their resale value—began perceiving prices as inflated. This sentiment coincided with a notable shift in sales momentum: brands that had performed strongly in the first half of 2024 (January-June) experienced declining sales in the second half (July-December).

Future Outlook

As 2025 begins, shopping behavior of inbound tourists is shifting. While the number of inbound visitors continue to climb (source: JNTO), demand for luxury brand purchases is cooling.

The primary driver is yen appreciation. Trump’s tariffs in his second administration triggered stock market volatility and strengthened the yen. Furthermore, weakness in the Chinese economy has significantly reduced luxury spending by Chinese tourists. Rising product prices over recent years have also contributed to this shift. Japan's price advantage has narrowed as domestic prices have climbed closer to international levels. When exchange rates fluctuate, the incentive to shop in Japan diminishes accordingly.

Slowing inbound demand is likely to pressure imported luxury brands in 2025, with many expected to post sales below 2024 levels. The most prominent luxury brands—those that benefited most from inbound tourism—face the steepest headwinds. Moreover, elevated prices have dampened mass market demand. Even affluent consumers, the core customer segment, report feeling saturated with purchases. Aside from asset-class products, consumers are adopting a more cautious approach to spending. Even though the stock prices—a key driver of affluent consumer spendin—have risen since mid-2025, persistent global economic uncertainty continues to weigh on confidence.

Given the circumstances, the imported luxury brand retail market (major 15 items) in 2025 is forecasted to decline to 4,197,900 million yen, down 6.7% from the previous year. The imported luxury brand retail market is expected to experience a retracement from 2025, after years of benefiting tremendously from rapid yen depreciation.

Research Outline

2.Research Object: Trading firms, manufacturers, and retailers that import and sell products (clothing, accessories, watches, jewelry, crystals/bone chinaware/porcelains, eyewear, and writing instruments) produced by the European and U.S. brands, and Japanese subsidiaries of such brands

3.Research Methogology: Face-to-face interviews (including online interviews) by our expert researchers, survey via telephone, and literature research

Imported Luxury Brands Market

In this research, imported brands refer to luxury brands for the following 15 items: 1) women’s clothing, 2) men’s clothing, 3) babies’ clothing, 4) bags & leather goods, 5) shoes, 6) ties, 7) scarves/shawls/handkerchiefs, 8) leatherwear, 9) belts, 10) gloves, 11) watches, 12) jewelry, 13) crystals/chinaware/porcelains, 14) eyewear, and 15) writing instruments.

Note that we only refer to products imported from European countries or the United States.

<Products and Services in the Market>

Women’s clothing, men’s clothing, babies’ clothing, bags & leather goods, shoes, ties, scarves/shawls/handkerchiefs, leatherwear, belts, gloves, watches, jewelry, crystals/porcelains, eyewear, and writing instruments

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.